Page 15: of Maritime Reporter Magazine (December 2020)

Great Ships of 2020

Read this page in Pdf, Flash or Html5 edition of December 2020 Maritime Reporter Magazine

“Only 5 or 6 years ago, the average wind farm size was around 100MW. At World Energy Reports we forecast the average to be around 600MW by 2025. ”

Philip Lewis,

Director of Research, World Energy Reports

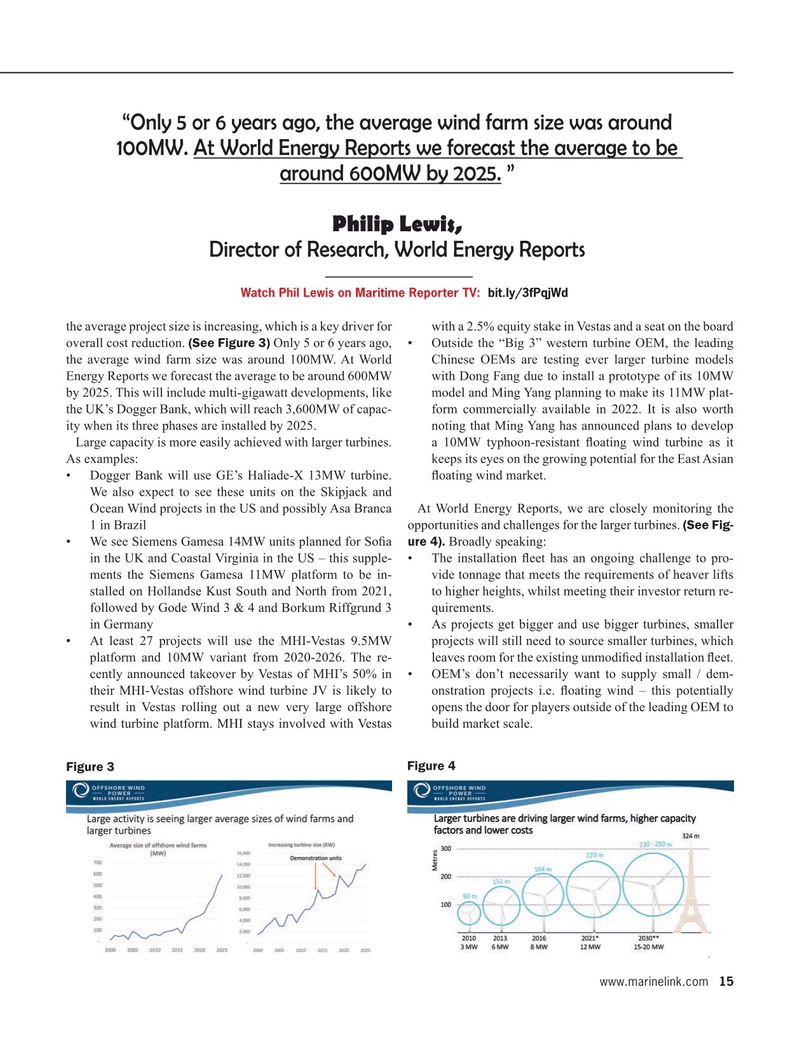

Watch Phil Lewis on Maritime Reporter TV: bit.ly/3fPqjWd the average project size is increasing, which is a key driver for with a 2.5% equity stake in Vestas and a seat on the board overall cost reduction. (See Figure 3) Only 5 or 6 years ago, • Outside the “Big 3” western turbine OEM, the leading the average wind farm size was around 100MW. At World Chinese OEMs are testing ever larger turbine models

Energy Reports we forecast the average to be around 600MW with Dong Fang due to install a prototype of its 10MW by 2025. This will include multi-gigawatt developments, like model and Ming Yang planning to make its 11MW plat- the UK’s Dogger Bank, which will reach 3,600MW of capac- form commercially available in 2022. It is also worth ity when its three phases are installed by 2025. noting that Ming Yang has announced plans to develop

Large capacity is more easily achieved with larger turbines. a 10MW typhoon-resistant ? oating wind turbine as it

As examples: keeps its eyes on the growing potential for the East Asian • Dogger Bank will use GE’s Haliade-X 13MW turbine. ? oating wind market.

We also expect to see these units on the Skipjack and

Ocean Wind projects in the US and possibly Asa Branca At World Energy Reports, we are closely monitoring the 1 in Brazil opportunities and challenges for the larger turbines. (See Fig- • We see Siemens Gamesa 14MW units planned for So? a ure 4). Broadly speaking: in the UK and Coastal Virginia in the US – this supple- • The installation ? eet has an ongoing challenge to pro- ments the Siemens Gamesa 11MW platform to be in- vide tonnage that meets the requirements of heaver lifts stalled on Hollandse Kust South and North from 2021, to higher heights, whilst meeting their investor return re- followed by Gode Wind 3 & 4 and Borkum Riffgrund 3 quirements.

in Germany • As projects get bigger and use bigger turbines, smaller • At least 27 projects will use the MHI-Vestas 9.5MW projects will still need to source smaller turbines, which platform and 10MW variant from 2020-2026. The re- leaves room for the existing unmodi? ed installation ? eet.

cently announced takeover by Vestas of MHI’s 50% in • OEM’s don’t necessarily want to supply small / dem- their MHI-Vestas offshore wind turbine JV is likely to onstration projects i.e. ? oating wind – this potentially result in Vestas rolling out a new very large offshore opens the door for players outside of the leading OEM to wind turbine platform. MHI stays involved with Vestas build market scale.

Figure 3 Figure 4 www.marinelink.com 15

MR #12 (1-17).indd 15 12/4/2020 8:40:47 AM

14

14

16

16