Page 23: of Offshore Engineer Magazine (Jan/Feb 2014)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2014 Offshore Engineer Magazine

0-99 0-99 0-99 28%28%28%28% 51%51%51% capex spending is attributable to IOCs, during the summer of 2013 at DSME’s and beyond.

re? ecting the general split in the market, shipyard in Okpo, South Korea, the race Offshore Europe, capex during 2014 is 008 222008 2009 008 2009 2010 0 2011 2012 2013 2014 22015 015 015 2016 22017 with independents and most NOCs pre- to develop the world’s ? rst operational expected to be driven by developments 34% 34% 34% dominantly concentrating investments in FLNG unit is also now underway, with within the NWECS region. Offshore shallow water prospects. That said, lead- the operator aiming for a start-up date of Norway In? eld Systems expects high ing independent operators Anadarko and 2015. Rotan is expected to enter pro- pro? le projects such as Aasta Hansteen,

Noble are anticipated to continue their duction a year later, while Shell’s giant Martin Linge and Edvard Grieg to drive successful global deepwater campaigns Prelude offshore Australia is unlikely expenditure. The forthcoming year is during the year, with Anadarko expected to commence production before 2017. also expected to see the region’s leading to be the third largest deepwater spender Offshore Indonesia, In? eld Systems operator Statoil rise to the position of within the Gulf of Mexico (GOM) after anticipates that NOC Pertamina will fourth-highest spender globally, behind

LLOG and Shell, and Noble expected to continue to hold the largest share of Total, Chevron and Petrobras. With continue its development of Tamar and expenditure, with Chevron expected to increasing development costs however, neighboring prospects within the Eastern be the most signi? cant foreign operator the Norwegian NOC has announced that

Mediterranean. in the country. The US IOC is expected it intends to keep exploration spending

On a regional level, Latin America is to focus upon the Gendalo-Gehem at its already-record 2013 levels. Offshore record-breaking discovery to production expected to continue to hold the largest project, which will see the re-tender of UK, the challenging Total-operated ? elds time of just 40 months, while Phase 2 of share of total capex, with developments its ? oating platform units at the start of of Franklin West (Phase 2), Laggan and

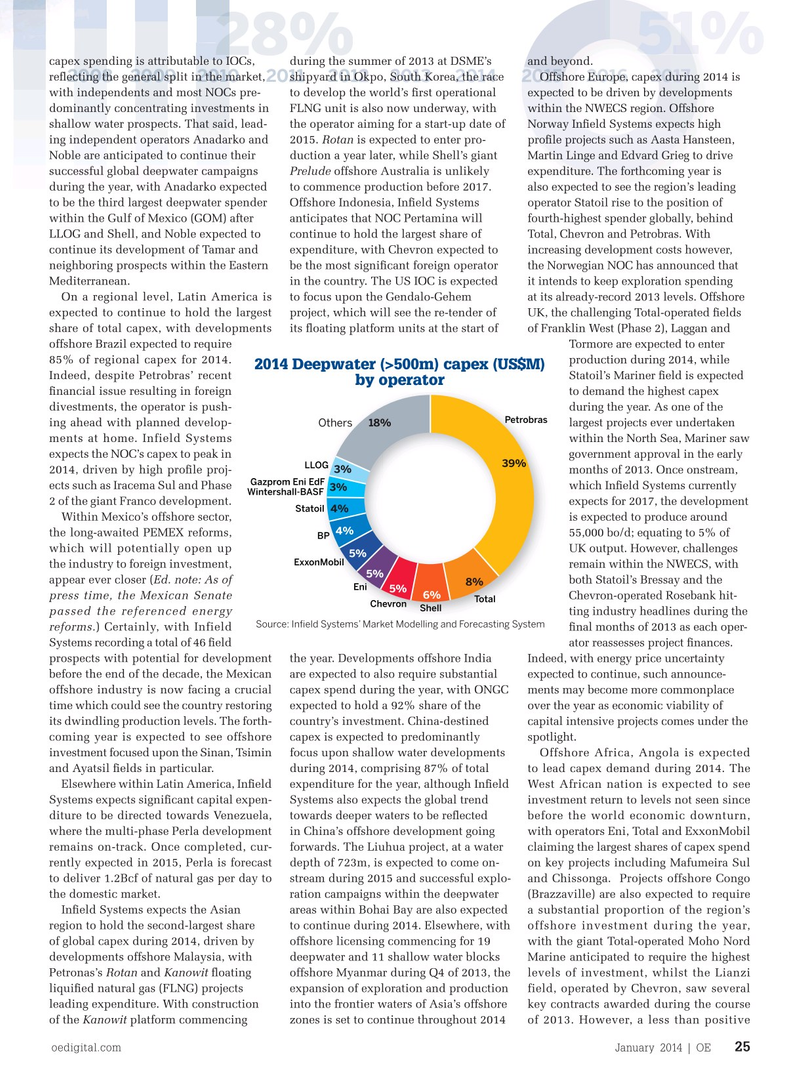

Jubilee (Hyedua) is anticipated to enter offshore Brazil expected to require Tormore are expected to enter production during the course of 2014, 85% of regional capex for 2014. production during 2014, while 2014 Deepwater (>500m) capex (US$M) taking just seven years from discovery to Indeed, despite Petrobras’ recent Statoil’s Mariner ? eld is expected by operator on-stream date. At the other end of the ? nancial issue resulting in foreign to demand the highest capex spectrum, Nigeria’s shallow water ? elds divestments, the operator is push- during the year. As one of the

