Page 13: of Offshore Engineer Magazine (Jan/Feb 2019)

FPSO/FNLG Outlook and Technologies

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2019 Offshore Engineer Magazine

SUBSEA INSIGHTS ‘Install-ability’ dant technology on board. No longer are vessels required to GE’s Subsea Connect portfolio has been designed to be in- lift well in excess of 3,000 metric tons in the subsea space. stalled using smaller construction ships, and Aker Solutions’

The industry is able to do more with less. latest generation subsea compression unit is half the size of

The shift toward install-ability is not just a function of eco- the most recent installation at Asgard off Norway. That lat- nomics. It re? ects the impact of consolidation and collabo- est subsea compression design could be used imminently at ration within the supply chain. Going forward we see such Jansz-Io off Australia, and Ormen Lange off Norway. collaborative efforts driving a greater prominence of bundled The shift toward install-ability is a structural change for products and services with industrial players looking to de- the industry in our view. With a recovery in subsea activity in liver across multiple value chains. sight, albeit unlikely to gather momentum until around 2020,

It is perhaps no surprise that the leading proponent of this we see an opportunity for those contractors able to provide new generation – TechnipFMC – is the only player with a fully a service across the value chain. We also see a growing op- integrated supply chain, and a vessel ? eet that does not include portunity for vessel owners and operators to collaborate with any assets capable of lifting more than 1,200 metric tons. OEMs, and for oil companies to be increasingly receptive to

The legacy Technip lacked the capacity to install the larg- vendor-based solutions. est infrastructure – from ultra-deepwater risers through to the Install-ability is part of a broader theme of project optimi- largest manifolds. It had to serve the market via a partnership zation. The offshore industry is only now starting to see the with Heerema that now looks to be increasingly redundant. bene? t of these lower cost programs. The redesigned projects,

Technip’s in? uence as a later-cycle player helped the legacy competitive with alternative investments elsewhere, prop up a

FMC business to consider ‘install-ability’ when the Subsea healthy queue of projects set to be sanctioned in 2019, particu- 2.0 product suite was being developed. larly for the second half of the year.

Subsea 2.0, which includes a new generation of subsea That hopper of subsea work represents a material oppor- trees, manifolds, control systems and pipelines, has been de- tunity for the light construction ? eet which is set to become signed with fewer components and smaller footprint to enable increasingly competitive for offshore installation work over it to be installed using smaller construction vessels. the next two-to-three years. With ? eld infrastructure increas-

The products have been optimized to best match what the ingly designed to ? t within a smaller footprint, light construc- business can provide under one contract, without the require- tion vessels are increasingly able to deliver a full installation ment to use external resources. The contractor has attempted scope of work. to capture as much of the value chain as possible using its as- Unlike larger construction assets, which look set to be in set base – from engineering through to fabrication and even- a state of oversupply for the foreseeable future, lighter con- tually installation. struction assets are one of the few subsectors of offshore set to

We see a similar shift from the competition: Baker Hughes tighten over the coming cycle.

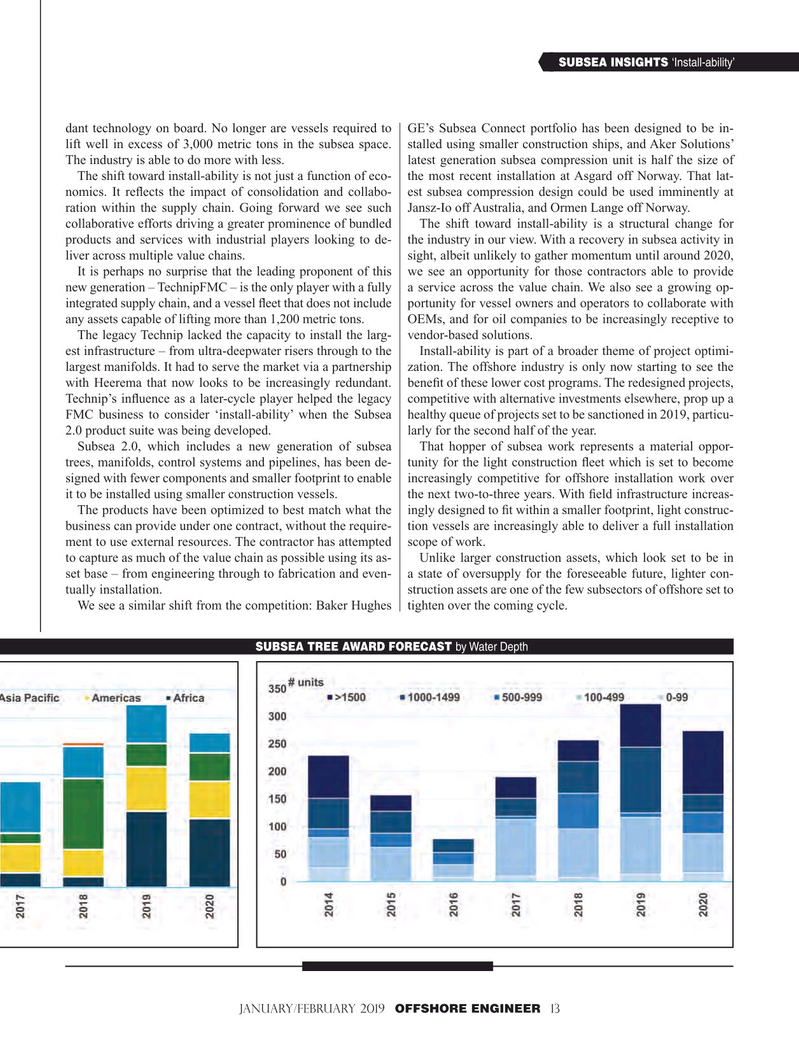

SUBSEA TREE AWARD FORECAST by Water Depth

January/February 2019 OFFSHORE ENGINEER 13 1-17 OE 2019.indd 13 1-17 OE 2019.indd 13 1/22/2019 2:13:38 PM1/22/2019 2:13:38 PM

12

12

14

14