Page 24: of Offshore Engineer Magazine (Sep/Oct 2016)

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2016 Offshore Engineer Magazine

FPSOFPSO demonstrates the escalation of costs in the FPS sector from 2012-2014 with a number of units such as the Ichthys ? oating production, storage and of? oading (FPSO) vessel and ? oating production semisubmersibles (FPSS) and the Egina FPSO costing multi- billion dollars each.

FPSOs represent by far the larg- est segment of the market in terms of numbers (49 installations) and capex (80%). With units such as Ichthys and

Keeping

Appomattox, FPSS units will account for the second largest segment of capex (9%) with tension leg platforms third (8%). The smallest segment, spars, have a forecast capex of $1.2 billion, with only two installations over the forecast.

Late in Latin America

Latin America accounts for 35% of both installations and capex, with all a? oat but one of these units being FPSOs.

Brazil will dominate the region and

The market for ? oating production systems may have stalled, but will see 20 of the 22 expected instal- lations in the region. The majority of

FPSs will still be a key part of the offshore technology tool kit, these FPS units were ordered before 2014, with delays heavily impacting outlines Douglas-Westwood’s Ben Wilby.

activity in the country. This has af- fected all of the FPSOs that are part of the “replicant hull” project – initially designed to reduce costs and time.

Eight converted FPSOs were ordered with identical hulls, however a number accounting for just 18% of total forecast spend. By contrast, he oil price collapse has deeply impacted the ? oat- of issues including: inexperienced 2017 alone is expected to account for almost 40%. ing production systems (FPS) market with orders shipyards and late payments have

T declining dramatically as operators focused on cut- meant that none are planned to be

The outlook ting budgets and redesigning projects. installed until 2017 – with some not

To 2020, Douglas-Westwood expects capex of $58 billion on With high costs and long construction periods, the FPS expected until the 2020s. Petrobras has not ordered a unit in

FPS units – an increase of 31% over the preceding ? ve-year market was one of the worst affected sectors across the oil approximately two years. However, the contract for the Libra period. A total of 63 ? oating production units are forecast and gas industry. There were four orders in 2015 – down from FPSO is expected to be awarded in Q3 this year. 12 in 2013 and 17 in 2014. The order value of vessels ordered to be installed, a decrease from 70 in the hindcast. This

Deepwater dominates Africa in 2015 was also low, with average cost at

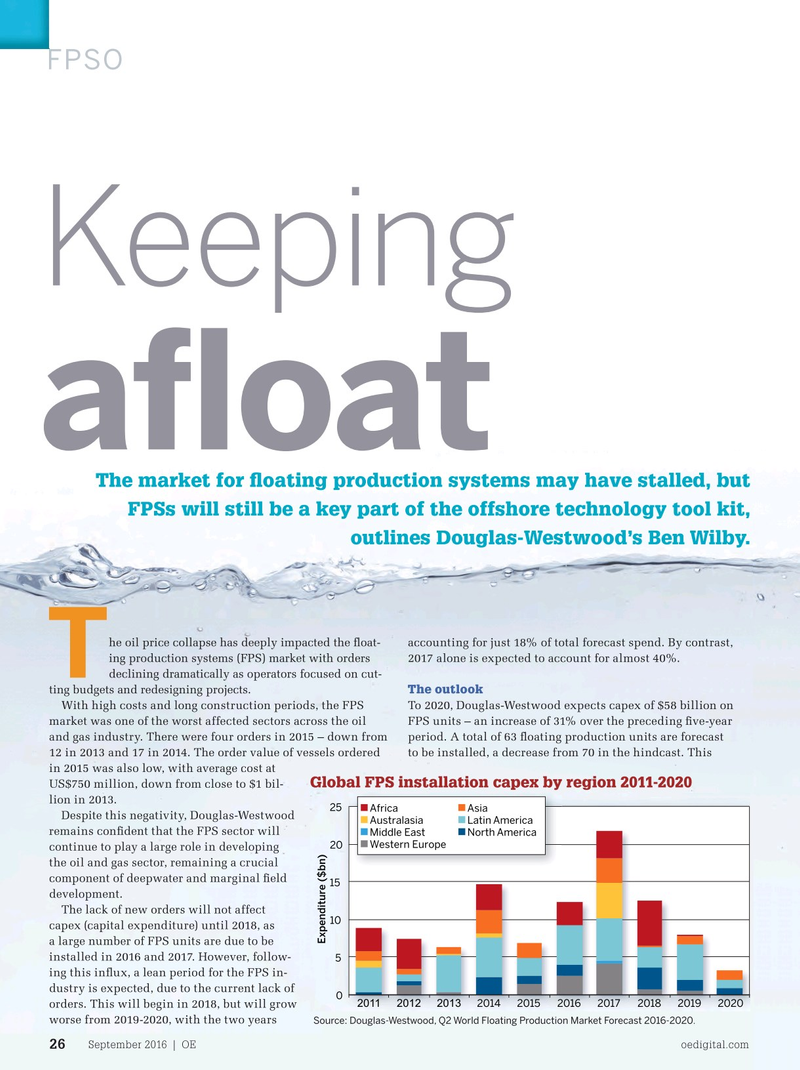

Global FPS installation capex by region 2011-2020

US$750 million, down from close to $1 bil- Africa will be the second largest region, with forecast capex lion in 2013. of $13 billion (22%). The vast majority of this spend will be 25 Africa Asia

Despite this negativity, Douglas-Westwood in the ? rst few years of the forecast, with capex in 2019–2020

Australasia Latin America remains con? dent that the FPS sector will limited to $200 million. The majority of FPS units in the region

Middle East North America 20 Western Europe continue to play a large role in developing are large and in deepwater areas – typically resulting in high the oil and gas sector, remaining a crucial costs and long lead times. This is the driver of high capex in the component of deepwater and marginal ? eld early years of the forecast with units such as Kaombo (ordered 15 development. in 2014) and Egina (ordered in 2013) due to be installed before

The lack of new orders will not affect 2019. Prior to the oil price collapse, East Africa was expected 10 capex (capital expenditure) until 2018, as to develop into a major hub, however, expected units have been

Expenditure ($bn) a large number of FPS units are due to be stalled or canceled due to low oil prices. installed in 2016 and 2017. However, follow- 5

Asian interest wanes ing this in? ux, a lean period for the FPS in- dustry is expected, due to the current lack of In Douglas-Westwood’s 2015 forecast, Asia was the third 0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 orders. This will begin in 2018, but will grow largest market and was expected to see a substantial number worse from 2019-2020, with the two years of installations – second only to Latin America. The region is

Source: Douglas-Westwood, Q2 World Floating Production Market Forecast 2016-2020.

September 2016 | OE oedigital.com 26 026_OE0916_ Feature2_DW.indd 26 8/25/16 10:12 AM

23

23

25

25