Page 30: of Offshore Engineer Magazine (Jan/Feb 2013)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2013 Offshore Engineer Magazine

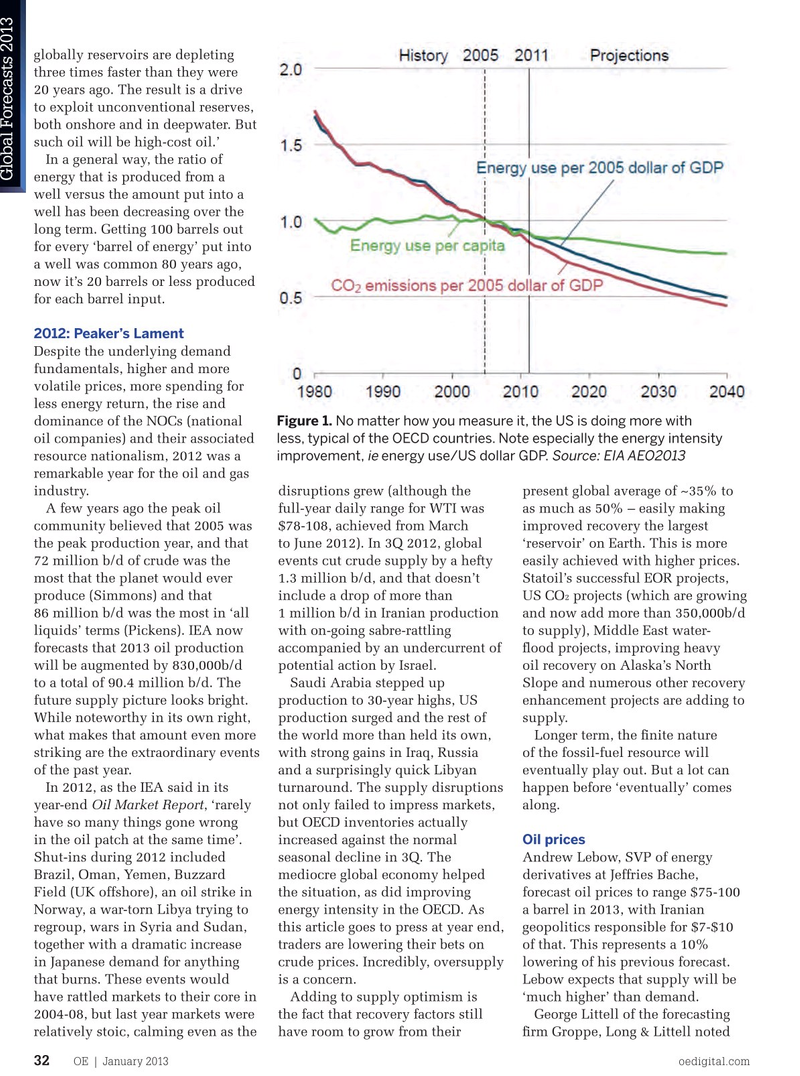

globally reservoirs are depleting three times faster than they were 20 years ago. The result is a drive to exploit unconventional reserves, both onshore and in deepwater. But such oil will be high-cost oil.’ In a general way, the ratio of

Global Forecasts 2013 energy that is produced from a well versus the amount put into a well has been decreasing over the long term. Getting 100 barrels out for every ‘barrel of energy’ put into a well was common 80 years ago, now it’s 20 barrels or less produced for each barrel input.

2012: Peaker’s Lament

Despite the underlying demand fundamentals, higher and more volatile prices, more spending for less energy return, the rise and dominance of the NOCs (national Figure 1. No matter how you measure it, the US is doing more with oil companies) and their associated less, typical of the OECD countries. Note especially the energy intensity resource nationalism, 2012 was a improvement, energy use/US dollar GDP. ie Source: EIA AEO2013 remarkable year for the oil and gas industry. disruptions grew (although the present global average of ~35% to A few years ago the peak oil full-year daily range for WTI was as much as 50% – easily making community believed that 2005 was $78-108, achieved from March improved recovery the largest the peak production year, and that to June 2012). In 3Q 2012, global ‘reservoir’ on Earth. This is more 72 million b/d of crude was the events cut crude supply by a hefty easily achieved with higher prices. most that the planet would ever 1.3 million b/d, and that doesn’t Statoil’s successful EOR projects, produce (Simmons) and that include a drop of more than US CO projects (which are growing 2 86 million b/d was the most in ‘all 1 million b/d in Iranian production and now add more than 350,000b/d liquids’ terms (Pickens). IEA now with on-going sabre-rattling to supply), Middle East water- forecasts that 2013 oil production accompanied by an undercurrent of food projects, improving heavy will be augmented by 830,000b/d potential action by Israel. oil recovery on Alaska’s North to a total of 90.4 million b/d. The Saudi Arabia stepped up Slope and numerous other recovery future supply picture looks bright. production to 30-year highs, US enhancement projects are adding to

While noteworthy in its own right, production surged and the rest of supply.

what makes that amount even more the world more than held its own, Longer term, the fnite nature striking are the extraordinary events with strong gains in Iraq, Russia of the fossil-fuel resource will of the past year. and a surprisingly quick Libyan eventually play out. But a lot can In 2012, as the IEA said in its turnaround. The supply disruptions happen before ‘eventually’ comes year-end Oil Market Report, ‘rarely not only failed to impress markets, along.

have so many things gone wrong but OECD inventories actually in the oil patch at the same time’. increased against the normal Oil prices

Shut-ins during 2012 included seasonal decline in 3Q. The Andrew Lebow, SVP of energy

Brazil, Oman, Yemen, Buzzard mediocre global economy helped derivatives at Jeffries Bache,

Field (UK offshore), an oil strike in the situation, as did improving forecast oil prices to range $75-100

Norway, a war-torn Libya trying to energy intensity in the OECD. As a barrel in 2013, with Iranian regroup, wars in Syria and Sudan, this article goes to press at year end, geopolitics responsible for $7-$10 together with a dramatic increase traders are lowering their bets on of that. This represents a 10% in Japanese demand for anything crude prices. Incredibly, oversupply lowering of his previous forecast. that burns. These events would is a concern. Lebow expects that supply will be have rattled markets to their core in Adding to supply optimism is ‘much higher’ than demand.

2004-08, but last year markets were the fact that recovery factors still George Littell of the forecasting relatively stoic, calming even as the have room to grow from their frm Groppe, Long & Littell noted

OE | January 2013 oedigital.com 32 oe_forecasts1.indd 32 03/01/2013 13:31

29

29

31

31