Page 60: of Offshore Engineer Magazine (Jul/Aug 2013)

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2013 Offshore Engineer Magazine

Mozambique

East Africa

All eyes are on Mozambique as rising signifcant natural gas fnds are set to turn the East African country into a major LNG player, but are oil riches on the horizon?

Japan’s Inpex announced in April that it would farm into

By Audrey Leon ozambique’s prolifc Rovuma basin holds 12 offshore 25% of Statoil’s share (reducing Statoil to 40%) in Areas 2 discoveries within a 50km radius. Rovuma’s deepwater and 5. The price of the farm-in was not announced by either

M basin covers 12,500 sq km and includes the Anadarko- and party, but JOGMEC said in May that it would provide equity

Eni-operated felds Area 1 and Area 4, in which the compa- fnancing of US$89.3 million (JPY 8.5 billion) to Inpex to nies have found a combined 170 Tcf of natural gas. Norway’s carry out the transaction, with JOGMEC becoming a share-

Statoil and Malaysia’s Petronas took stakes in Area 2 and 5, holder of Inpex’s subsidiary Inpex Mozambique Ltd.

and 3 and 6, respectively, during past licensing rounds. While natural gas has proved abundant in Mozambique,

All four companies have maintained a presence in three companies are also seeking to produce oil. Currently,

Mozambique since the country’s second licensing round in executives at Statoil and UK-based Tullow Oil espect to 2006, and have spent billions in the process. prove commercial oil deposits at their Cachalote well, in

For other companies interested in Mozambique, claim- Area 2, south of Mozambique’s current gas fnds. Tullow ing a stake now can be pricy. In April, China National Oil’s Angus McCoss told Bloomberg last month that fnding

Petroleum Corp. (CNPC) purchased a 28.57% at Eni’s oil off Mozambique is an attractive prospect. “The value subsidiary – Eni East Africa – for US$4.2 billion, giving it a lies in oil,” he says. “Cachalote is certainly worth doing as a foothold in Mozambique’s Area 4, where 75 Tcf of gas has potentially needle-moving prospect.” been discovered. Eni has similar plans to explore for oil off Mozambique.

In 2012, a bidding war escalated between Royal Dutch The Italian frm will drill its frst oil exploration well this

Shell and Thailand’s PTT Exploration & Production over month in Area 4, where it has already discovered 80 Tcf of

Dublin-based Cove Energy, which held 8.5% participating natural gas in the Mamba Complex and Coral prospects. Eni interest in Anadarko’s Rovuma Offshore Area 1. PTTEP plans to drill the Agulha-1 prospect later this year, to test eventually took over the East Africa-focused explorer for the hydrocarbon potential of Area 4’s deeper plays.

US$1.9 billion. With all eyes now on Mozambique, the country’s National

Petroleum Institute (Instituto de Petroleo/INP) used its spot at this year’s Offshore Technology Conference in Houston to advocate for investing in the country’s infrastructure includ- ing new rail and ports. A new airport in the capital, Maputo, opened in February.

INP’s exploration manager Carlos Zacarias, who spoke at

OTC, touted Mozambique’s new “Gas Master Plan,” which offers revisions to the country’s petroleum laws, regulations, and fscal packages, including new royalty rates for its abun- dance resources.

According to a study by ICF International, Mozambique could earn US$5.2 billion annually from its gas resources by 2026. Reforms to its current petroleum laws are certainly

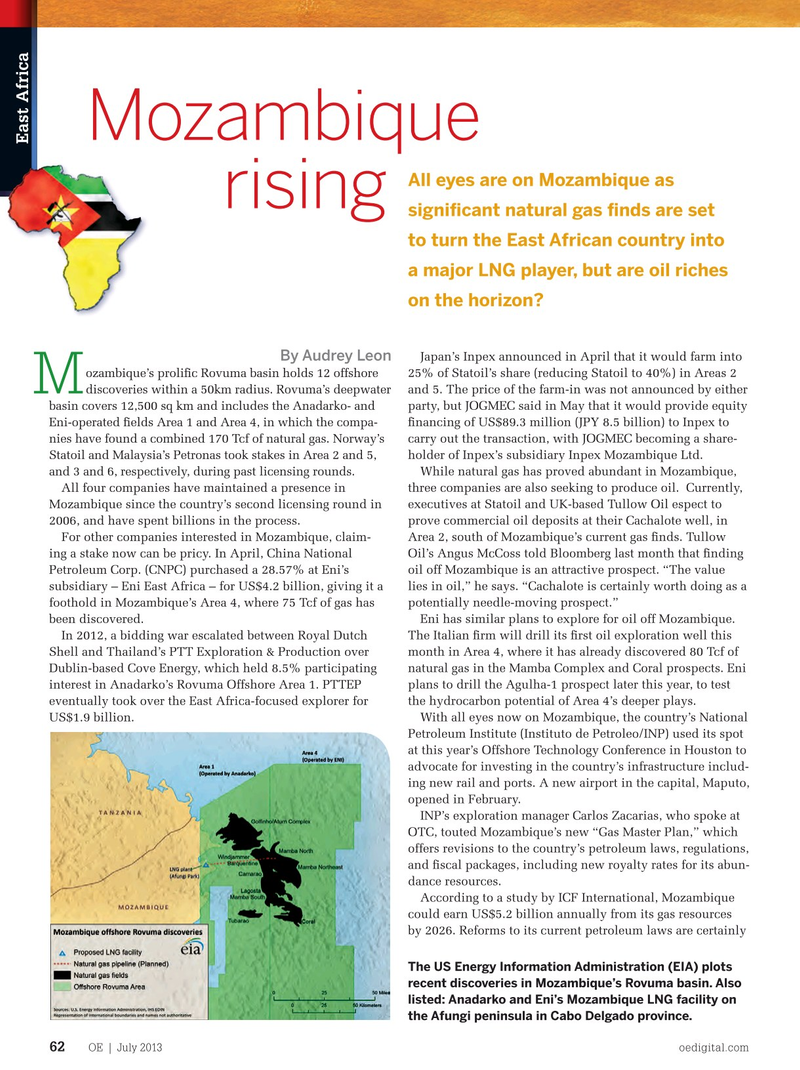

The US Energy Information Administration (EIA) plots recent discoveries in Mozambique’s Rovuma basin. Also listed: Anadarko and Eni’s Mozambique LNG facility on the Afungi peninsula in Cabo Delgado province.

OE | July 2013 oedigital.com 62

EastAfrica_Moz.indd 62 6/25/13 5:05 PM

59

59

61

61