Page 64: of Offshore Engineer Magazine (Feb/Mar 2015)

Read this page in Pdf, Flash or Html5 edition of Feb/Mar 2015 Offshore Engineer Magazine

Offshore East Africa:

East Africa

As a result of recent ofshore successes in Mozambique w hat’s next?

and Tanzania, the entire East

Africa margin currently has offshore East Africa during the past fve – as reported by the operators) to justify the attention of the world’s years are summarized in Table 1. LNG developments and although plans

Gas was frst discovered onshore East are progressing in both countries, no new ventures teams, explorers

Africa in the 1960s, albeit at a sig- fnal investment decisions have yet been and gas (LNG) buyers. What nifcantly smaller scale than the current announced. might happen next in this new

With a minimum of four years for offshore volumes. The most substantial construction, between project sanction and onshore discoveries were Pande (dis- hydrocarbon province? frst LNG production, in these greenfeld covered 1961) and Temane (discovered

Jeremy Berry explains.

sites, the earliest LNG export dates from 1967) in Mozambique and Songo Songo the region will be 2019-20 for Mozambique (discovered 1974) and Mnazi Bay (dis- eepwater sands of Tertiary and covered 1982) in Tanzania. (which has already selected a site for the

Cretaceous ages, related to the However, it was not until the 2000s

LNG plant in Cabo Delgado province) and

D

Rovuma and Rufji River deltas, that these more material accumula- 2022-23 for Tanzania. However, project offshore Mozambique and Tanzania, tions began production. The limited fnance also still needs to be put in place have proved to be the most prolifc new local market and lack of infrastructure to fund these developments and with each offshore “basin” in the world in the past in the region – responsible for the delay two train plant costing in the region of fve years, with some 185 Tcf of natural in the development of these onshore $20-30billion, further delays may be envis- gas resources already having been discov- felds – remains the major challenge for aged in the current climate.

ered since the frst well (Windjammer-1 the monetization of the huge offshore

Future prospects in Area 1, offshore Mozambique) in gas resources. While plans for various

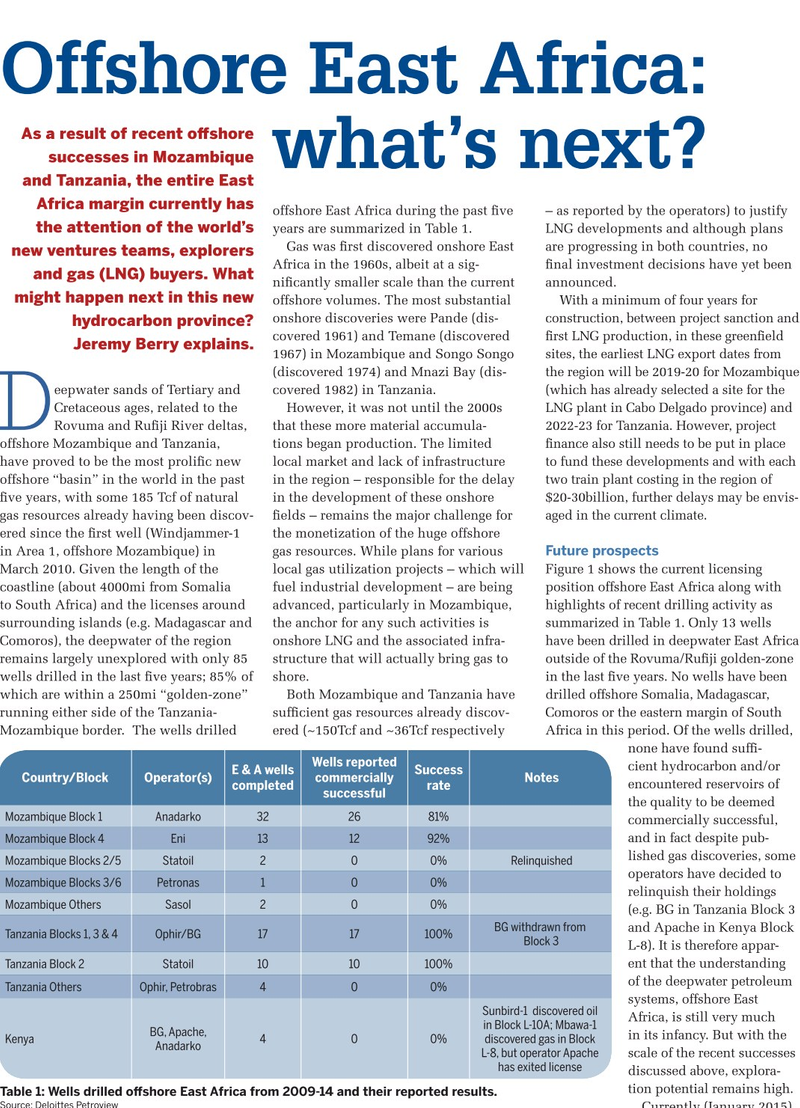

March 2010. Given the length of the local gas utilization projects – which will Figure 1 shows the current licensing coastline (about 4000mi from Somalia fuel industrial development – are being position offshore East Africa along with to South Africa) and the licenses around advanced, particularly in Mozambique, highlights of recent drilling activity as surrounding islands (e.g. Madagascar and the anchor for any such activities is summarized in Table 1. Only 13 wells

Comoros), the deepwater of the region onshore LNG and the associated infra- have been drilled in deepwater East Africa remains largely unexplored with only 85 structure that will actually bring gas to outside of the Rovuma/Rufji golden-zone wells drilled in the last fve years; 85% of shore. in the last fve years. No wells have been which are within a 250mi “golden-zone” Both Mozambique and Tanzania have drilled offshore Somalia, Madagascar, running either side of the Tanzania- suffcient gas resources already discov- Comoros or the eastern margin of South

Mozambique border. The wells drilled ered (~150Tcf and ~36Tcf respectively Africa in this period. Of the wells drilled, none have found suff-

Wells reported cient hydrocarbon and/or

E & A wells Success

Country/Block Operator(s) commercially Notes encountered reservoirs of completed rate successful the quality to be deemed

Mozambique Block 1 Anadarko 32 26 81% commercially successful, and in fact despite pub-

Mozambique Block 4 Eni 13 12 92% lished gas discoveries, some

Mozambique Blocks 2/5 Statoil 2 0 0% Relinquished operators have decided to

Mozambique Blocks 3/6 Petronas 1 0 0% relinquish their holdings

Mozambique Others Sasol 2 0 0% (e.g. BG in Tanzania Block 3

BG withdrawn from and Apache in Kenya Block

Tanzania Blocks 1, 3 & 4 Ophir/BG 17 17 100% Block 3

L-8). It is therefore appar- ent that the understanding

Tanzania Block 2 Statoil 10 10 100% of the deepwater petroleum

Tanzania Others Ophir, Petrobras 4 0 0% systems, offshore East

Sunbird-1 discovered oil

Africa, is still very much in Block L-10A; Mbawa-1

BG, Apache, in its infancy. But with the

Kenya 4 0 0% discovered gas in Block

Anadarko

L-8, but operator Apache scale of the recent successes has exited license discussed above, explora- tion potential remains high.

Table 1: Wells drilled ofshore East Africa from 2009-14 and their reported results.

Source: Deloittes Petroview

Currently (January 2015)

February 2015 | OE oedigital.com 66

63

63

65

65