Page 54: of Offshore Engineer Magazine (Mar/Apr 2015)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2015 Offshore Engineer Magazine

Australia is relatively robust and unlikely to see a signifcant drop off in 2015, as many of the programs are underway already, are needed for contract delivery / or are essential for the continued per-

Australian and New Zealand formance of felds that operate with low break-evens and high netbacks.

This could change heading into 2016, if a low oil price persists. The development

Australia New Zealand offshore exploration spend more than 12 months out from early-2015 is likely to be more discretion-

Angus Rodger and Matt Howell discuss the ary and, after a year of low prices, nothing

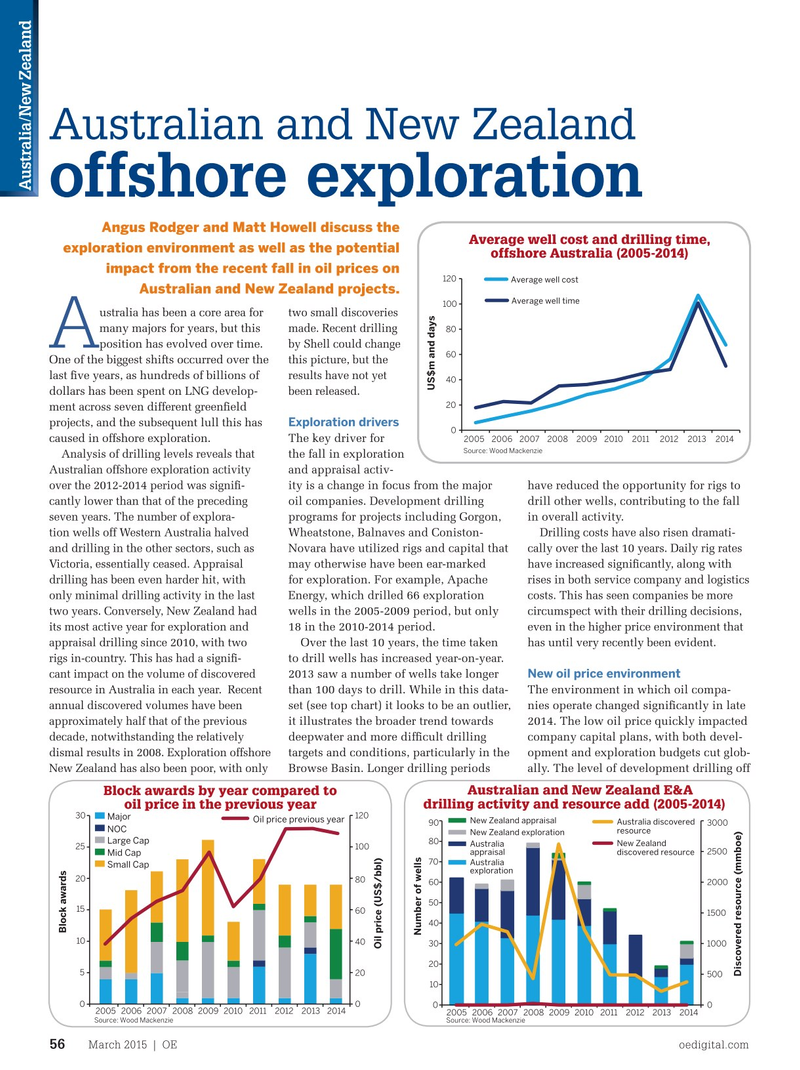

Average well cost and drilling time, exploration environment as well as the potential will be sacrosanct. This is where we offshore Australia (2005-2014) would expect more of an impact on devel- impact from the recent fall in oil prices on 120

Average well cost opment drilling and related expenditure.

Australian and New Zealand projects.

