Page 44: of Offshore Engineer Magazine (May/Jun 2014)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2014 Offshore Engineer Magazine

GLOBAL DEEPWATER REVIEW

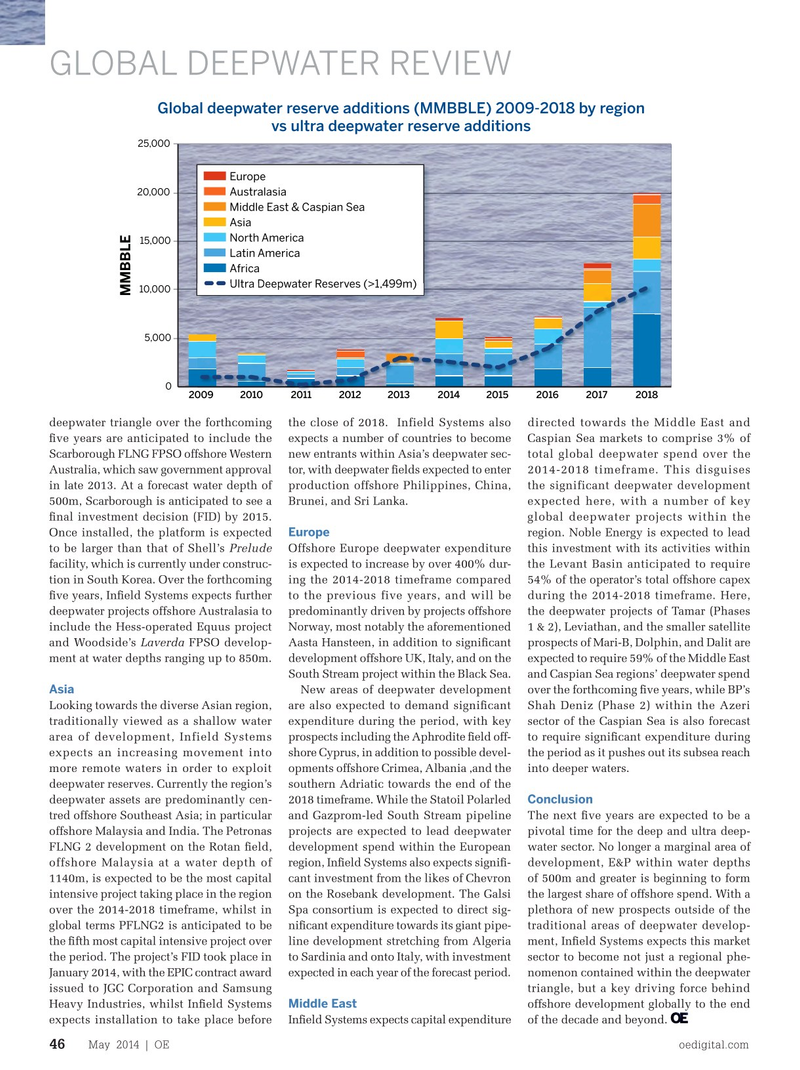

Global deepwater reserve additions (MMBBLE) 2009-2018 by region vs ultra deepwater reserve additions 25,000

Europe 20,000

Australasia

Middle East & Caspian Sea

Asia

North America 15,000

Latin America

Africa

Ultra Deepwater Reserves (>1,499m) Ultra Deepwater Reserves (>1,499m) 10,000

MMBBLE 5,000 0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 009 2010 2011 2012 2013 2014 2015 2016 2017 2018 deepwater triangle over the forthcoming the close of 2018. Infield Systems also directed towards the Middle East and ? ve years are anticipated to include the expects a number of countries to become Caspian Sea markets to comprise 3% of

Scarborough FLNG FPSO offshore Western new entrants within Asia’s deepwater sec- total global deepwater spend over the

Australia, which saw government approval tor, with deepwater ? elds expected to enter 2014-2018 timeframe. This disguises in late 2013. At a forecast water depth of production offshore Philippines, China, the significant deepwater development 500m, Scarborough is anticipated to see a Brunei, and Sri Lanka. expected here, with a number of key ? nal investment decision (FID) by 2015. global deepwater projects within the

Europe

Once installed, the platform is expected region. Noble Energy is expected to lead to be larger than that of Shell’s Prelude Offshore Europe deepwater expenditure this investment with its activities within facility, which is currently under construc- is expected to increase by over 400% dur- the Levant Basin anticipated to require tion in South Korea. Over the forthcoming ing the 2014-2018 timeframe compared 54% of the operator’s total offshore capex ? ve years, In? eld Systems expects further to the previous five years, and will be during the 2014-2018 timeframe. Here, deepwater projects offshore Australasia to predominantly driven by projects offshore the deepwater projects of Tamar (Phases include the Hess-operated Equus project Norway, most notably the aforementioned 1 & 2), Leviathan, and the smaller satellite and Woodside’s Laverda FPSO develop- Aasta Hansteen, in addition to signi? cant prospects of Mari-B, Dolphin, and Dalit are ment at water depths ranging up to 850m. development offshore UK, Italy, and on the expected to require 59% of the Middle East

South Stream project within the Black Sea. and Caspian Sea regions’ deepwater spend

Asia

New areas of deepwater development over the forthcoming ? ve years, while BP’s

Looking towards the diverse Asian region, are also expected to demand signi? cant Shah Deniz (Phase 2) within the Azeri traditionally viewed as a shallow water expenditure during the period, with key sector of the Caspian Sea is also forecast area of development, Infield Systems prospects including the Aphrodite ? eld off- to require signi? cant expenditure during expects an increasing movement into shore Cyprus, in addition to possible devel- the period as it pushes out its subsea reach more remote waters in order to exploit opments offshore Crimea, Albania ,and the into deeper waters. deepwater reserves. Currently the region’s southern Adriatic towards the end of the

Conclusion deepwater assets are predominantly cen- 2018 timeframe. While the Statoil Polarled tred offshore Southeast Asia; in particular and Gazprom-led South Stream pipeline The next ? ve years are expected to be a offshore Malaysia and India. The Petronas projects are expected to lead deepwater pivotal time for the deep and ultra deep-

FLNG 2 development on the Rotan ? eld, development spend within the European water sector. No longer a marginal area of offshore Malaysia at a water depth of region, In? eld Systems also expects signi? - development, E&P within water depths 1140m, is expected to be the most capital cant investment from the likes of Chevron of 500m and greater is beginning to form intensive project taking place in the region on the Rosebank development. The Galsi the largest share of offshore spend. With a over the 2014-2018 timeframe, whilst in Spa consortium is expected to direct sig- plethora of new prospects outside of the global terms PFLNG2 is anticipated to be ni? cant expenditure towards its giant pipe- traditional areas of deepwater develop- the ? fth most capital intensive project over line development stretching from Algeria ment, In? eld Systems expects this market the period. The project’s FID took place in to Sardinia and onto Italy, with investment sector to become not just a regional phe-

January 2014, with the EPIC contract award expected in each year of the forecast period. nomenon contained within the deepwater issued to JGC Corporation and Samsung triangle, but a key driving force behind

Middle East

Heavy Industries, whilst In? eld Systems offshore development globally to the end expects installation to take place before In? eld Systems expects capital expenditure of the decade and beyond.

May 2014 | OE oedigital.com 46 042_OE0514_DW2_Infield.indd 46 4/18/14 7:12 PM

43

43

45

45