Page 25: of Offshore Engineer Magazine (Sep/Oct 2016)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2016 Offshore Engineer Magazine

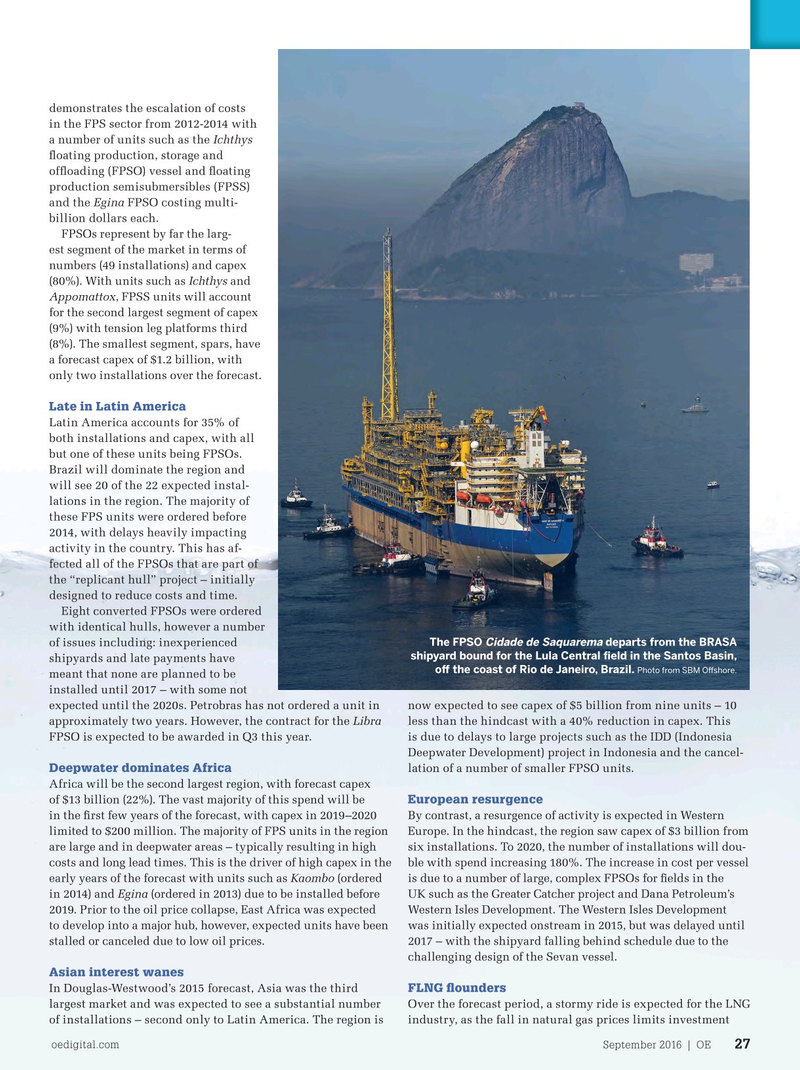

demonstrates the escalation of costs in the FPS sector from 2012-2014 with a number of units such as the Ichthys ? oating production, storage and of? oading (FPSO) vessel and ? oating production semisubmersibles (FPSS) and the Egina FPSO costing multi- billion dollars each.

FPSOs represent by far the larg- est segment of the market in terms of numbers (49 installations) and capex (80%). With units such as Ichthys and

Keeping

Appomattox, FPSS units will account for the second largest segment of capex (9%) with tension leg platforms third (8%). The smallest segment, spars, have a forecast capex of $1.2 billion, with only two installations over the forecast.

Late in Latin America

Latin America accounts for 35% of both installations and capex, with all a? oat but one of these units being FPSOs.

Brazil will dominate the region and

The market for ? oating production systems may have stalled, but will see 20 of the 22 expected instal- lations in the region. The majority of

FPSs will still be a key part of the offshore technology tool kit, these FPS units were ordered before 2014, with delays heavily impacting outlines Douglas-Westwood’s Ben Wilby.

activity in the country. This has af- fected all of the FPSOs that are part of the “replicant hull” project – initially designed to reduce costs and time.

Eight converted FPSOs were ordered with identical hulls, however a number

The FPSO departs from the BRASA Cidade de Saquarema of issues including: inexperienced shipyard bound for the Lula Central ? eld in the Santos Basin, shipyards and late payments have o

24

24

26

26