Page 61: of Offshore Engineer Magazine (Jul/Aug 2013)

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2013 Offshore Engineer Magazine

East Africa attractive to both the government and the oil and gas compa- taken some pressure off the main dock. “Before the dock nies operating there. you could only have three rigs,” he says.

“There’s 170 Tcf in Area 1 and Area 4, but they are not Anadarko is focused on developing its large-scale fully explored,” Zacarias told OTC delegates. “We hope Mozambique LNG project at Palma and plans are in the the companies operating in Mozambique will continue to works to build an air strip there. Anadarko will need to unlock more resources.” route fowlines around surface faults and deep channels.

Infrastructure diffculties aside, Peffer said there are many other challenges in Mozambique, including manag-

Anadarko’s Mozambique playbook

Last year, at IHS CERAWeek, Anadarko’s CEO and Chairman ing expectations of local citizens and government. He says

James Hackett told Daniel Yergin that the company ‘dou- Mozambique’s government seemed to be most focused on bled’ down on Mozambique out of desperation. Hackett was capacity building – making sure that its citizens have good being facetious, but he went on to say that the company jobs and training. Another challenge: the distance from needed to invest in a place that “wasn’t already picked over Anadarko’s northern discoveries and the capital in the by the majors.” These are exciting times for Anadarko; R.A. South, where most of the schools, educated workforce, con- “Al” Walker replaced Hackett as President and CEO last sulates, and government offcials reside.

May and Chairman this year. It’s not all bad news. The coastline may be long, but so far “Not everyone gets to open a new gas resource in the discoveries are close enough to the shore to give them a their lifetime,” says President of Anadarko

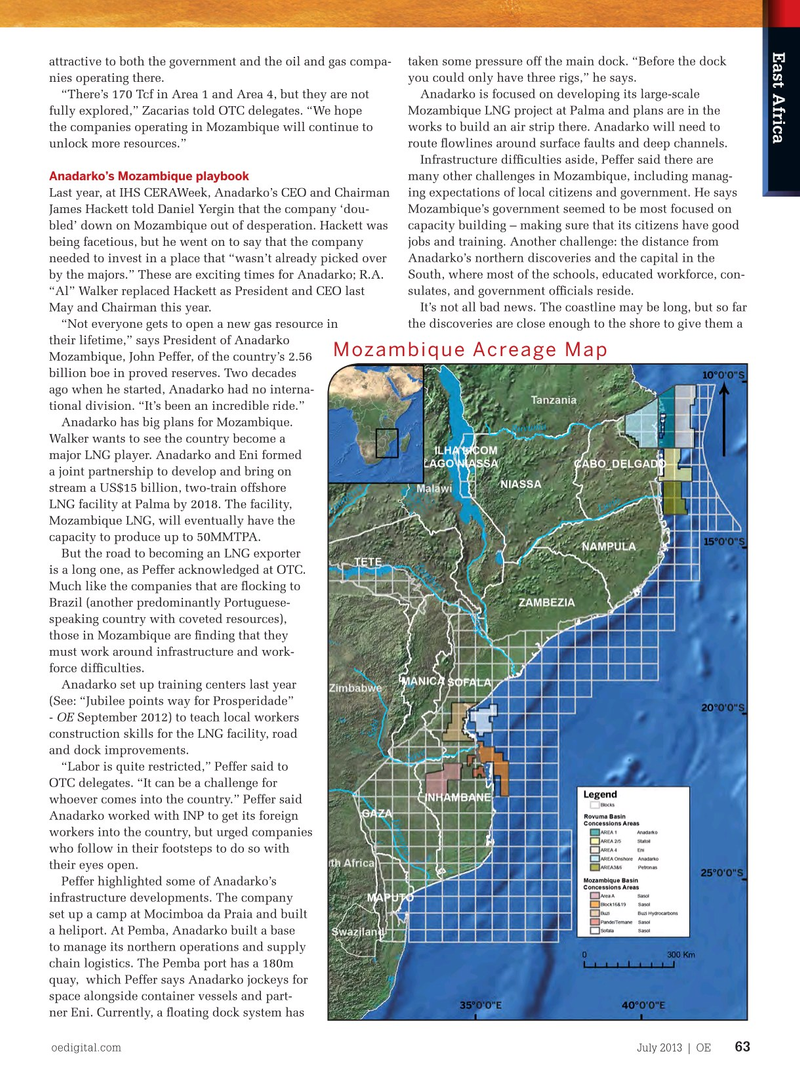

Mozambique Acreage Map

Mozambique, John Peffer, of the country’s 2.56 billion boe in proved reserves. Two decades ago when he started, Anadarko had no interna- tional division. “It’s been an incredible ride.”

Anadarko has big plans for Mozambique.

Walker wants to see the country become a major LNG player. Anadarko and Eni formed a joint partnership to develop and bring on stream a US$15 billion, two-train offshore

LNG facility at Palma by 2018. The facility,

Mozambique LNG, will eventually have the capacity to produce up to 50MMTPA.

But the road to becoming an LNG exporter is a long one, as Peffer acknowledged at OTC.

Much like the companies that are focking to

Brazil (another predominantly Portuguese- speaking country with coveted resources), those in Mozambique are fnding that they must work around infrastructure and work- force diffculties.

Anadarko set up training centers last year (See: “Jubilee points way for Prosperidade” - OE September 2012) to teach local workers construction skills for the LNG facility, road and dock improvements. “Labor is quite restricted,” Peffer said to

OTC delegates. “It can be a challenge for whoever comes into the country.” Peffer said

Anadarko worked with INP to get its foreign workers into the country, but urged companies who follow in their footsteps to do so with their eyes open.

Peffer highlighted some of Anadarko’s infrastructure developments. The company set up a camp at Mocimboa da Praia and built a heliport. At Pemba, Anadarko built a base to manage its northern operations and supply chain logistics. The Pemba port has a 180m quay, which Peffer says Anadarko jockeys for space alongside container vessels and part- ner Eni. Currently, a foating dock system has oedigital.com July 2013 | OE 63

EastAfrica_Moz.indd 63 6/25/13 1:00 PM

60

60

62

62