Page 19: of Offshore Engineer Magazine (Jul/Aug 2013)

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2013 Offshore Engineer Magazine

Perspectives

Analysis

Independents’ frontier successes ramp wider offshore activity

By Julie Wilson quickly to the new era of frontier explo- Liberia, Chevron farmed-in to operate

Independent oil companies have led ration. Shell and Total farmed-in to three deepwater licences during 2010. In the way opening new frontiers in recent French Guiana ahead of the discovery 2012, Shell announced a frontier explo- years, but this may change as companies well. Others have moved to establish ration partnership with Tullow, covering of all sizes have locked-up huge swathes positions, once the potential of frontier the Atlantic basin. Further moves by the of frontier acreage, creating opportuni- countries had been confrmed. Majors to enter these emerging plays are ties for exploration-driven deals. Many Total and Eni were fast-followers into likely to accelerate the discovery of new new frontiers are offshore in deep Uganda and Ghana, respectively. In volumes. The results have been very waters, and a surge in frontier deepwater rewarding for the companies involved. exploration will be facilitated by dra- Over seven billion barrels of oil equiva-

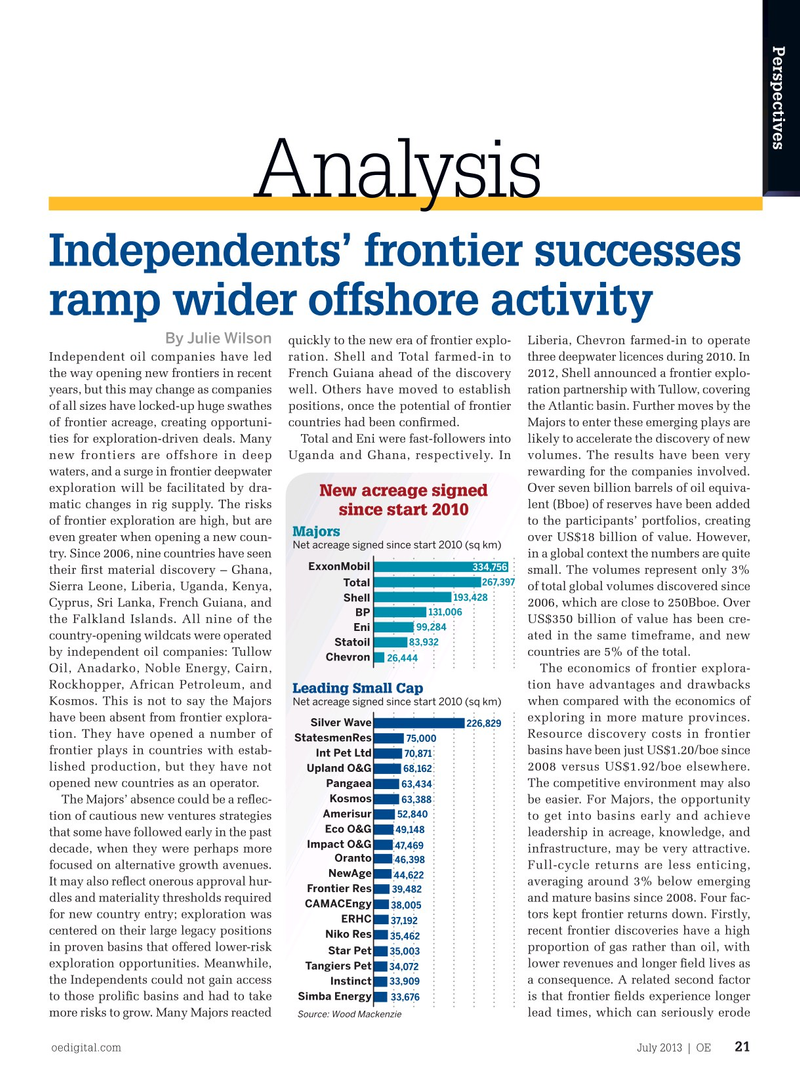

New acreage signed matic changes in rig supply. The risks lent (Bboe) of reserves have been added since start 2010 of frontier exploration are high, but are to the participants’ portfolios, creating

Majors even greater when opening a new coun- over US$18 billion of value. However,

Net acreage signed since start 2010 (sq km) try. Since 2006, nine countries have seen in a global context the numbers are quite

ExxonMobil 334,756 their frst material discovery – Ghana, small. The volumes represent only 3% 267,397

Total

Sierra Leone, Liberia, Uganda, Kenya, of total global volumes discovered since 193,428

Shell

Cyprus, Sri Lanka, French Guiana, and 2006, which are close to 250Bboe. Over 131,006

BP the Falkland Islands. All nine of the US$350 billion of value has been cre- 99,284

Eni country-opening wildcats were operated ated in the same timeframe, and new 83,932

Statoil by independent oil companies: Tullow countries are 5% of the total.

Chevron 26,444

Oil, Anadarko, Noble Energy, Cairn, The economics of frontier explora-

Rockhopper, African Petroleum, and tion have advantages and drawbacks

Leading Small Cap

Kosmos. This is not to say the Majors when compared with the economics of

Net acreage signed since start 2010 (sq km) have been absent from frontier explora- exploring in more mature provinces.

Silver Wave 226,829 tion. They have opened a number of Resource discovery costs in frontier

StatesmenRes 75,000 frontier plays in countries with estab- basins have been just US$1.20/boe since

Int Pet Ltd 70,871 lished production, but they have not 2008 versus US$1.92/boe elsewhere.

Upland O&G 68,162 opened new countries as an operator. The competitive environment may also

Pangaea 63,434

Kosmos 63,388

The Majors’ absence could be a refec- be easier. For Majors, the opportunity

Amerisur 52,840 tion of cautious new ventures strategies to get into basins early and achieve

Eco O&G 49,148 that some have followed early in the past leadership in acreage, knowledge, and

Impact O&G 47,469 decade, when they were perhaps more infrastructure, may be very attractive.

Oranto 46,398 focused on alternative growth avenues. Full-cycle returns are less enticing,

NewAge 44,622

It may also refect onerous approval hur- averaging around 3% below emerging

Frontier Res 39,482 dles and materiality thresholds required and mature basins since 2008. Four fac-

CAMACEngy 38,005 for new country entry; exploration was tors kept frontier returns down. Firstly,

ERHC 37,192 centered on their large legacy positions recent frontier discoveries have a high

Niko Res 35,462 in proven basins that offered lower-risk proportion of gas rather than oil, with

Star Pet 35,003 exploration opportunities. Meanwhile, lower revenues and longer feld lives as

Tangiers Pet 34,072 the Independents could not gain access a consequence. A related second factor 33,909

Instinct

Simba Energy to those prolifc basins and had to take is that frontier felds experience longer 33,676 more risks to grow. Many Majors reacted lead times, which can seriously erode

Source: Wood Mackenzie oedigital.com July 2013 | OE 21

Analysis_WoodMac_Quickstats.indd 21 6/24/13 1:47 AM

18

18

20

20