Page 12: of Maritime Reporter Magazine (February 2024)

Read this page in Pdf, Flash or Html5 edition of February 2024 Maritime Reporter Magazine

Maritime Risk

Top Marine Business Risks in 2024

By Rich Soja, North American Head Marine, Allianz Commercial yber incidents such as ransomware attacks, data linked to several large ? re incidents at sea in recent years.

breaches, and IT disruptions are the biggest worry Regularly assessing and updating prudent ? re mitigation for companies globally in 2024, according to the practices, including preventative measures, ? re extinguish-

C13th annual Allianz Risk Barometer, an annual busi- ing methods and contingency planning remain essential for all ness risk ranking incorporating the views of 3,069 risk manage- businesses to lower the risk of loss from an incident.

ment experts in 92 countries and territories including CEOs, risk managers, brokers and insurance experts. The closely inter- Natural Catastrophes linked peril of Business Interruption ranks second while Natu- For Marine and Shipping risk professionals, Natural Catas- ral Catastrophes rose from sixth to third place this year. trophes, which includes storm, ? ood, earthquake, wild? re and

While those risks may be top of mind for the global business other extreme weather events, rank as the second most concern- community, the Marine and Shipping respondents had other ing business threat at 30%, up from fourth position in 2023.

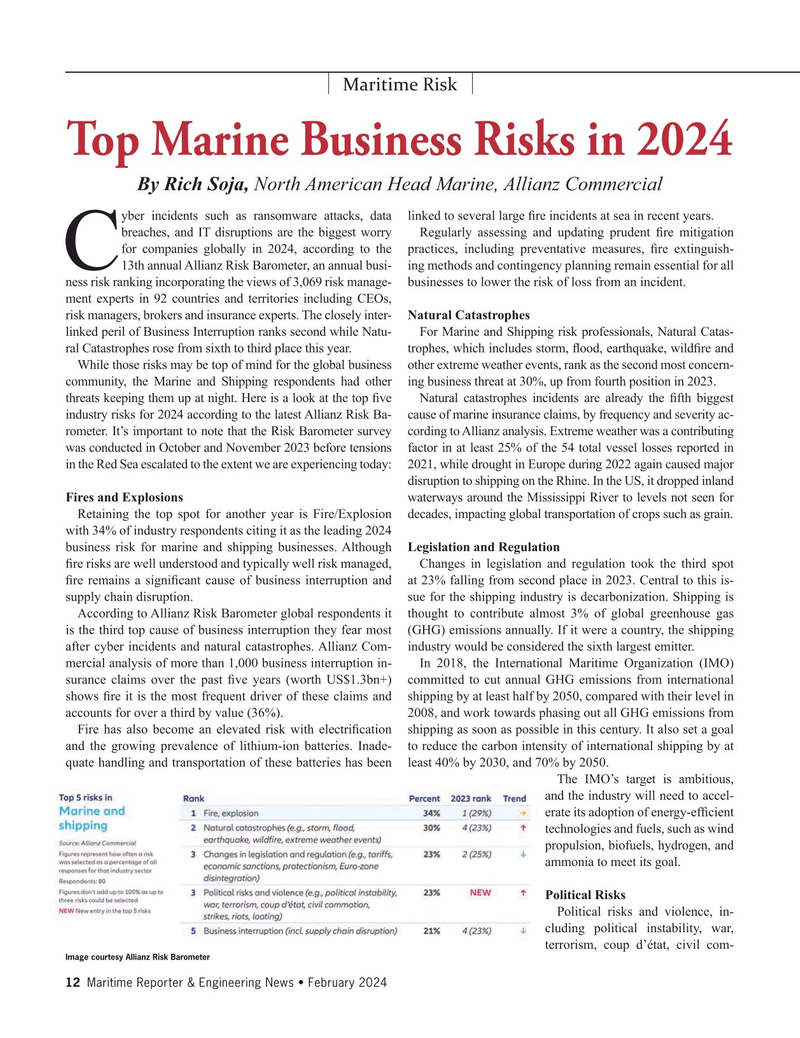

threats keeping them up at night. Here is a look at the top ? ve Natural catastrophes incidents are already the ? fth biggest industry risks for 2024 according to the latest Allianz Risk Ba- cause of marine insurance claims, by frequency and severity ac- rometer. It’s important to note that the Risk Barometer survey cording to Allianz analysis. Extreme weather was a contributing was conducted in October and November 2023 before tensions factor in at least 25% of the 54 total vessel losses reported in in the Red Sea escalated to the extent we are experiencing today: 2021, while drought in Europe during 2022 again caused major disruption to shipping on the Rhine. In the US, it dropped inland

Fires and Explosions waterways around the Mississippi River to levels not seen for

Retaining the top spot for another year is Fire/Explosion decades, impacting global transportation of crops such as grain.

with 34% of industry respondents citing it as the leading 2024 business risk for marine and shipping businesses. Although Legislation and Regulation ? re risks are well understood and typically well risk managed, Changes in legislation and regulation took the third spot ? re remains a signi? cant cause of business interruption and at 23% falling from second place in 2023. Central to this is- supply chain disruption. sue for the shipping industry is decarbonization. Shipping is

According to Allianz Risk Barometer global respondents it thought to contribute almost 3% of global greenhouse gas is the third top cause of business interruption they fear most (GHG) emissions annually. If it were a country, the shipping after cyber incidents and natural catastrophes. Allianz Com- industry would be considered the sixth largest emitter.

mercial analysis of more than 1,000 business interruption in- In 2018, the International Maritime Organization (IMO) surance claims over the past ? ve years (worth US$1.3bn+) committed to cut annual GHG emissions from international shows ? re it is the most frequent driver of these claims and shipping by at least half by 2050, compared with their level in accounts for over a third by value (36%). 2008, and work towards phasing out all GHG emissions from

Fire has also become an elevated risk with electri? cation shipping as soon as possible in this century. It also set a goal and the growing prevalence of lithium-ion batteries. Inade- to reduce the carbon intensity of international shipping by at quate handling and transportation of these batteries has been least 40% by 2030, and 70% by 2050.

The IMO’s target is ambitious, and the industry will need to accel- erate its adoption of energy-ef? cient technologies and fuels, such as wind propulsion, biofuels, hydrogen, and ammonia to meet its goal.

Political Risks

Political risks and violence, in- cluding political instability, war, terrorism, coup d’état, civil com-

Image courtesy Allianz Risk Barometer 12 Maritime Reporter & Engineering News • February 2024

MR #2 (1-17).indd 12 2/6/2024 9:40:35 AM

11

11

13

13