Page 53: of Offshore Engineer Magazine (Apr/May 2013)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2013 Offshore Engineer Magazine

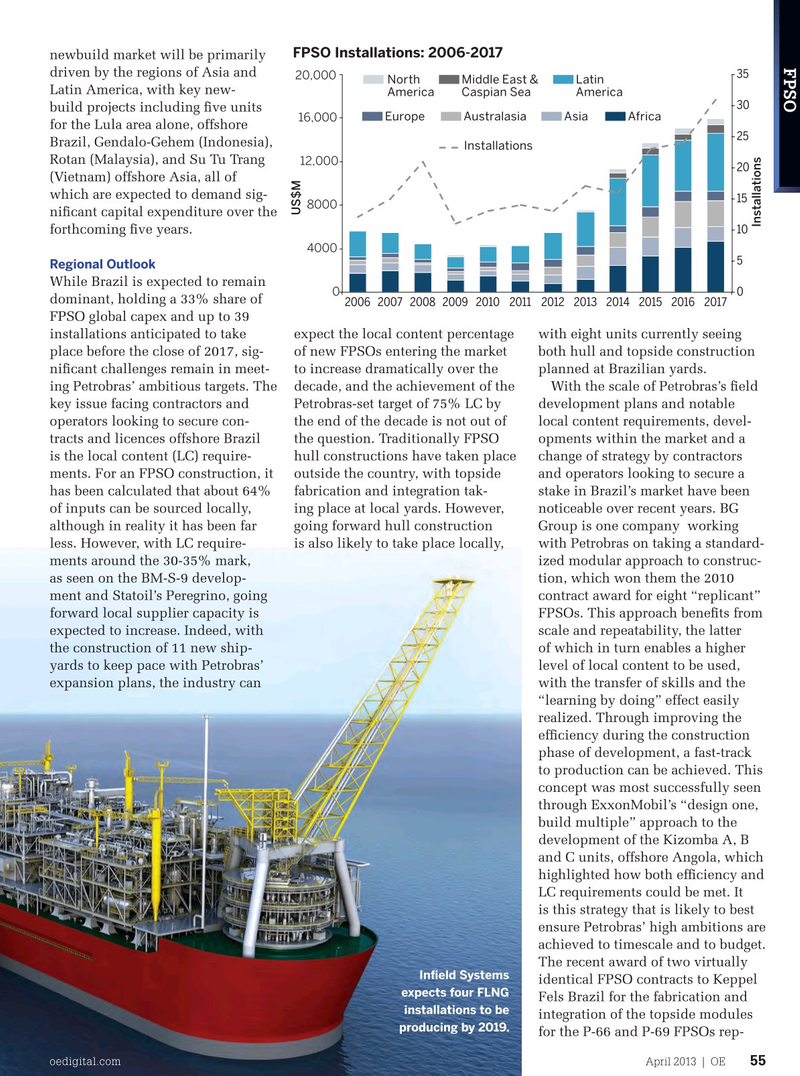

FPSO Installations: 2006-2017 newbuild market will be primarily

Eyebrow

FPSO driven by the regions of Asia and 35 20,000

North Middle East & Latin

Latin America, with key new-

America Caspian Sea America 30 build projects including fve units 16,000 Europe Australasia Asia Africa for the Lula area alone, offshore 25

Brazil, Gendalo-Gehem (Indonesia),

Installations

Rotan (Malaysia), and Su Tu Trang 12,000 20 (Vietnam) offshore Asia, all of which are expected to demand sig- 15 8000

US$M nifcant capital expenditure over the

Installations 10 forthcoming fve years. 4000 5

Regional Outlook

While Brazil is expected to remain 0 200620072008200920102011201220132014201520162017 0 dominant, holding a 33% share of

FPSO global capex and up to 39 expect the local content percentage installations anticipated to take with eight units currently seeing of new FPSOs entering the market place before the close of 2017, sig- both hull and topside construction to increase dramatically over the nifcant challenges remain in meet- planned at Brazilian yards. ing Petrobras’ ambitious targets. The decade, and the achievement of the With the scale of Petrobras’s feld

Petrobras-set target of 75% LC by key issue facing contractors and development plans and notable the end of the decade is not out of operators looking to secure con- local content requirements, devel- the question. Traditionally FPSO tracts and licences offshore Brazil opments within the market and a hull constructions have taken place is the local content (LC) require- change of strategy by contractors outside the country, with topside ments. For an FPSO construction, it and operators looking to secure a fabrication and integration tak- has been calculated that about 64% stake in Brazil’s market have been ing place at local yards. However, of inputs can be sourced locally, noticeable over recent years. BG going forward hull construction although in reality it has been far Group is one company working is also likely to take place locally, less. However, with LC require- with Petrobras on taking a standard- ments around the 30-35% mark, ized modular approach to construc- as seen on the BM-S-9 develop- tion, which won them the 2010 ment and Statoil’s Peregrino, going contract award for eight “replicant” forward local supplier capacity is FPSOs. This approach benefts from expected to increase. Indeed, with scale and repeatability, the latter the construction of 11 new ship- of which in turn enables a higher yards to keep pace with Petrobras’ level of local content to be used, expansion plans, the industry can with the transfer of skills and the “learning by doing” effect easily realized. Through improving the effciency during the construction phase of development, a fast-track to production can be achieved. This concept was most successfully seen through ExxonMobil’s “design one, build multiple” approach to the development of the Kizomba A, B and C units, offshore Angola, which highlighted how both effciency and

LC requirements could be met. It is this strategy that is likely to best ensure Petrobras’ high ambitions are achieved to timescale and to budget.

The recent award of two virtually

Infeld Systems identical FPSO contracts to Keppel expects four FLNG

Fels Brazil for the fabrication and installations to be integration of the topside modules producing by 2019.

for the P-66 and P-69 FPSOs rep- oedigital.com oedigital.com April 2013 | OE 5555 oe_fpso_infield.indd 55 4/1/13 3:39 PM

52

52

54

54