Page 18: of Maritime Reporter Magazine (April 2024)

Read this page in Pdf, Flash or Html5 edition of April 2024 Maritime Reporter Magazine

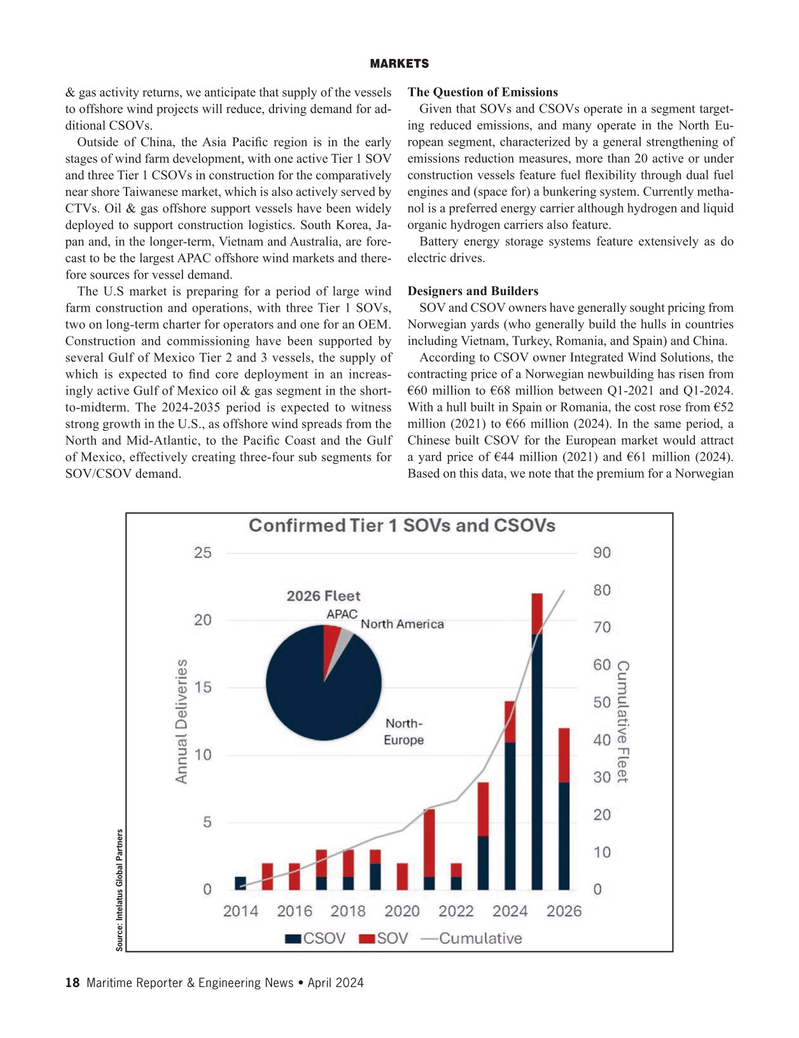

MARKETS & gas activity returns, we anticipate that supply of the vessels The Question of Emissions to offshore wind projects will reduce, driving demand for ad- Given that SOVs and CSOVs operate in a segment target- ditional CSOVs. ing reduced emissions, and many operate in the North Eu-

Outside of China, the Asia Paci? c region is in the early ropean segment, characterized by a general strengthening of stages of wind farm development, with one active Tier 1 SOV emissions reduction measures, more than 20 active or under and three Tier 1 CSOVs in construction for the comparatively construction vessels feature fuel ? exibility through dual fuel near shore Taiwanese market, which is also actively served by engines and (space for) a bunkering system. Currently metha-

CTVs. Oil & gas offshore support vessels have been widely nol is a preferred energy carrier although hydrogen and liquid deployed to support construction logistics. South Korea, Ja- organic hydrogen carriers also feature.

pan and, in the longer-term, Vietnam and Australia, are fore- Battery energy storage systems feature extensively as do cast to be the largest APAC offshore wind markets and there- electric drives. fore sources for vessel demand.

The U.S market is preparing for a period of large wind Designers and Builders farm construction and operations, with three Tier 1 SOVs, SOV and CSOV owners have generally sought pricing from two on long-term charter for operators and one for an OEM. Norwegian yards (who generally build the hulls in countries

Construction and commissioning have been supported by including Vietnam, Turkey, Romania, and Spain) and China. several Gulf of Mexico Tier 2 and 3 vessels, the supply of According to CSOV owner Integrated Wind Solutions, the which is expected to ? nd core deployment in an increas- contracting price of a Norwegian newbuilding has risen from ingly active Gulf of Mexico oil & gas segment in the short- €60 million to €68 million between Q1-2021 and Q1-2024. to-midterm. The 2024-2035 period is expected to witness With a hull built in Spain or Romania, the cost rose from €52 strong growth in the U.S., as offshore wind spreads from the million (2021) to €66 million (2024). In the same period, a

North and Mid-Atlantic, to the Paci? c Coast and the Gulf Chinese built CSOV for the European market would attract of Mexico, effectively creating three-four sub segments for a yard price of €44 million (2021) and €61 million (2024).

SOV/CSOV demand. Based on this data, we note that the premium for a Norwegian

Source: Intelatus Global Partners 18 Maritime Reporter & Engineering News • April 2024

MR #4 (18-33).indd 18 4/5/2024 8:12:14 AM

17

17

19

19