Page 65: of Offshore Engineer Magazine (Feb/Mar 2015)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2015 Offshore Engineer Magazine

Geofocus there are only two drillships the impending Minerals active in the region (Belford and Petroleum Resources

Dolphin for Anadarko in Amendment Bill have

Mozambique and Discoverer meant there has been no

Americas for Statoil in offshore drilling activity

Tanzania: Deepsea Metro is for over a decade, other stacked in Tanzania), from than for Total’s Brulpadda a high of fve in November well, which unfortunately 2012, and four operating was suspended in October as recently as August 2014 2014, due to mechanical (Baker Hughes’ Rig Count). It issues related to extreme is diffcult to conceive at the current and sea condi- present time of any increase tions. In most areas, early through 2015. Depending mover advantage is now upon the results of the over.

ongoing interpretation of In a scramble to be seismic and wells in Kenya, part of the economic

Tanzania and Mozambique, boom that hydrocarbon and the remaining explora- production is anticipated tion periods for licenses to bring to all of East across East Africa, the drill- Africa, individual states ships already in the region are jostling for position. could potentially be assigned In its pursuit of appro- to any number of prospects priate revenue sharing through the year, but it is with Tanzania, Zanzibar’s most likely that for the time semi-autonomous gov- being they will be focused ernment has effectively on the Rovuma/Rufji areas. blocked any work on four

It should be noted that the licenses awarded to Shell

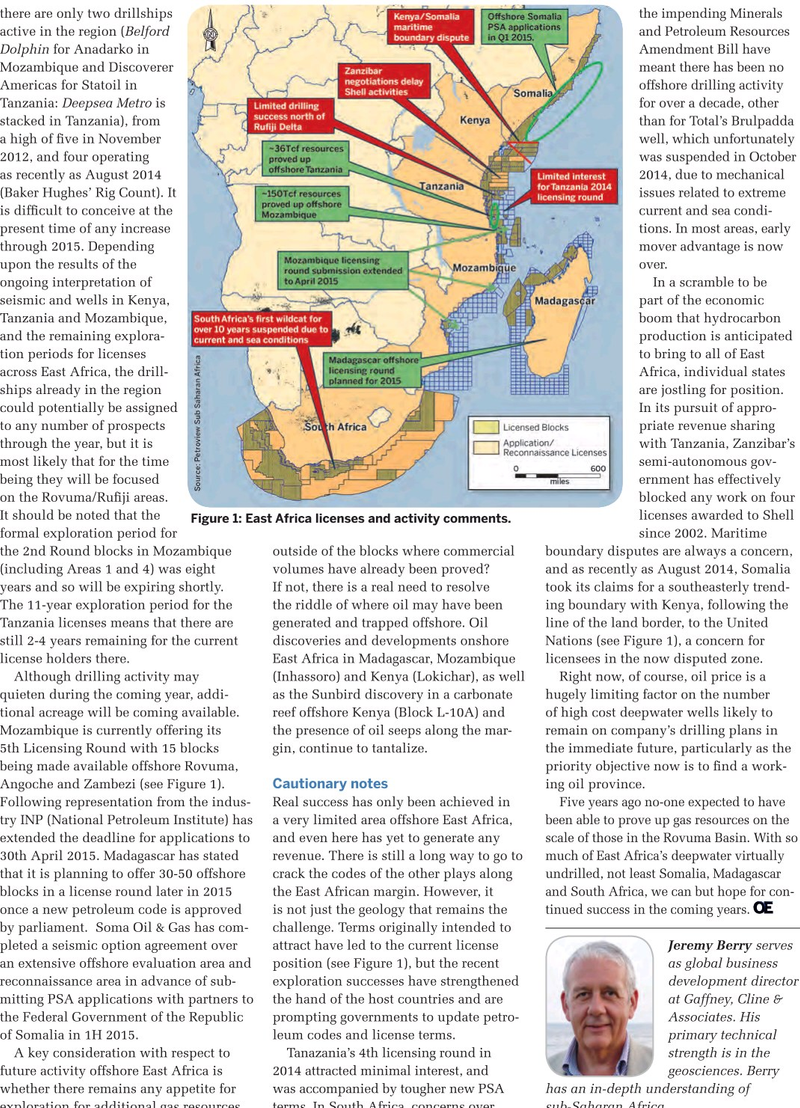

Figure 1: East Africa licenses and activity comments.

formal exploration period for since 2002. Maritime the 2nd Round blocks in Mozambique outside of the blocks where commercial boundary disputes are always a concern, (including Areas 1 and 4) was eight volumes have already been proved? and as recently as August 2014, Somalia years and so will be expiring shortly. If not, there is a real need to resolve took its claims for a southeasterly trend-

The 11-year exploration period for the the riddle of where oil may have been ing boundary with Kenya, following the

Tanzania licenses means that there are generated and trapped offshore. Oil line of the land border, to the United still 2-4 years remaining for the current discoveries and developments onshore Nations (see Figure 1), a concern for license holders there. East Africa in Madagascar, Mozambique licensees in the now disputed zone.

Although drilling activity may (Inhassoro) and Kenya (Lokichar), as well Right now, of course, oil price is a quieten during the coming year, addi- as the Sunbird discovery in a carbonate hugely limiting factor on the number tional acreage will be coming available. reef offshore Kenya (Block L-10A) and of high cost deepwater wells likely to

Mozambique is currently offering its the presence of oil seeps along the mar- remain on company’s drilling plans in 5th Licensing Round with 15 blocks gin, continue to tantalize. the immediate future, particularly as the being made available offshore Rovuma, priority objective now is to fnd a work-

Cautionary notes

Angoche and Zambezi (see Figure 1). ing oil province.

Five years ago no-one expected to have

Following representation from the indus- Real success has only been achieved in been able to prove up gas resources on the try INP (National Petroleum Institute) has a very limited area offshore East Africa, scale of those in the Rovuma Basin. With so extended the deadline for applications to and even here has yet to generate any much of East Africa’s deepwater virtually 30th April 2015. Madagascar has stated revenue. There is still a long way to go to undrilled, not least Somalia, Madagascar that it is planning to offer 30-50 offshore crack the codes of the other plays along and South Africa, we can but hope for con- blocks in a license round later in 2015 the East African margin. However, it tinued success in the coming years. once a new petroleum code is approved is not just the geology that remains the by parliament. Soma Oil & Gas has com- challenge. Terms originally intended to pleted a seismic option agreement over attract have led to the current license Jeremy Berry serves an extensive offshore evaluation area and position (see Figure 1), but the recent as global business reconnaissance area in advance of sub- exploration successes have strengthened development director mitting PSA applications with partners to the hand of the host countries and are at Gaffney, Cline & the Federal Government of the Republic prompting governments to update petro- Associates. His of Somalia in 1H 2015. leum codes and license terms. primary technical

A key consideration with respect to Tanazania’s 4th licensing round in strength is in the future activity offshore East Africa is 2014 attracted minimal interest, and geosciences. Berry whether there remains any appetite for was accompanied by tougher new PSA has an in-depth understanding of exploration for additional gas resources terms. In South Africa, concerns over sub-Saharan Africa.

oedigital.com February 2015 | OE 67

64

64

66

66