Page 54: of Offshore Engineer Magazine (Apr/May 2013)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2013 Offshore Engineer Magazine

resents a further example of maxi- with just seventeen installations 2012 saw Petronas award a Technip- mizing effciency and LC demands between 2008 and 2012. In contrast Daewoo Consortium a $2 billion going forward. to Latin American FPSO develop- contract for the frst of these units,

Somewhat surprisingly, with a ments, where the average tonnage which will include the engineering,

FPSO

EPIC total of nine new or redeployed per unit is anticipated to be over procurement, installation and com-

FPSO units expected to witness 200,000m tonnes and is situated in missioning for the FLNG facility, installation offshore UK over the an average water depth of almost with hull construction expected to next fve years, the country will 1600m, offshore Asia the average take place at Daewoo’s shipyard in be placed second only to Brazil in tonnage of FPSOs is expected to South Korea. terms of numbers of FPSO instal- be around 120,000 tonnes over the Offshore Africa FPSO activity is lations, while in capex terms the period, with average water depths also expected to remain strong; with

UK is expected to be ranked ffth of just 160m. Currently one new- Infeld Systems forecasting 19 FPSO globally over the period. Despite build unit is under construction; developments over the next fve

February 2013 seeing the cancella- the Enping 24-2 FPSO at the Dalian years. Here, Angola is anticipated tion of Shell’s FPSO development to continue to dominate the FPSO plans for the Fram feld, which market, with eight projects in the

