Page 35: of Offshore Engineer Magazine (Jan/Feb 2013)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2013 Offshore Engineer Magazine

Global Forecasts 2013

The big picture

US crude and condensate to 6.1 million b/d, as depletion of should have started ? ve years ago. production has been falling since the sweet spots that were drilled It’s clearly in their best interest to 1972 with only a couple brief ? rst gives way to less productive do so, to open up access to Asia.’

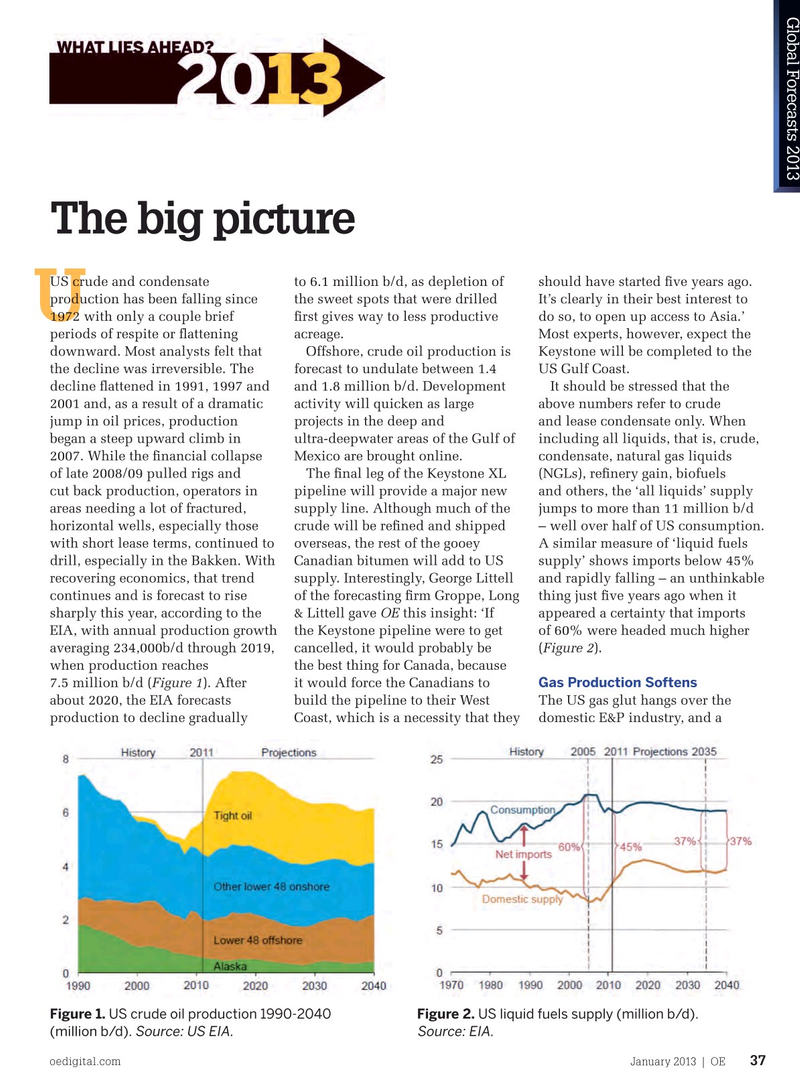

U periods of respite or ? attening acreage. Most experts, however, expect the downward. Most analysts felt that Offshore, crude oil production is Keystone will be completed to the the decline was irreversible. The forecast to undulate between 1.4 US Gulf Coast. decline ? attened in 1991, 1997 and and 1.8 million b/d. Development It should be stressed that the 2001 and, as a result of a dramatic activity will quicken as large above numbers refer to crude jump in oil prices, production projects in the deep and and lease condensate only. When began a steep upward climb in ultra-deepwater areas of the Gulf of including all liquids, that is, crude, 2007. While the ? nancial collapse Mexico are brought online. condensate, natural gas liquids of late 2008/09 pulled rigs and The ? nal leg of the Keystone XL (NGLs), re? nery gain, biofuels cut back production, operators in pipeline will provide a major new and others, the ‘all liquids’ supply areas needing a lot of fractured, supply line. Although much of the jumps to more than 11 million b/d horizontal wells, especially those crude will be re? ned and shipped – well over half of US consumption. with short lease terms, continued to overseas, the rest of the gooey A similar measure of ‘liquid fuels drill, especially in the Bakken. With Canadian bitumen will add to US supply’ shows imports below 45% recovering economics, that trend supply. Interestingly, George Littell and rapidly falling – an unthinkable continues and is forecast to rise of the forecasting ? rm Groppe, Long thing just ? ve years ago when it sharply this year, according to the & Littell gave OE this insight: ‘If appeared a certainty that imports

EIA, with annual production growth the Keystone pipeline were to get of 60% were headed much higher averaging 234,000b/d through 2019, cancelled, it would probably be (Figure 2).

when production reaches the best thing for Canada, because 7.5 million b/d (Figure 1). After it would force the Canadians to Gas Production Softens about 2020, the EIA forecasts build the pipeline to their West The US gas glut hangs over the production to decline gradually Coast, which is a necessity that they domestic E&P industry, and a

Figure 1. US crude oil production 1990-2040 Figure 2. US liquid fuels supply (million b/d). (million b/d).

Source: US EIA. Source: EIA.

oedigital.com January 2013 | OE 37 oe_forecasts3.indd 37 03/01/2013 13:34

34

34

36

36