Page 29: of Offshore Engineer Magazine (Feb/Mar 2015)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2015 Offshore Engineer Magazine

suggests that exploration and production companies will reduce projects with competitive break-even prices lined up to be devel- drilling activities in deepwater areas by 2% in 2015. This trend oped to support the increasing global oil demand. As a result we has been evident in the past quarters, where we have seen low see the offshore ? eet allocation increasingly weighted towards contracting activity from exploration and production compa- development drilling. This call on deepwater production and nies, and signi? cant decrease in day rates from the new mutual expected oil price increase will further provide incentives for contracts that have been realized due to current oversupply in increased in? ll drilling on already producing ? elds as the eco- the ? oater space. The current market situation is challenging for nomic bene? t of keeping the infrastructure alive is added to the the rig owners, which are expected to face troublesome years to value analysis. With the expected oil price increase our analysis come. In terms of survival, rig owners with solid backlogs will be suggests, as a result of exploration and production companies best equipped to ride the passing storm (Figure 3). bene? ting from better cash ? ows and increasing oil demand,

In late 2014, we have seen increased attrition activity of older exploration activity will again be deemed attractive.

low-speci? cation units from rig owners, including majors such

Darkness before dawn as Diamond and Transocean, which are in the process of scrap- ping a total of 18 ? oaters. This trend will continue as explora- Adding an oil market oversupply situation on top of an E&P tion and production companies high grade their operating ? eet. industry working against diminishing margins and a rapidly

This selective behavior emphasizes the current market situa- increasing rig ? eet, market drivers indicate a continuation of tion, where supply growth is outpacing demand and is expected the market cool-down we are experiencing. to result in further attrition pressure on low-speci? cation units. However, with an expected slowdown from shale and

A large number of newbuilds are expected to hit the market onshore oil supply, the oil market will need to turn to deep- within the next two years, adding distress to an already chal- water production to meet the expected long term oil demand lenging market. Already rig owners are trying to counteract the growth. Our analysis tells a challenging story short term in the effects on utilization levels of this in? ux by postponing planned deepwater drilling space, and sees the rational in increased newbuild deliveries. attrition activity and newbuild delays from rig owners.

A vital question for the rig market exists: how long will this It is always darkest before dawn; the long term, triggered by downturn continue? Our analysis suggests we will see an oil balancing oil market driving increasing oil prices, will again market return to balance in 2017-18. Combining the expected provide a scenario with market fundamentals pointing towards oil market balance with rig market supply side actions, we increasing utilization levels. anticipate brighter days to come for the deepwater drilling mar- ket. The latest EIA oil demand estimate for 2020 is 98.1 MMb/d, Joachim Bjørni is an analyst in Rystad up from~92 MMb/d today. To meet these production levels, it is Energy’s global oil? eld service team. His pivotal for the oil market to see an increased contribution from experience includes rig supply and deepwater production. The past years’ shale production has demand, and global exploration and demonstrated tremendous year on year (YoY) growth numbers production spending. Joachim holds an MA of 72%. However, future growth levels for shale production are in international business from the estimated to slow to around 9% YoY. Coupled with an expected University of Edinburgh.

