Page 30: of Maritime Reporter Magazine (August 2021)

The Shipyard Annual

Read this page in Pdf, Flash or Html5 edition of August 2021 Maritime Reporter Magazine

SHIPBUILDING WTIVs

International Wind

Turbine and Foundation

Installation Vessel Market

As of end-June 2021, more than 100 turbine and foundation installation and maintenance vessels will be required for offshore wind projects planned over this decade.

By Philip Lewis IMA/WER ore than 100 turbine and foundation installa- These are the ? ndings in a new report “International Wind tion and maintenance vessels will be required Turbine and Foundation Installation Vessel Market” just com- for offshore wind projects planned over this pleted by World Energy Reports.

decade. Almost all of the current ? eet of inter- The 70+ report provides a guide to understanding the driv-

M national wind turbine installation vessels will be technically ers that will shape requirements in this growing, globalizing redundant as installation vessels by 2025 as a consequence of and technically evolving industry. The report examines the the rapidly growing wind turbine sizes, greater water depths structure of the installation industry, pro? les the underlying and increase in foundation size. Demand will be satis? ed by market drivers, forecasts wind installation activity through over 60 newly constructed or upgraded vessels – presenting 2030 and identi? es installation vessel technical requirements a $14 billion-dollar opportunity for engineering ? rms, ship- to meet future demand.

builders and conversion yards, equipment suppliers, service providers and those who ? nance marine assets.

Introducing offshore wind turbine and foundation installation vessels

Foundation installation requirements are also rapidly changing. Market requirements are now shifting to purpose- Until now installation requirements have been largely satis- built wind foundation installation vessels capable of handling ? ed by WTIVs and heavy lift vessels deigned for the oil & the largest monopile foundations. More specialized vessels gas and port/salvage market. Market requirements are now will be required for this purpose. shifting to larger capacity WTIVs and purpose-built wind

As well as uncertainties posed by the rapidly evolving tech- foundation installation vessels capable of handling the largest nological terrain, installation vessel owners are also having monopile foundations. to navigate their way through evolving local content require- A WTIV is a self-propelled self-elevating jack-up with a ments in Taiwan, Japan, the United States and elsewhere. crane capacity of 600 tonnes or greater for lifting a WTG set

China is a relatively closed and busy offshore wind market in 5-6 lifts. WTIVs perform a range of functions as part of the with its own demand drivers. Chinese WTIVs are unlikely to offshore wind farm supply chain: operate outside of China. In fact, it is more likely to see smaller A new generation foundation installation vessel is a self- installation vessels redeployed to the Chinese market, especially propelled DP2/3 vessel with a large deck space for carrying as they become less technically suited to international demand. foundations from the manufacturer’s facility direct to site and with a crane capacity of 3,000 tonnes or greater.

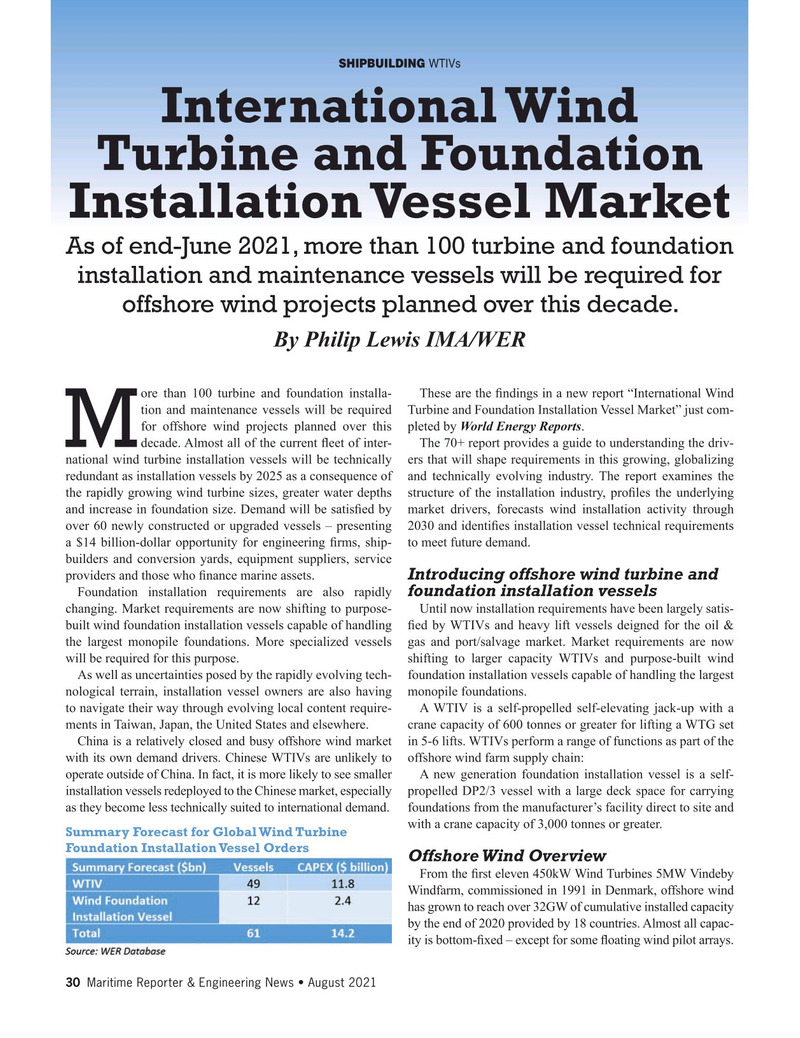

Summary Forecast for Global Wind Turbine

Foundation Installation Vessel Orders

Offshore Wind Overview

From the ? rst eleven 450kW Wind Turbines 5MW Vindeby

Windfarm, commissioned in 1991 in Denmark, offshore wind has grown to reach over 32GW of cumulative installed capacity by the end of 2020 provided by 18 countries. Almost all capac- ity is bottom-? xed – except for some ? oating wind pilot arrays.

30 Maritime Reporter & Engineering News • August 2021

MR #8 (18-33).indd 30 8/2/2021 4:42:41 PM

29

29

31

31