Page 61: of Maritime Reporter Magazine (November 2023)

Workboat Edition

Read this page in Pdf, Flash or Html5 edition of November 2023 Maritime Reporter Magazine

MARKET IN FOCUS: OFFSHORE WIND

Chart Intelatus Global Partners ing resource on the leasing and permitting of offshore wind long lifetime, they will require constant routine inspection, and plans to approve over 13 GW of project capacity before repair and maintenance, the technicians for which are trans- the end of 2024 and provide ? nancing support through the ported and/or housed on CTVs and SOVs.

In? ation Reduction Act related tax credits. Based on current developer plans, the pipeline translates to

At the state level, especially for the Northeast and Mid-At- close to 4,500 turbines being installed in U.S. waters by 2035, lantic segment, we see states with clear ambitions to increase which are expected to be supplied by the three dominant west- the use of renewable energy, reduce the amount of imported ern OEMS: Siemens, GE and Vestas.

hydrocarbons, setting offshore wind procurement targets and creating a clear route to market for developers. Looking to Other Markets for Guidance

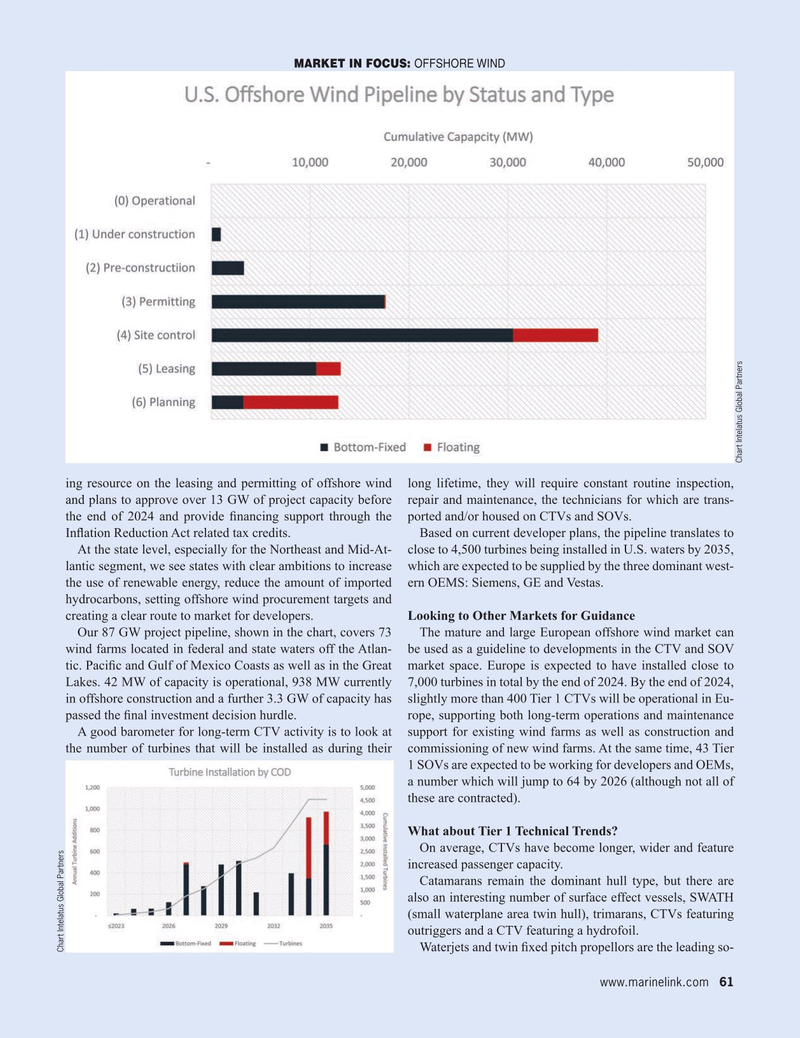

Our 87 GW project pipeline, shown in the chart, covers 73 The mature and large European offshore wind market can wind farms located in federal and state waters off the Atlan- be used as a guideline to developments in the CTV and SOV tic. Paci? c and Gulf of Mexico Coasts as well as in the Great market space. Europe is expected to have installed close to

Lakes. 42 MW of capacity is operational, 938 MW currently 7,000 turbines in total by the end of 2024. By the end of 2024, in offshore construction and a further 3.3 GW of capacity has slightly more than 400 Tier 1 CTVs will be operational in Eu- passed the ? nal investment decision hurdle. rope, supporting both long-term operations and maintenance

A good barometer for long-term CTV activity is to look at support for existing wind farms as well as construction and the number of turbines that will be installed as during their commissioning of new wind farms. At the same time, 43 Tier 1 SOVs are expected to be working for developers and OEMs, a number which will jump to 64 by 2026 (although not all of these are contracted).

What about Tier 1 Technical Trends?

On average, CTVs have become longer, wider and feature increased passenger capacity.

Catamarans remain the dominant hull type, but there are also an interesting number of surface effect vessels, SWATH (small waterplane area twin hull), trimarans, CTVs featuring outriggers and a CTV featuring a hydrofoil.

Waterjets and twin ? xed pitch propellors are the leading so-

Chart Intelatus Global Partners www.marinelink.com 61

MR #11 (50-65).indd 61 11/2/2023 5:02:25 PM

60

60

62

62