Petrobras expected to enter production during 2014 ing ahead with planned develop- largest projects ever undertaken 18%

Others average discovery to production times of ments at home. Infield Systems within the North Sea, Mariner saw 26 years, re? ecting the challenging oper- expects the NOC’s capex to peak in government approval in the early 39%

LLOG 3% ating environment within the country 2014, driven by high pro? le proj- months of 2013. Once onstream, Gazprom Eni EdF and preference of IOCs towards deepwa- ects such as Iracema Sul and Phase which In? eld Systems currently 3%

Wintershall-BASF ter ? eld development. 2 of the giant Franco development. expects for 2017, the development

Statoil 4%

In capital expenditure (capex) terms, Within Mexico’s offshore sector, is expected to produce around 4% shallow water developments are expected the long-awaited PEMEX reforms, 55,000 bo/d; equating to 5% of BP to form the largest share of global invest- which will potentially open up UK output. However, challenges 5% ExxonMobil ment during the forthcoming year, with the industry to foreign investment, remain within the NWECS, with 5% the North West European Continental appear ever closer (Ed. note: As of both Statoil’s Bressay and the 8%

Eni 5% 6%

Shelf (NWECS) and Southeast Asia antic- press time, the Mexican Senate Chevron-operated Rosebank hit-

Total

Chevron

Shell ipated to require particularly high levels passed the referenced energy ting industry headlines during the

Source: In? eld Systems’ Market Modelling and Forecasting System of shallow water spend. While develop- reforms.) Certainly, with Infield ? nal months of 2013 as each oper- ments in less than 500m are expected Systems recording a total of 46 ? eld ator reassesses project ? nances. to hold the largest share of capex, when prospects with potential for development the year. Developments offshore India Indeed, with energy price uncertainty looking at the top ten operators in isola- before the end of the decade, the Mexican are expected to also require substantial expected to continue, such announce- tion, 63% of expenditure for 2014 is offshore industry is now facing a crucial capex spend during the year, with ONGC ments may become more commonplace expected to be attributable to deep and time which could see the country restoring expected to hold a 92% share of the over the year as economic viability of ultra-deepwater developments. Although its dwindling production levels. The forth- country’s investment. China-destined capital intensive projects comes under the

NOC Petrobras leads deepwater develop- coming year is expected to see offshore capex is expected to predominantly spotlight. ment, a signi? cant share of deepwater investment focused upon the Sinan, Tsimin focus upon shallow water developments Offshore Africa, Angola is expected and Ayatsil ? elds in particular. during 2014, comprising 87% of total to lead capex demand during 2014. The

Elsewhere within Latin America, In? eld expenditure for the year, although In? eld West African nation is expected to see

Others

Systems expects signi? cant capital expen- Systems also expects the global trend investment return to levels not seen since diture to be directed towards Venezuela, towards deeper waters to be re? ected before the world economic downturn, 14%

Brazil where the multi-phase Perla development in China’s offshore development going with operators Eni, Total and ExxonMobil 24%

UK 3% remains on-track. Once completed, cur- forwards. The Liuhua project, at a water claiming the largest shares of capex spend

Venezuela 3% rently expected in 2015, Perla is forecast depth of 723m, is expected to come on- on key projects including Mafumeira Sul to deliver 1.2Bcf of natural gas per day to stream during 2015 and successful explo- and Chissonga. Projects offshore Congo

Iran 5% the domestic market. ration campaigns within the deepwater (Brazzaville) are also expected to require

In? eld Systems expects the Asian areas within Bohai Bay are also expected a substantial proportion of the region’s 6%

Nigeria region to hold the second-largest share to continue during 2014. Elsewhere, with offshore investment during the year, 14%

Russia (Sakhalin) of global capex during 2014, driven by offshore licensing commencing for 19 with the giant Total-operated Moho Nord 7% developments offshore Malaysia, with deepwater and 11 shallow water blocks Marine anticipated to require the highest

Norway

Petronas’s Rotan and Kanowit ? oating offshore Myanmar during Q4 of 2013, the levels of investment, whilst the Lianzi 7% 10% liqui? ed natural gas (FLNG) projects expansion of exploration and production field, operated by Chevron, saw several 7%

China (PRC)

Angola leading expenditure. With construction into the frontier waters of Asia’s offshore key contracts awarded during the course

USA of the Kanowit platform commencing zones is set to continue throughout 2014 of 2013. However, a less than positive oedigital.com January 2014 | OE 25 024_OE0114 CovStory_MktForecast1_infield.indd 25 12/19/13 4:22 PM

22

22

24

24