Page 20: of Offshore Engineer Magazine (Oct/Nov 2013)

Read this page in Pdf, Flash or Html5 edition of Oct/Nov 2013 Offshore Engineer Magazine

countries weak education more systematic approach— systems fail to provide to place the understanding companies with adequately- and management of social,

Quick stats trained potential employees. political and ethical issues

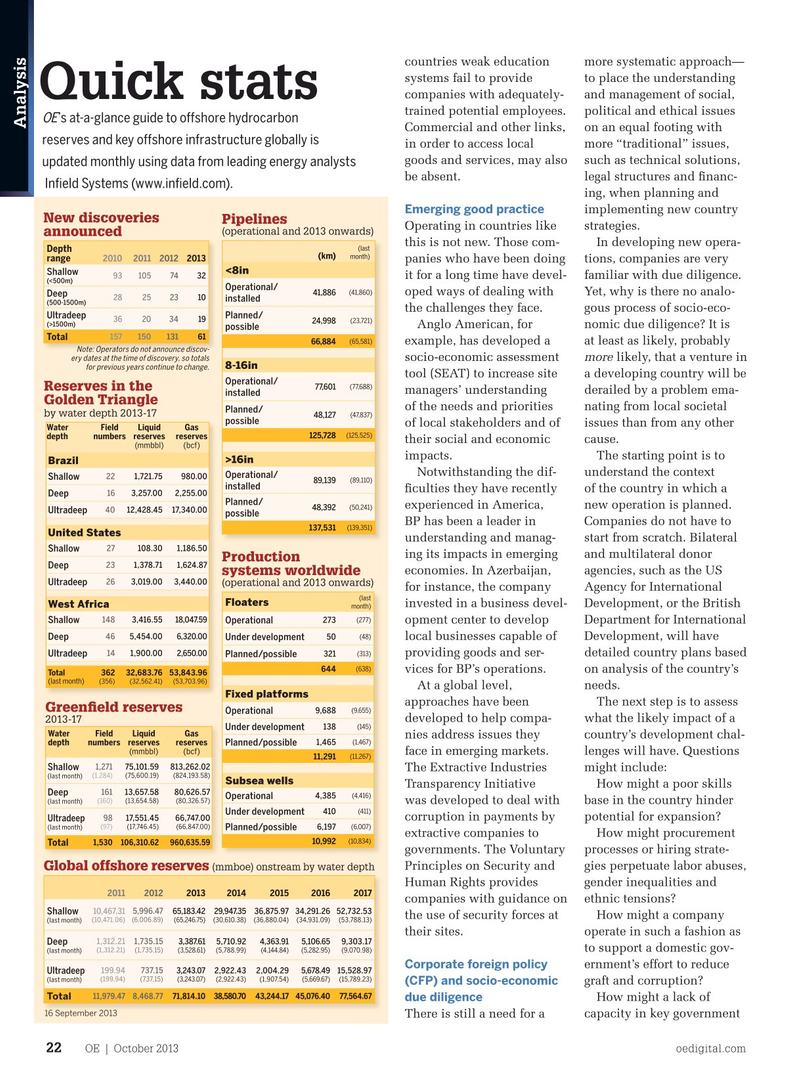

OE ’s at-a-glance guide to ofshore hydrocarbon

Analysis

Commercial and other links, on an equal footing with reserves and key ofshore infrastructure globally is in order to access local more “traditional” issues, goods and services, may also such as technical solutions, updated monthly using data from leading energy analysts be absent. legal structures and fnanc- Infeld Systems (www.infeld.com).

ing, when planning and implementing new country

Emerging good practice

New discoveries Pipelines

Operating in countries like strategies. (operational and 2013 onwards) announced this is not new. Those com- In developing new opera- (last

Depth month) (km) range 2010 2011 2012 2013 panies who have been doing tions, companies are very <8in

Shallow 93 105 74 32 it for a long time have devel- familiar with due diligence. (<500m)

Operational/ (41,860) oped ways of dealing with Yet, why is there no analo- 41,886

Deep 28 25 23 10 installed (500-1500m) the challenges they face. gous process of socio-eco-

Ultradeep Planned/ 36 20 34 19 (23,721) 24,998 (>1500m)

Anglo American, for nomic due diligence? It is possible 157 150 131 61

Total (65,581) 66,884 example, has developed a at least as likely, probably

Note: Operators do not announce discov- ery dates at the time of discovery, so totals socio-economic assessment more likely, that a venture in 8-16in for previous years continue to change.

