Page 32: of Maritime Reporter Magazine (April 2021)

Offshore Wind Energy: Installation, Crew & Supply Vessels

Read this page in Pdf, Flash or Html5 edition of April 2021 Maritime Reporter Magazine

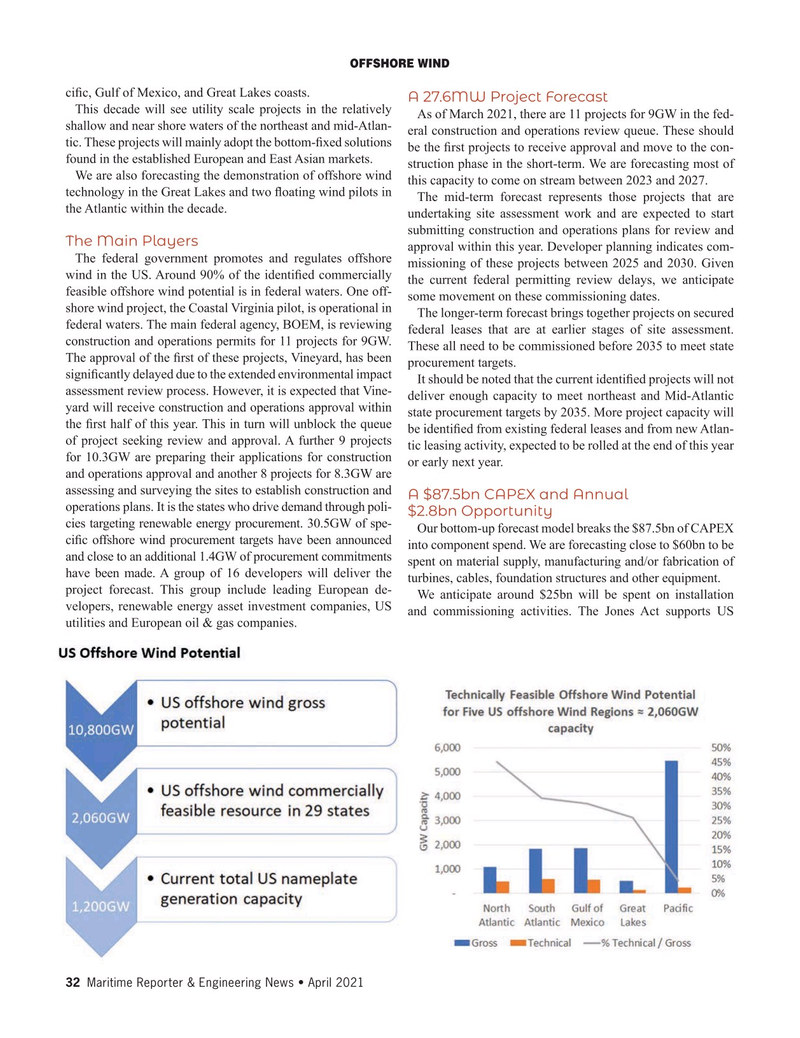

OFFSHORE WIND ci? c, Gulf of Mexico, and Great Lakes coasts.

A 27.6MW Project Forecast

This decade will see utility scale projects in the relatively

As of March 2021, there are 11 projects for 9GW in the fed- shallow and near shore waters of the northeast and mid-Atlan- eral construction and operations review queue. These should tic. These projects will mainly adopt the bottom-? xed solutions be the ? rst projects to receive approval and move to the con- found in the established European and East Asian markets.

struction phase in the short-term. We are forecasting most of

We are also forecasting the demonstration of offshore wind this capacity to come on stream between 2023 and 2027.

technology in the Great Lakes and two ? oating wind pilots in

The mid-term forecast represents those projects that are the Atlantic within the decade.

undertaking site assessment work and are expected to start submitting construction and operations plans for review and

The Main Players approval within this year. Developer planning indicates com-

The federal government promotes and regulates offshore missioning of these projects between 2025 and 2030. Given wind in the US. Around 90% of the identi? ed commercially the current federal permitting review delays, we anticipate feasible offshore wind potential is in federal waters. One off- some movement on these commissioning dates.

shore wind project, the Coastal Virginia pilot, is operational in

The longer-term forecast brings together projects on secured federal waters. The main federal agency, BOEM, is reviewing federal leases that are at earlier stages of site assessment. construction and operations permits for 11 projects for 9GW. These all need to be commissioned before 2035 to meet state

The approval of the ? rst of these projects, Vineyard, has been procurement targets.

signi? cantly delayed due to the extended environmental impact

It should be noted that the current identi? ed projects will not assessment review process. However, it is expected that Vine- deliver enough capacity to meet northeast and Mid-Atlantic yard will receive construction and operations approval within state procurement targets by 2035. More project capacity will the ? rst half of this year. This in turn will unblock the queue be identi? ed from existing federal leases and from new Atlan- of project seeking review and approval. A further 9 projects tic leasing activity, expected to be rolled at the end of this year for 10.3GW are preparing their applications for construction or early next year.

and operations approval and another 8 projects for 8.3GW are assessing and surveying the sites to establish construction and

A $87.5bn CAPEX and Annual operations plans. It is the states who drive demand through poli- $2.8bn Opportunity cies targeting renewable energy procurement. 30.5GW of spe-

Our bottom-up forecast model breaks the $87.5bn of CAPEX ci? c offshore wind procurement targets have been announced into component spend. We are forecasting close to $60bn to be and close to an additional 1.4GW of procurement commitments spent on material supply, manufacturing and/or fabrication of have been made. A group of 16 developers will deliver the turbines, cables, foundation structures and other equipment.

project forecast. This group include leading European de-

We anticipate around $25bn will be spent on installation velopers, renewable energy asset investment companies, US and commissioning activities. The Jones Act supports US utilities and European oil & gas companies. 32 Maritime Reporter & Engineering News • April 2021

MR #4 (18-33).indd 32 4/1/2021 11:57:52 AM

31

31

33

33