Page 30: of Offshore Engineer Magazine (Feb/Mar 2015)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2015 Offshore Engineer Magazine

RIG MARKET REVIEW

Rig market hits hard ti mes used for longer-term activity projections. This outlook does not

Orderbooks re? ect reined-in spending based on speci? cally address or directly consider the award, startup, or conservative near-term oil price estimates. development of speci? c projects that collectively could create

ABS’ James Graf sets out the detail.

short-term volatility.

eak demand, excess oil supply – due in part Demand outlook

Oil prices have declined signi? cantly, and despite a few to shale oil production – and the decision by

W optimistic ticks upward, they have dropped steadily over the the Organization of the Petroleum Exporting past few months. Meanwhile, production numbers remain

Countries (OPEC) to maintain production levels have driven relatively constant, and OPEC, which has in the past stepped the price of oil down. While there has been oil price volatil- in to alter production levels to re? ect demand, has shown ity in the past, the 33% drop in a three-month period at the no interest in pursuing that route this time around. At the end of 2014 was precipitous. And the outlook is far from 166th meeting of the organization in Vienna, Austria, on 27 rosy, with the average price per barrel likely to remain below

November 2014 under the Chairmanship of its President HE

US$60/bbl through 2015 with modest increase the following

Abdourhman Ataher Al-Ahirish, Libyan Vice Prime Minister year. At present, there is no expectation for oil to rise to $90/ for Corporations and Head of its Delegation, OPEC members bbl until 2017 or later. agreed to hold ? rm on production targets despite falling

The numbers in perspective prices.

Forecasts, by their nature, are speculative; so it is important While OPEC’s intentions are never entirely transparent, the to understand the basis for the projections. In this case, the organization’s motivation is likely based on its desire to pre- outlook is framed by macro industry demand drivers and uses serve long-term market share, which sends a signal to the North a supply vs. demand approach to project future supply needs. American unconventional oil producers. Weak demand growth

Oil price and oil demand are closely correlated to activity in in Europe and Japan and the slowing growth in China contrib- the offshore industry on a longer-term trend basis and conse- ute to weak global demand, and that is expected to continue quently represent a primary base demand indicator that can be through 2015. Indications at present imply the low oil price

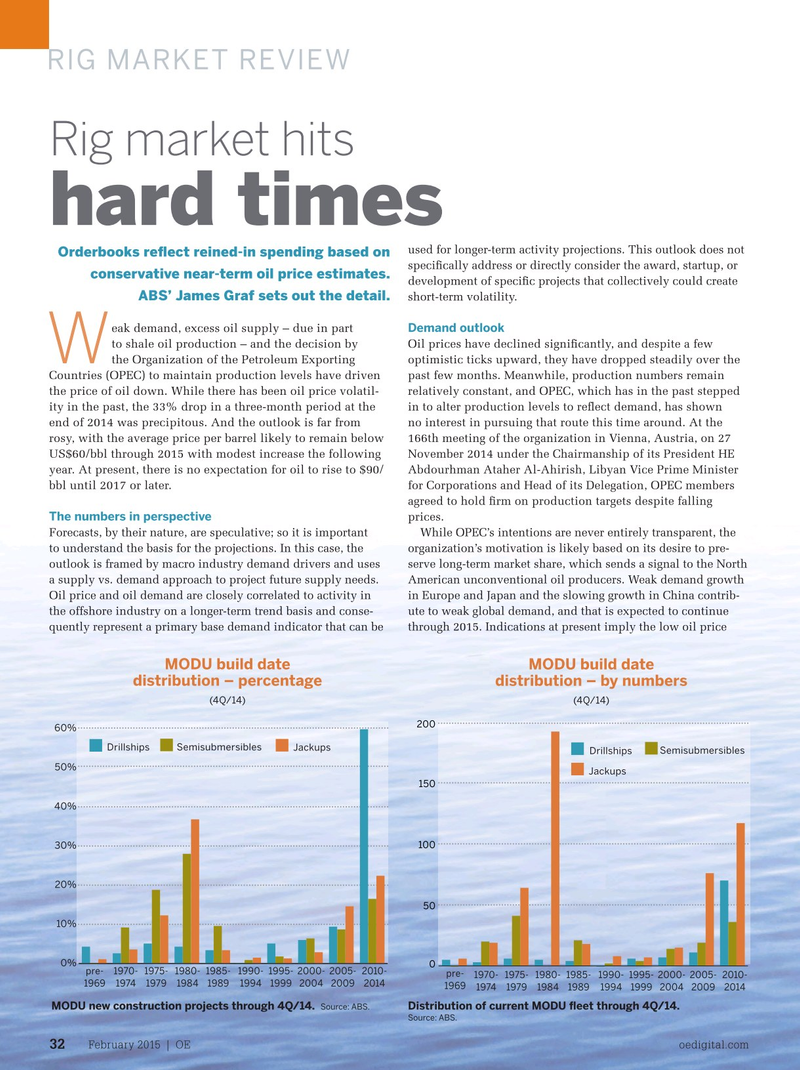

MODU build date MODU build date distribution – percentage distribution – by numbers (4Q/14) (4Q/14) 200 60%

Drillships Semisubmersibles Jackups

Drillships Semisubmersibles 50%

Jackups 150 40% 30% 100 20% 50 10% 0% 0 pre- 1970-1975-1980-1985- 1990-1995-2000-2005-2010- pre- 1970-1975-1980-1985- 1990-1995-2000-2005-2010- 1969 1974 1979 1984 1989 1994 1999 2004 2009 2014 1969 1974 1979 1984 1989 1994 1999 2004 2009 2014

MODU new construction projects through 4Q/14. Distribution of current MODU ? eet through 4Q/14. Source: ABS.

Source: ABS.

February 2015 | OE oedigital.com 32 032_OE0215_Rigmarket_ABS.indd 32 1/20/15 6:09 PM

29

29

31

31