Page 23: of Maritime Reporter Magazine (August 2023)

Shipyard Annual

Read this page in Pdf, Flash or Html5 edition of August 2023 Maritime Reporter Magazine

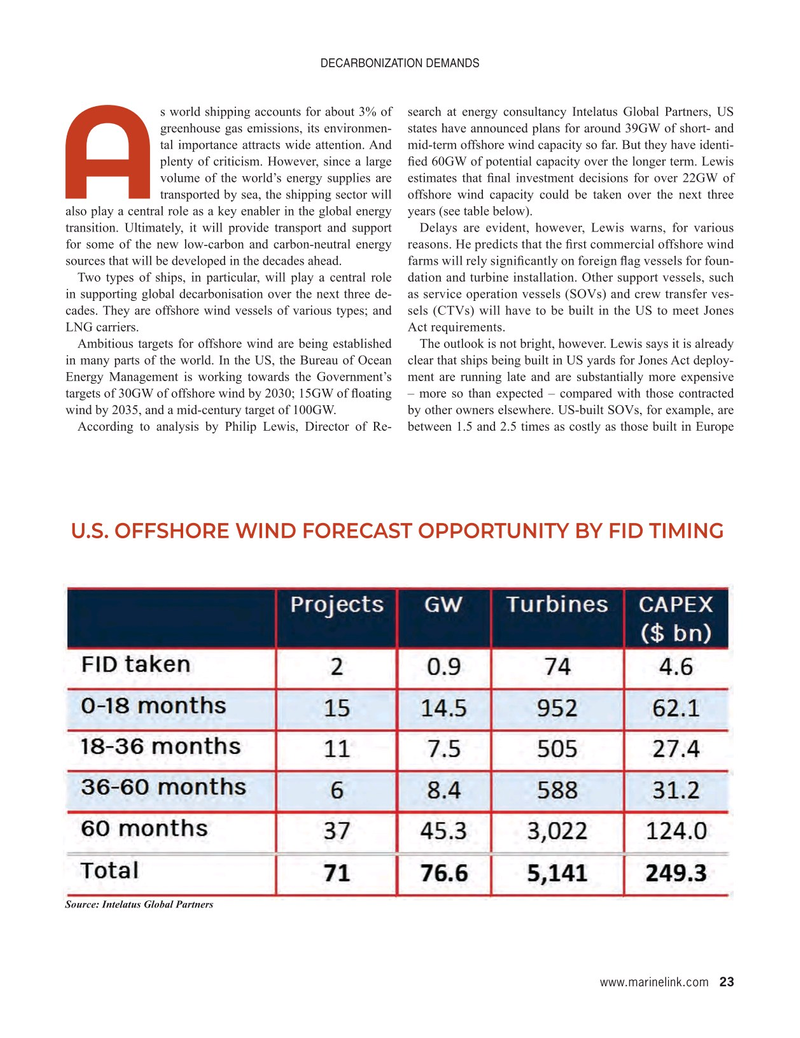

DECARBONIZATION DEMANDS s world shipping accounts for about 3% of search at energy consultancy Intelatus Global Partners, US greenhouse gas emissions, its environmen- states have announced plans for around 39GW of short- and tal importance attracts wide attention. And mid-term offshore wind capacity so far. But they have identi- plenty of criticism. However, since a large ? ed 60GW of potential capacity over the longer term. Lewis volume of the world’s energy supplies are estimates that ? nal investment decisions for over 22GW of

Atransported by sea, the shipping sector will offshore wind capacity could be taken over the next three also play a central role as a key enabler in the global energy years (see table below). transition. Ultimately, it will provide transport and support Delays are evident, however, Lewis warns, for various for some of the new low-carbon and carbon-neutral energy reasons. He predicts that the ? rst commercial offshore wind sources that will be developed in the decades ahead. farms will rely signi? cantly on foreign ? ag vessels for foun-

Two types of ships, in particular, will play a central role dation and turbine installation. Other support vessels, such in supporting global decarbonisation over the next three de- as service operation vessels (SOVs) and crew transfer ves- cades. They are offshore wind vessels of various types; and sels (CTVs) will have to be built in the US to meet Jones

LNG carriers. Act requirements.

Ambitious targets for offshore wind are being established The outlook is not bright, however. Lewis says it is already in many parts of the world. In the US, the Bureau of Ocean clear that ships being built in US yards for Jones Act deploy-

Energy Management is working towards the Government’s ment are running late and are substantially more expensive targets of 30GW of offshore wind by 2030; 15GW of ? oating – more so than expected – compared with those contracted wind by 2035, and a mid-century target of 100GW. by other owners elsewhere. US-built SOVs, for example, are

According to analysis by Philip Lewis, Director of Re- between 1.5 and 2.5 times as costly as those built in Europe

U.S. OFFSHORE WIND FORECAST OPPORTUNITY BY FID TIMING

Source: Intelatus Global Partners www.marinelink.com 23

MR #8 (18-33).indd 23 8/3/2023 10:58:03 AM

22

22

24

24