Page 51: of Maritime Reporter Magazine (August 2025)

Read this page in Pdf, Flash or Html5 edition of August 2025 Maritime Reporter Magazine

GREEN METHANOL gen or ammonia, green methanol can be stored and handled cryogenic systems and extensive safety protocols, which using existing infrastructure with only moderate adaptation. It adds complexity and cost, especially for smaller ports and has a lower energy density than traditional marine fuels, but operators. In contrast, methanol is liquid at ambient temper- its well-to-wake emissions can be reduced by over 80% or atures and compatible with conventional bunkering systems, more depending on the production pathway. When produced reducing the barrier to entry.

using low-carbon feedstocks such as renewable natural gas From a climate perspective, methanol—especially if pro- (RNG) and paired with carbon capture technologies, methanol duced renewably—offers signi? cantly lower well-to-wake can achieve ultra-low—potentially even negative—lifecycle GHG emissions than LNG. LNG’s lifecycle emissions are carbon intensities. penalized by methane slip during production, transport, and

Critically, green methanol is the only alternative fuel with: combustion. Methanol avoids this issue, and with proper feed- • A growing commercial supply base stock sourcing and certi? cation, its climate bene? ts are veri? - • Established safety protocols able and substantial.

• Compatibility with dual-fuel engine designs already in use Methanol’s comparatively lower energy density can be off-

Major shipping companies are already investing in meth- set by its easier storage and retro? tting potential. For contain- anol-capable ? eets. A.P. Moller–Maersk has ordered over er, short-sea, and roll-on, roll-off (RoRo) shipping segments, 25 dual-fuel methanol vessels and began taking deliveries where operational ? exibility and port infrastructure are key in 2024. CMA CGM and COSCO have also committed to considerations, methanol offers a pragmatic and potentially methanol-fueled newbuilds, recognizing the ? exibility and future-proof solution.

lower lifecycle emissions of this fuel. Engine manufacturers

Scaling Green Methanol: such as Everllence, Wärtsilä and Caterpillar are scaling up dual-fuel methanol engine offerings, further reinforcing the

Lessons from Practice viability of this pathway. As of 2023–2024, global production of green methanol— encompassing both bio methanol and e methanol—remains

Methanol vs LNG limited, accounting for less than 0.1% of the energy demand

While both methanol and lique? ed natural gas (LNG) are in the maritime sector. While current capacity stands at ap- viewed as transitional fuels, methanol holds distinct advan- proximately 0.5 million tonnes per year, announced projects tages in certain applications. LNG infrastructure requires suggest this could grow to nearly 40 million tonnes annually

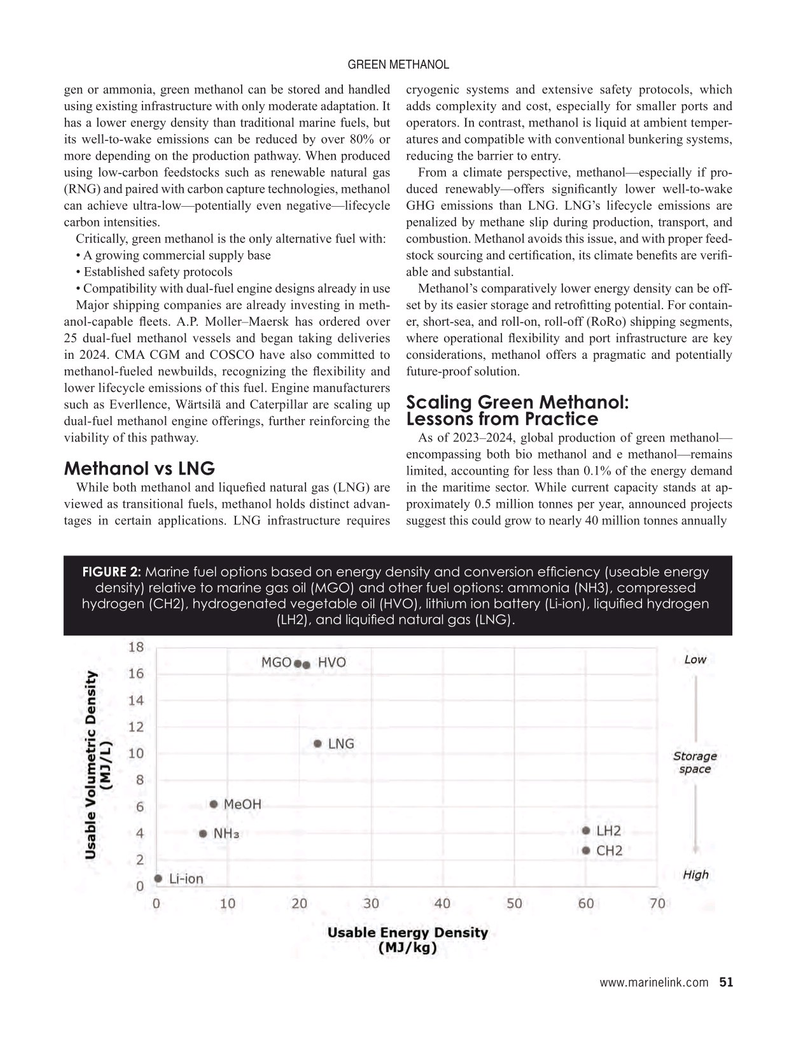

FIGURE 2: Marine fuel options based on energy density and conversion ef? ciency (useable energy density) relative to marine gas oil (MGO) and other fuel options: ammonia (NH3), compressed hydrogen (CH2), hydrogenated vegetable oil (HVO), lithium ion battery (Li-ion), liqui? ed hydrogen (LH2), and liqui? ed natural gas (LNG).

www.marinelink.com 51

MR #8 (50-61).indd 51 MR #8 (50-61).indd 51 8/1/2025 4:44:56 PM8/1/2025 4:44:56 PM

50

50

52

52