tool (SEAT) to increase site a developing country will be

Operational/ (77,688) 77,601

Reserves in the managers’ understanding derailed by a problem ema- installed

Golden Triangle of the needs and priorities nating from local societal

Planned/ by water depth 2013-17 (47,837) 48,127 possible of local stakeholders and of issues than from any other

Water Field Liquid Gas (125,525) 125,728 depth numbers reserves reserves their social and economic cause. (mmbbl) (bcf) impacts. The starting point is to >16in

Brazil

Notwithstanding the dif- understand the context

Operational/ 22 1,721.75980.00

Shallow (89,110) 89,139 installed fculties they have recently of the country in which a

Deep 16 3,257.00 2,255.00

Planned/ experienced in America, new operation is planned. (50,241) 48,392 40 12,428.45 17,340.00

Ultradeep possible

BP has been a leader in Companies do not have to (139,351) 137,531

United States understanding and manag- start from scratch. Bilateral 27 108.30 1,186.50

Shallow ing its impacts in emerging and multilateral donor

Production 23 1,378.71 1,624.87

Deep economies. In Azerbaijan, agencies, such as the US systems worldwide 26 3,019.00 3,440.00

Ultradeep (operational and 2013 onwards) for instance, the company Agency for International (last

Floaters invested in a business devel- Development, or the British

West Africa month) (277) 148 3,416.55 18,047.59 273

Shallow Operational opment center to develop Department for International (48) 46 5,454.00 6,320.00 50

Deep Under development local businesses capable of Development, will have 14 1,900.00 2,650.00 321 (313) providing goods and ser- detailed country plans based

Ultradeep Planned/possible (638) 644 vices for BP’s operations. on analysis of the country’s

Total 362 32,683.76 53,843.96 (last month) (356) (32,562.41) (53,703.96)

At a global level, needs.

Fixed platforms approaches have been The next step is to assess

Greenfeld reserves (9,655) 9,688

Operational developed to help compa- what the likely impact of a 2013-17 (145) 138

Under development

Water Field Liquid Gas nies address issues they country’s development chal- (1,467) 1,465 depth numbers reserves reserves

Planned/possible (mmbbl) (bcf) face in emerging markets. lenges will have. Questions (11,267) 11,291 1,271 75,101.59 813,262.02

Shallow

The Extractive Industries might include: (last month) (1,284) (75,600.19) (824,193.58)

Subsea wells

Transparency Initiative How might a poor skills

Deep 161 13,657.58 80,626.57 (4,416) 4,385

Operational (last month) (160) (13,654.58) (80,326.57) was developed to deal with base in the country hinder (411) 410

Under development corruption in payments by potential for expansion?

98 17,551.45 66,747.00

Ultradeep (last month) (97) (17,746.45) (66,847.00) (6,007) 6,197

Planned/possible extractive companies to How might procurement (10,834) 10,992 1,530 106,310.62 960,635.59

Total governments. The Voluntary processes or hiring strate-

Principles on Security and gies perpetuate labor abuses,

Global offshore reserves (mmboe) onstream by water depth

Human Rights provides gender inequalities and 2011 2012 201320142015 20162017 companies with guidance on ethnic tensions?

5,996.47 10,467.31 65,183.42 29,947.35 36,875.97 34,291.26 52,732.53

Shallow the use of security forces at How might a company (last month) (10,471.06) (6,006.89) (65,246.75) (30,610.38) (36,880.04) (34,931.09) (53,788.13) their sites. operate in such a fashion as

Deep 1,312.21 1,735.15 3,387.61 5,710.92 4,363.91 5,106.65 9,303.17 to support a domestic gov- (last month) (1,312.21) (1,735.15) (3,528.61) (5,788.99) (4,144.84) (5,282.95) (9,070.98) ernment’s effort to reduce

Corporate foreign policy 199.94 737.15 3,243.07 2,922.43 2,004.29 5,678.49 15,528.97

Ultradeep (last month) (199.94) (737.15) (3,243.07) (2,922.43) (1,907.54) (5,669.67) (15,789.23) graft and corruption?

(CFP) and socio-economic 11,979.47 8,468.77 71,814.10 38,580.70 43,244.17 45,076.40 77,564.67

Total

How might a lack of due diligence 16 September 2013

There is still a need for a capacity in key government

OE | October 2013 oedigital.com 22

OE1013_Analysis.indd 22 9/30/13 8:33 AM

19

19

21

21