Page 28: of Offshore Engineer Magazine (Feb/Mar 2015)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2015 Offshore Engineer Magazine

RIG MARKET REVIEW

Deepwater drilling markets –

Darkness before dawn outages fell and additions from other projects came onstream.

Over supply of oil, diminishing returns and an

The result was an over-supplied situation, which came sooner increasing rig ? eet will challenge rig operators and more forcefully than the market had anticipated (Figure 2).

in 2015. Rystad Energy’s Joachim Bjørni and

On 27 November 2014, OPEC refrained from cutting production despite projections showing a need for a cut of 1.5-2 MMb/d in

Oddmund Føre look for a ray of light.

2015 to balance global supply and demand. The global oil market hroughout 2014, drilling companies were punished is now in uncharted territory as it has lost its traditional swing in a bearish market where few ? xtures and downward producer, and oil prices are left to balance supply and demand.

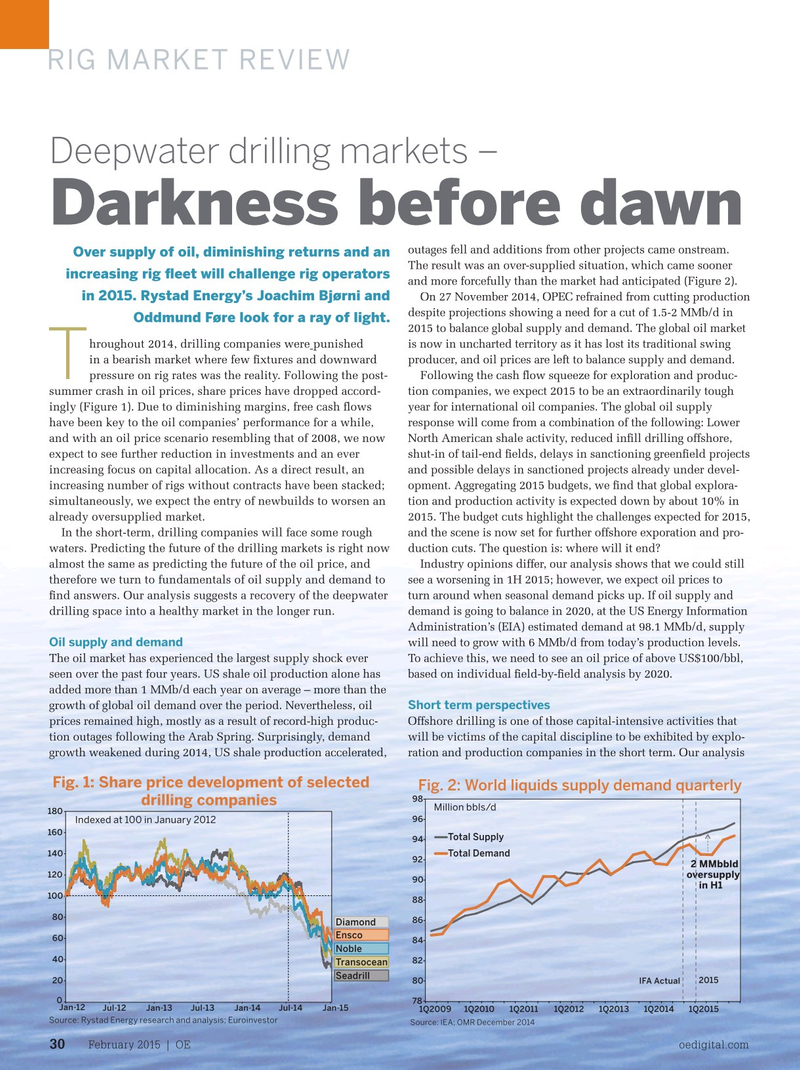

T pressure on rig rates was the reality. Following the post- Following the cash ? ow squeeze for exploration and produc- summer crash in oil prices, share prices have dropped accord- tion companies, we expect 2015 to be an extraordinarily tough ingly (Figure 1). Due to diminishing margins, free cash ? ows year for international oil companies. The global oil supply have been key to the oil companies’ performance for a while, response will come from a combination of the following: Lower and with an oil price scenario resembling that of 2008, we now North American shale activity, reduced in? ll drilling offshore, expect to see further reduction in investments and an ever shut-in of tail-end ? elds, delays in sanctioning green? eld projects increasing focus on capital allocation. As a direct result, an and possible delays in sanctioned projects already under devel- increasing number of rigs without contracts have been stacked; opment. Aggregating 2015 budgets, we ? nd that global explora- simultaneously, we expect the entry of newbuilds to worsen an tion and production activity is expected down by about 10% in already oversupplied market. 2015. The budget cuts highlight the challenges expected for 2015,

In the short-term, drilling companies will face some rough and the scene is now set for further offshore exporation and pro- waters. Predicting the future of the drilling markets is right now duction cuts. The question is: where will it end?

Industry opinions differ, our analysis shows that we could still almost the same as predicting the future of the oil price, and see a worsening in 1H 2015; however, we expect oil prices to therefore we turn to fundamentals of oil supply and demand to turn around when seasonal demand picks up. If oil supply and ? nd answers. Our analysis suggests a recovery of the deepwater demand is going to balance in 2020, at the US Energy Information drilling space into a healthy market in the longer run.

Administration’s (EIA) estimated demand at 98.1 MMb/d, supply

Oil supply and demand will need to grow with 6 MMb/d from today’s production levels.

The oil market has experienced the largest supply shock ever

To achieve this, we need to see an oil price of above US$100/bbl, seen over the past four years. US shale oil production alone has based on individual ? eld-by-? eld analysis by 2020.

added more than 1 MMb/d each year on average – more than the

Short term perspectives growth of global oil demand over the period. Nevertheless, oil prices remained high, mostly as a result of record-high produc- Offshore drilling is one of those capital-intensive activities that tion outages following the Arab Spring. Surprisingly, demand will be victims of the capital discipline to be exhibited by explo- growth weakened during 2014, US shale production accelerated, ration and production companies in the short term. Our analysis

Fig. 3: Short term ?eet status, selected *

Uncontracted drilling companies

Fig. 1: Share price development of selected

Fig. 2: World liquids supply demand quarterly

Contracted

Percentage of ?eet in respective categories 98 drilling companies 100% 3% 9%

Million bbls/d 180 96

Indexed at 100 in January 2012 90% 21% 31% 34% 35% 160 38%

Total Supply 94 80% 46% 47% 51% 53% 55% 61% 140

Total Demand 57% 70% 92 69% 2 MMbbld 73% 70% 81% 120 60% oversupply 90 in H1 50% 100 88 40% 80 86

Diamond 30%

Ensco 60 84 20%

Noble 40 82

Transocean 10%

Seadrill 20 80 IFA Actual 2015 0% 15 16 17 15 16 17 15 16 17 15 16 17 15 16 17 15 16 17

Transocean ENSCO Seadrill Diamond Market avg.

Noble 0 78

Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 1Q2009 1Q2010 1Q2011 1Q2012 1Q2013 1Q2014 1Q2015 *as of December 18th 2014

Source: Rystad Energy research and analysis; Rystad Energy RigCube

Source: Rystad Energy research and analysis; Euroinvestor

Source: IEA; OMR December 2014

February 2015 | OE oedigital.com 30 030_OE0215_Rigmarket_Rystad.indd 30 1/20/15 5:51 PM

27

27

29

29