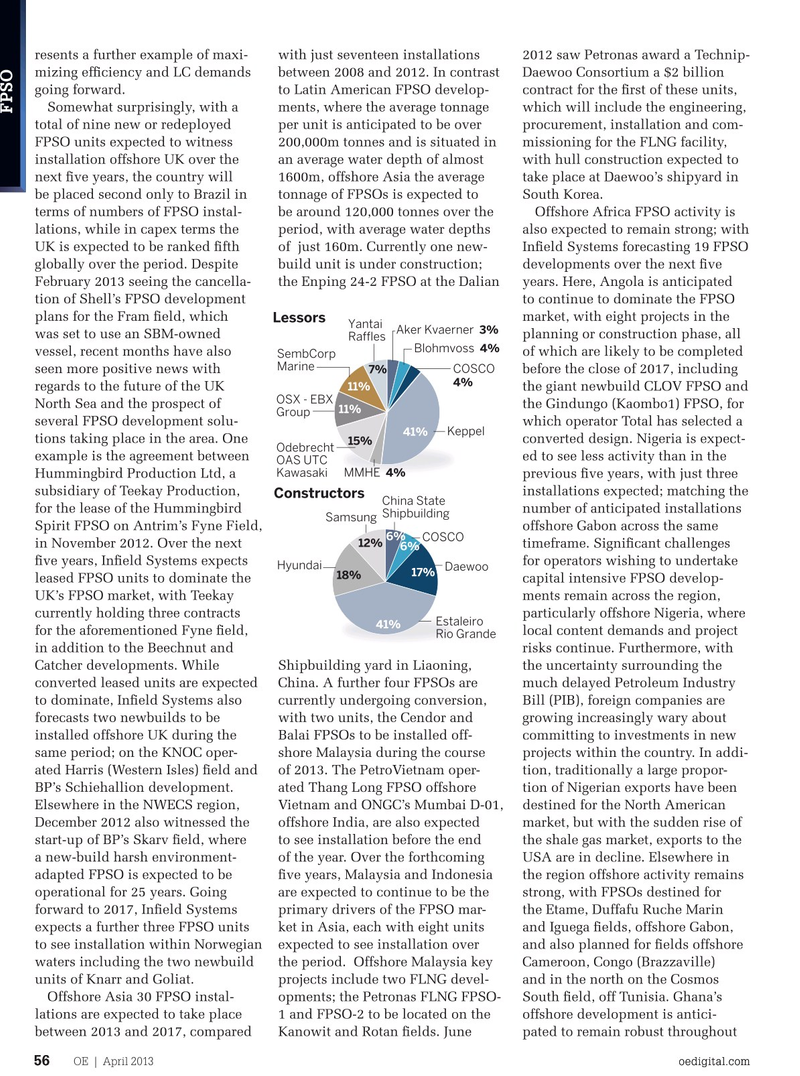

Lessors

Yantai

Aker Kvaerner 3% was set to use an SBM-owned planning or construction phase, all

Raffles 4% vessel, recent months have also of which are likely to be completed

SembCorp Blohmvoss

Marine

COSCO seen more positive news with before the close of 2017, including 7% 4% 11% regards to the future of the UK the giant newbuild CLOV FPSO and

OSX - EBX

North Sea and the prospect of the Gindungo (Kaombo1) FPSO, for 11%

Group several FPSO development solu- which operator Total has selected a

Keppel 41% tions taking place in the area. One converted design. Nigeria is expect- 15%

Odebrecht example is the agreement between ed to see less activity than in the

OAS UTC 4%

Kawasaki MMHE

Hummingbird Production Ltd, a previous fve years, with just three subsidiary of Teekay Production, installations expected; matching the

Constructors

China State for the lease of the Hummingbird number of anticipated installations

Samsung Shipbuilding

Spirit FPSO on Antrim’s Fyne Field, offshore Gabon across the same

COSCO 12%6% in November 2012. Over the next timeframe. Signifcant challenges 6% fve years, Infeld Systems expects for operators wishing to undertake

Hyundai

Daewoo 17% 18% leased FPSO units to dominate the capital intensive FPSO develop-

UK’s FPSO market, with Teekay ments remain across the region, currently holding three contracts particularly offshore Nigeria, where

Estaleiro 41% for the aforementioned Fyne feld, local content demands and project

Rio Grande in addition to the Beechnut and risks continue. Furthermore, with

Catcher developments. While Shipbuilding yard in Liaoning, the uncertainty surrounding the converted leased units are expected China. A further four FPSOs are much delayed Petroleum Industry to dominate, Infeld Systems also currently undergoing conversion, Bill (PIB), foreign companies are forecasts two newbuilds to be with two units, the Cendor and growing increasingly wary about installed offshore UK during the Balai FPSOs to be installed off- committing to investments in new same period; on the KNOC oper- shore Malaysia during the course projects within the country. In addi- ated Harris (Western Isles) feld and of 2013. The PetroVietnam oper- tion, traditionally a large propor-

BP’s Schiehallion development. ated Thang Long FPSO offshore tion of Nigerian exports have been

Elsewhere in the NWECS region, Vietnam and ONGC’s Mumbai D-01, destined for the North American

December 2012 also witnessed the offshore India, are also expected market, but with the sudden rise of start-up of BP’s Skarv feld, where to see installation before the end the shale gas market, exports to the a new-build harsh environment- of the year. Over the forthcoming USA are in decline. Elsewhere in adapted FPSO is expected to be fve years, Malaysia and Indonesia the region offshore activity remains operational for 25 years. Going are expected to continue to be the strong, with FPSOs destined for forward to 2017, Infeld Systems primary drivers of the FPSO mar- the Etame, Duffafu Ruche Marin expects a further three FPSO units ket in Asia, each with eight units and Iguega felds, offshore Gabon, to see installation within Norwegian expected to see installation over and also planned for felds offshore waters including the two newbuild the period. Offshore Malaysia key Cameroon, Congo (Brazzaville) units of Knarr and Goliat. projects include two FLNG devel- and in the north on the Cosmos

Offshore Asia 30 FPSO instal- opments; the Petronas FLNG FPSO- South feld, off Tunisia. Ghana’s lations are expected to take place 1 and FPSO-2 to be located on the offshore development is antici- between 2013 and 2017, compared Kanowit and Rotan felds. June pated to remain robust throughout

OE | April 2013 oedigital.comoedigital.com 5656 oe_fpso_infield.indd 56 4/1/13 2:26 AM

53

53

55

55