In comparison, the deferral of short-

Average well time 100 ustralia has been a core area for two small discoveries term exploration activity is a relatively many majors for years, but this made. Recent drilling simple way to reduce expenditure and 80

A position has evolved over time. by Shell could change one we are already seeing occur in 60 this picture, but the

One of the biggest shifts occurred over the

Australia. Many companies with com- results have not yet last fve years, as hundreds of billions of mitment wells due in 2015 and 2016 40

US$m and days dollars has been spent on LNG develop- been released.

are applying to the National Offshore 20

Petroleum Titles Administrator (NOPTA, ment across seven different greenfeld

Exploration drivers the government licensing regulator) to projects, and the subsequent lull this has 0 20052006 2007 20082009 2010 201120122013 2014 defer commitments. If successful, these caused in offshore exploration. The key driver for

Source: Wood Mackenzie

Analysis of drilling levels reveals that the fall in exploration deferrals could result in minimal explo-

Australian offshore exploration activity and appraisal activ- ration and appraisal activity. over the 2012-2014 period was signif- have reduced the opportunity for rigs to ity is a change in focus from the major In New Zealand, short-term activity is cantly lower than that of the preceding drill other wells, contributing to the fall oil companies. Development drilling unlikely to be affected by the drop in oil seven years. The number of explora- in overall activity. programs for projects including Gorgon, price. One of the two rigs active there is

Drilling costs have also risen dramati- tion wells off Western Australia halved

Wheatstone, Balnaves and Coniston- being transported back to Singapore and cally over the last 10 years. Daily rig rates and drilling in the other sectors, such as

Novara have utilized rigs and capital that the other is committed to the continua-

Victoria, essentially ceased. Appraisal have increased signifcantly, along with may otherwise have been ear-marked tion of development drilling. The rig is rises in both service company and logistics drilling has been even harder hit, with for exploration. For example, Apache scheduled to remain in New Zealand once costs. This has seen companies be more only minimal drilling activity in the last

Energy, which drilled 66 exploration that development drilling is complete for circumspect with their drilling decisions, two years. Conversely, New Zealand had wells in the 2005-2009 period, but only an exploration well. That said, this well even in the higher price environment that its most active year for exploration and 18 in the 2010-2014 period. could be considered in jeopardy, depend- has until very recently been evident.

appraisal drilling since 2010, with two

Over the last 10 years, the time taken ing on the funding position of the compa-

This has had a signif- rigs in-country. to drill wells has increased year-on-year. nies involved.

New oil price environment cant impact on the volume of discovered 2013 saw a number of wells take longer

Longer term resource in Australia in each year. Recent than 100 days to drill. While in this data- The environment in which oil compa- nies operate changed signifcantly in late set (see top chart) it looks to be an outlier, We are yet to see if the appetite for new annual discovered volumes have been 2014. The low oil price quickly impacted it illustrates the broader trend towards exploration in the longer-term will be approximately half that of the previous company capital plans, with both devel- deepwater and more diffcult drilling affected. An early litmus test could decade, notwithstanding the relatively opment and exploration budgets cut glob- targets and conditions, particularly in the be upcoming license rounds offshore dismal results in 2008. Exploration offshore ally. The level of development drilling off Browse Basin. Longer drilling periods Australia, traditionally a core area of

New Zealand has also been poor, with only deepwater exploration for the majors.

Block awards by year compared to Australian and New Zealand E&A

While the plunge in prices may test oil price in the previous year drilling activity and resource add (2005-2014) 30 120 appetite for blocks that are either in deep

Major

Oil price previous year

New Zealand appraisal

Australia discovered 90 3000

NOC resource water or on the fringes of existing plays,

New Zealand exploration

Large Cap 80

Australia New Zealand 25 100 on the other hand acreage can potentially discovered resource appraisal 2500

Mid Cap 70 Australia now be acquired through competitive

Small Cap exploration 20 bidding with a far lower work commit- 80 60 2000 ment than in previous years. 50 15

The low price will have a signif- 60 1500 40 cant impact on the block bidding level.

Block awards

Number of wells 10 40

Analysis reveals there is a very strong 30 1000

Oil price (US$/bbl) correlation between oil price at the 20 5 20 timing of bidding and the popularity of

Discovered resource (mmboe) 500 10 rounds and hence the number of permits 0 0 awarded many months later. This would 0 0 2005200620072008200920102011201220132014 2005200620072008200920102011201220132014

Source: Wood Mackenzie Source: Wood Mackenzie suggest that bids for 2014 blocks will be

March 2015 | OE oedigital.com 56 056_OE0315_Geo2_WoodMac.indd 56 2/22/15 11:07 AM

53

53

55

55