Page 36: of Offshore Engineer Magazine (Jan/Feb 2013)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2013 Offshore Engineer Magazine

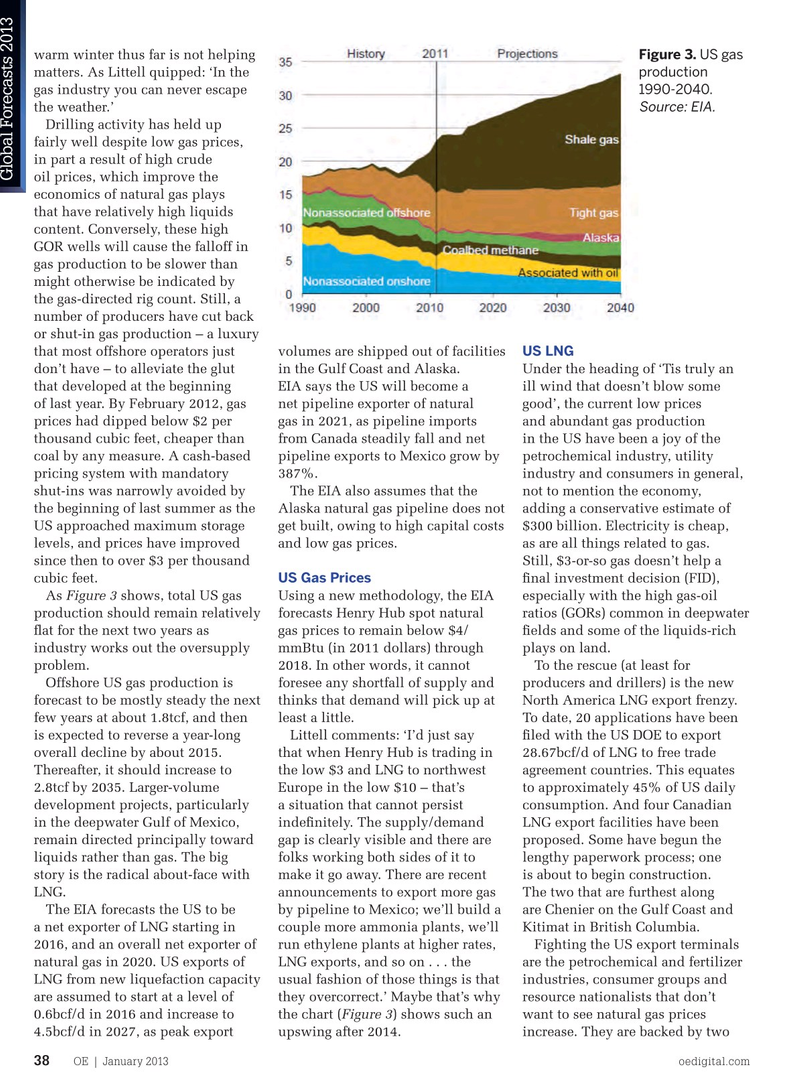

warm winter thus far is not helping Figure 3. US gas matters. As Littell quipped: ‘In the production gas industry you can never escape 1990-2040. the weather.’

Source: EIA.

Drilling activity has held up fairly well despite low gas prices, in part a result of high crude

Global Forecasts 2013 oil prices, which improve the economics of natural gas plays that have relatively high liquids content. Conversely, these high

GOR wells will cause the falloff in gas production to be slower than might otherwise be indicated by the gas-directed rig count. Still, a number of producers have cut back or shut-in gas production – a luxury that most offshore operators just volumes are shipped out of facilities US LNG don’t have – to alleviate the glut in the Gulf Coast and Alaska. Under the heading of ‘Tis truly an that developed at the beginning EIA says the US will become a ill wind that doesn’t blow some of last year. By February 2012, gas net pipeline exporter of natural good’, the current low prices prices had dipped below $2 per gas in 2021, as pipeline imports and abundant gas production thousand cubic feet, cheaper than from Canada steadily fall and net in the US have been a joy of the coal by any measure. A cash-based pipeline exports to Mexico grow by petrochemical industry, utility pricing system with mandatory 387%. industry and consumers in general, shut-ins was narrowly avoided by The EIA also assumes that the not to mention the economy, the beginning of last summer as the Alaska natural gas pipeline does not adding a conservative estimate of

US approached maximum storage get built, owing to high capital costs $300 billion. Electricity is cheap, levels, and prices have improved and low gas prices. as are all things related to gas. since then to over $3 per thousand Still, $3-or-so gas doesn’t help a cubic feet. US Gas Prices fnal investment decision (FID), As Figure 3 shows, total US gas Using a new methodology, the EIA especially with the high gas-oil production should remain relatively forecasts Henry Hub spot natural ratios (GORs) common in deepwater fat for the next two years as gas prices to remain below $4/ felds and some of the liquids-rich industry works out the oversupply mmBtu (in 2011 dollars) through plays on land. problem. 2018. In other words, it cannot To the rescue (at least for Offshore US gas production is foresee any shortfall of supply and producers and drillers) is the new forecast to be mostly steady the next thinks that demand will pick up at North America LNG export frenzy. few years at about 1.8tcf, and then least a little. To date, 20 applications have been is expected to reverse a year-long Littell comments: ‘I’d just say fled with the US DOE to export overall decline by about 2015. that when Henry Hub is trading in 28.67bcf/d of LNG to free trade

Thereafter, it should increase to the low $3 and LNG to northwest agreement countries. This equates 2.8tcf by 2035. Larger-volume Europe in the low $10 – that’s to approximately 45% of US daily development projects, particularly a situation that cannot persist consumption. And four Canadian in the deepwater Gulf of Mexico, indefnitely. The supply/demand LNG export facilities have been remain directed principally toward gap is clearly visible and there are proposed. Some have begun the liquids rather than gas. The big folks working both sides of it to lengthy paperwork process; one story is the radical about-face with make it go away. There are recent is about to begin construction.

LNG. announcements to export more gas The two that are furthest along The EIA forecasts the US to be by pipeline to Mexico; we’ll build a are Chenier on the Gulf Coast and a net exporter of LNG starting in couple more ammonia plants, we’ll Kitimat in British Columbia. 2016, and an overall net exporter of run ethylene plants at higher rates, Fighting the US export terminals natural gas in 2020. US exports of LNG exports, and so on . . . the are the petrochemical and fertilizer

LNG from new liquefaction capacity usual fashion of those things is that industries, consumer groups and are assumed to start at a level of they overcorrect.’ Maybe that’s why resource nationalists that don’t 0.6bcf/d in 2016 and increase to the chart (Figure 3) shows such an want to see natural gas prices 4.5bcf/d in 2027, as peak export upswing after 2014. increase. They are backed by two

OE | January 2013 oedigital.com 38 oe_forecasts3.indd 38 03/01/2013 13:34

35

35

37

37