Page 33: of Maritime Reporter Magazine (August 2024)

Read this page in Pdf, Flash or Html5 edition of August 2024 Maritime Reporter Magazine

A GROWING FLEET

Africa and APAC account for most of the market quantity by net’s 2 GW project in the Netherlands and Germany through 2030. We note that the forecast beyond 2030 is signi? cantly this decade and XLCCs vessel is planned to support the con- less certain than the forecast for 2024-2030, due to a current struction of the Morocco-UK green electricity interconnector.

lack of ? rm plans, although projects amounting to 140,000 VARD is both the largest builder and designer of vessels or- kilometers of interconnectors have been identi? ed, of which dered for delivery in the ten-year period of 2018-2027. VARD ~80% are in Europe and ~16% in APAC. We anticipate that designs account for half of the cable layers delivered in this most of these projects will be realized during the next decade. ten-year period.

It is interesting to note that the Europe-Africa intercon- nectors not only include cables linking North African coun- A CONNECTED FUTURE tries to European countries with Mediterranean coasts, such Whatever one’s views are on the energy transition, the trend as Greece, Italy and Spain, but also includes extremely long remains for our economies to become increasingly electri? ed. connectors designed to bring renewable electricity from North This means moving ever larger amounts of electricity through

Africa to the UK. on- and offshore networks. Europe/UK and China will be the major drivers for offshore wind cable laying activity for the

WHO OWNS; WHO BUILDS? foreseeable future and the European/UK markets will con-

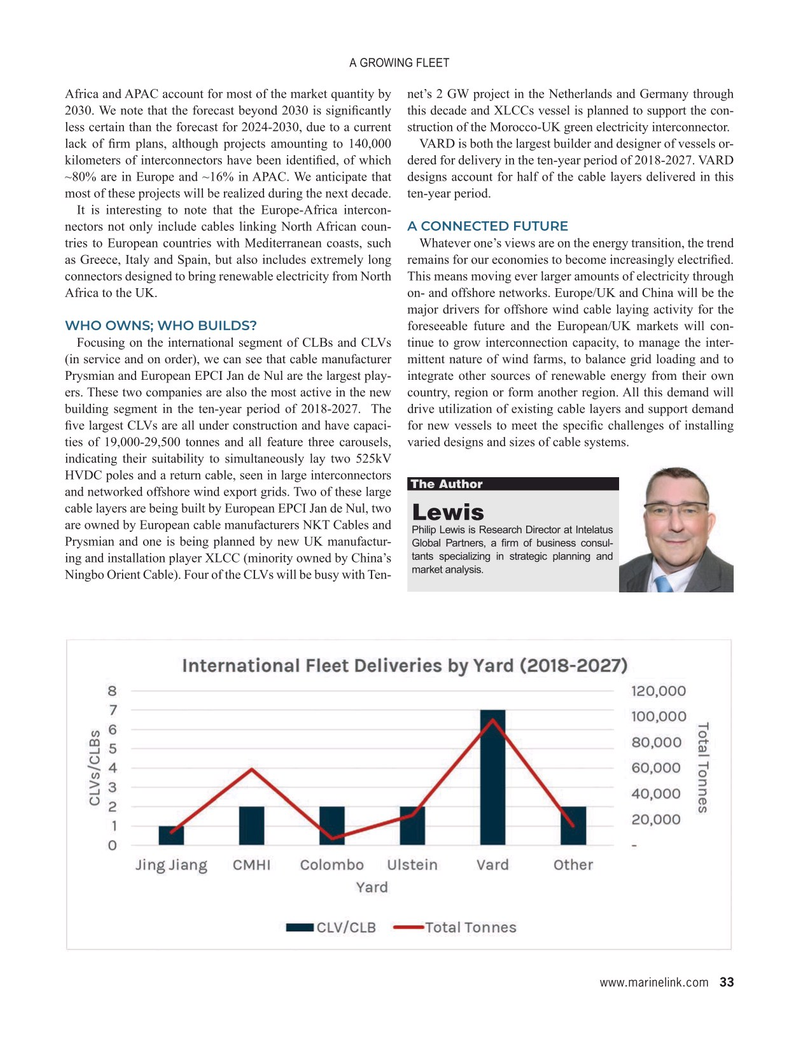

Focusing on the international segment of CLBs and CLVs tinue to grow interconnection capacity, to manage the inter- (in service and on order), we can see that cable manufacturer mittent nature of wind farms, to balance grid loading and to

Prysmian and European EPCI Jan de Nul are the largest play- integrate other sources of renewable energy from their own ers. These two companies are also the most active in the new country, region or form another region. All this demand will building segment in the ten-year period of 2018-2027. The drive utilization of existing cable layers and support demand ? ve largest CLVs are all under construction and have capaci- for new vessels to meet the speci? c challenges of installing ties of 19,000-29,500 tonnes and all feature three carousels, varied designs and sizes of cable systems.

indicating their suitability to simultaneously lay two 525kV

HVDC poles and a return cable, seen in large interconnectors

The Author and networked offshore wind export grids. Two of these large cable layers are being built by European EPCI Jan de Nul, two

Lewis are owned by European cable manufacturers NKT Cables and

Philip Lewis is Research Director at Intelatus

Prysmian and one is being planned by new UK manufactur-

Global Partners, a ? rm of business consul- tants specializing in strategic planning and ing and installation player XLCC (minority owned by China’s market analysis.

Ningbo Orient Cable). Four of the CLVs will be busy with Ten- www.marinelink.com 33

MR #8 (18-33).indd 33 8/8/2024 10:52:43 AM

32

32

34

34