Page 28: of Maritime Reporter Magazine (January 2021)

The Ship Repair & Conversion Edition

Read this page in Pdf, Flash or Html5 edition of January 2021 Maritime Reporter Magazine

REPAIR & CONVERSION “Marsoft Inc. suggested that 18,000 bulkers, tankers and containerships (typically 5 to 15 years of age) could be the subject of retro? ts, a market that could be worth $12 - $16B.” ing (Marinakis) was hinting at an order for multiple LNG that it would be re? tting three vessels with MAN two-stroke fueled VLCCs at the Hyundai yard, though it was not clear if engines with a “dual fuel” capability to burn LPG. All told, this came to fruition. BW LPG would be retro? tting 15 vessels with MAN LG-IP

The Sea-LNG consortium, a group promoting LNG fuels engines. According to MAN Energy Solutions: “The vast ma- for ships, and a member roster including TOTE, Total and jority of current orders for LPG carriers over 30,000 cu. m. two dozen others, pegged the gas fueled late 2020 ? eet at are with ME-LGIP technology, enabling these vessels to use 175 ships on the water, with 232 on order. The LNG-ready their own cargo as fuel in the future.” ? eet totaled 232. In a November, 2020 webinar, Sea-LNG’s For the BW LPG 15 vessel retro? tting program, Wärtsilä

General Manager, Steve Esau, made the case that investment has been designated as the system integrator, which involves modeling showed that ? tting vessels for LNG fueling pro- not only installation of its LPG Fuel Supply System (LFSS) vided “…the best return on investment (ROI), on a net pres- system, but also the required ship design modi? cations. Ac- ent value (NPV) basis, over a 10-year time horizon…” with cording to Wärtsilä’s description of the LFSS: “ The LPG “relatively fast” payback periods. In a December webinar fuel tank(s) is loaded through dedicated bunkering lines, or concerning the Poseidon Principles ? rst year results, Société in case of a LPG carrier reloaded from the cargo tanks. From

Générale shipping banker Paul Taylor, the Poseidon consor- the fuel tank(s), the LPG is conditioned and prepared as fuel. tium’s Vice Chair, stressed the importance of retro? tting ves- A system consisting of pumps and heat exchanger is used to sels, saying: “It’s not all about investment in new tonnage supply the engine with a stable and reliable fuel ? ow, at the ... there are plenty of things that one can do with an existing correct pressure and temperature.” portfolio.” Vessel modi? cations need to be ? nanced. In mid-December,

The business case for growing with re? tting existing ships BW LPG announced its intention to acquire 39% of the eq- (rather than building new vessels with reduced emissions) is uity in Navigator Gas, another listed owner of LPG vessels, a very real concept. In mid-December, the Oslo-listed BW from investment funds tied to WL Ross & Company. At the

LPG (controlling 46 gas carriers, and part of the much larg- same time, Epic Gas, a company in the BW orbit, announced er BW Group, which has a large stake in DHT) announced that it would be joining forces with Lauritzen Kosan, adding

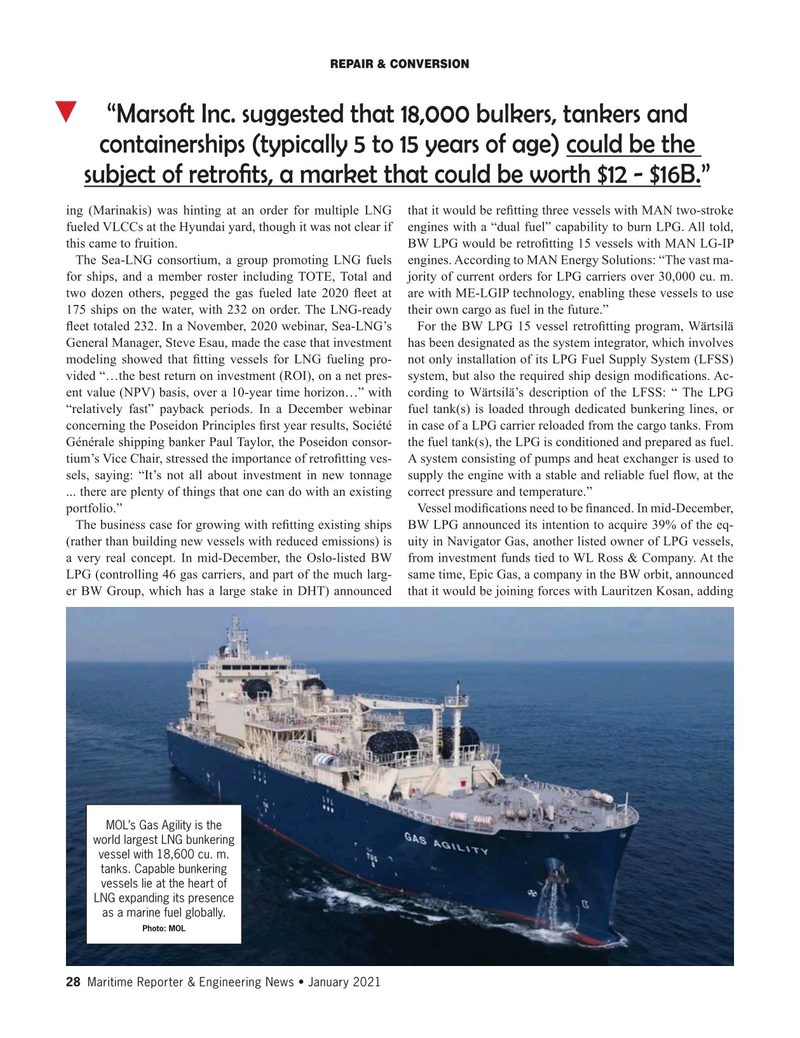

MOL’s Gas Agility is the world largest LNG bunkering vessel with 18,600 cu. m. tanks. Capable bunkering vessels lie at the heart of

LNG expanding its presence as a marine fuel globally.

Photo: MOL 28 Maritime Reporter & Engineering News • January 2021

MR #1 (18-33).indd 28 1/7/2021 4:45:03 PM

27

27

29

29