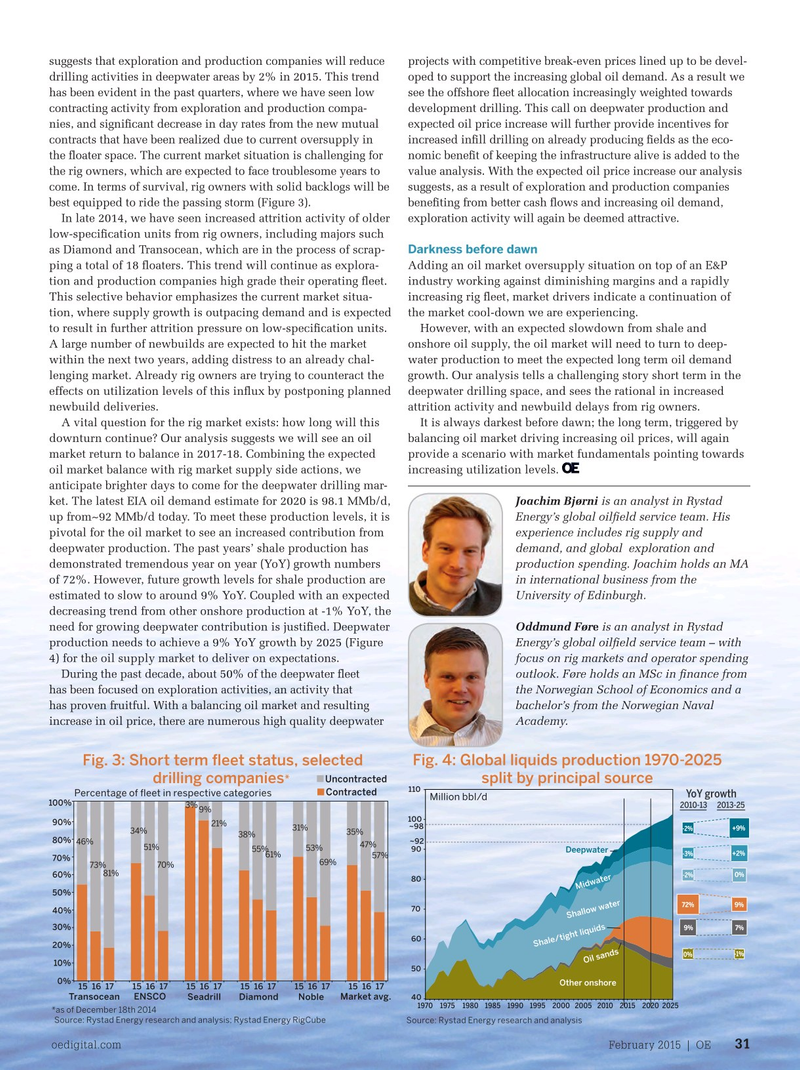

decreasing trend from other onshore production at -1% YoY, the need for growing deepwater contribution is justi? ed. Deepwater Oddmund Føre is an analyst in Rystad production needs to achieve a 9% YoY growth by 2025 (Figure Energy’s global oil? eld service team – with 4) for the oil supply market to deliver on expectations. focus on rig markets and operator spending

During the past decade, about 50% of the deepwater ? eet outlook. Føre holds an MSc in ? nance from has been focused on exploration activities, an activity that the Norwegian School of Economics and a has proven fruitful. With a balancing oil market and resulting bachelor’s from the Norwegian Naval increase in oil price, there are numerous high quality deepwater Academy.

Fig. 4: Global liquids production 1970-2025

Fig. 3: Short term ?eet status, selected *

Uncontracted split by principal source drilling companies

Fig. 2: World liquids supply demand quarterly 110

Contracted

Percentage of ?eet in respective categories

YoY growth

Million bbl/d 98 100% 3% 9% 2010-13 2013-25

Million bbls/d 100 96 90% 21% ~98 +9 31% -2% % 34% 35% 38%

Total Supply 94 80% ~92 46% 47% 51% 53% 90 55% 61%

Deepwater +2 -3% %

Total Demand 57% 70% 92 69% 2 MMbbld 73% 70% 81% 0 -2% % 60% oversupply 80 90 in H1

Midwater 50% 88 % % 72 9 70 40%

Shallow water 86 30% 9 7 % % 60 84

Shale/tight liquids 20% 0% -1%

Oil sands 82 10% 50 80 IFA Actual 2015 0%

Other onshore 15 16 17 15 16 17 15 16 17 15 16 17 15 16 17 15 16 17

Transocean ENSCO Seadrill Diamond Market avg.

40 Noble 78 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 1Q2009 1Q2010 1Q2011 1Q2012 1Q2013 1Q2014 1Q2015 *as of December 18th 2014

Source: Rystad Energy research and analysis; Rystad Energy RigCube

Source: Rystad Energy research and analysis

Source: IEA; OMR December 2014 oedigital.com February 2015 | OE 31 030_OE0215_Rigmarket_Rystad.indd 31 1/20/15 5:52 PM

28

28

30

30