Page 32: of Offshore Engineer Magazine (May/Jun 2019)

Offshore Renewables Review

Read this page in Pdf, Flash or Html5 edition of May/Jun 2019 Offshore Engineer Magazine

FEATURE Tiebacks

TAPPING

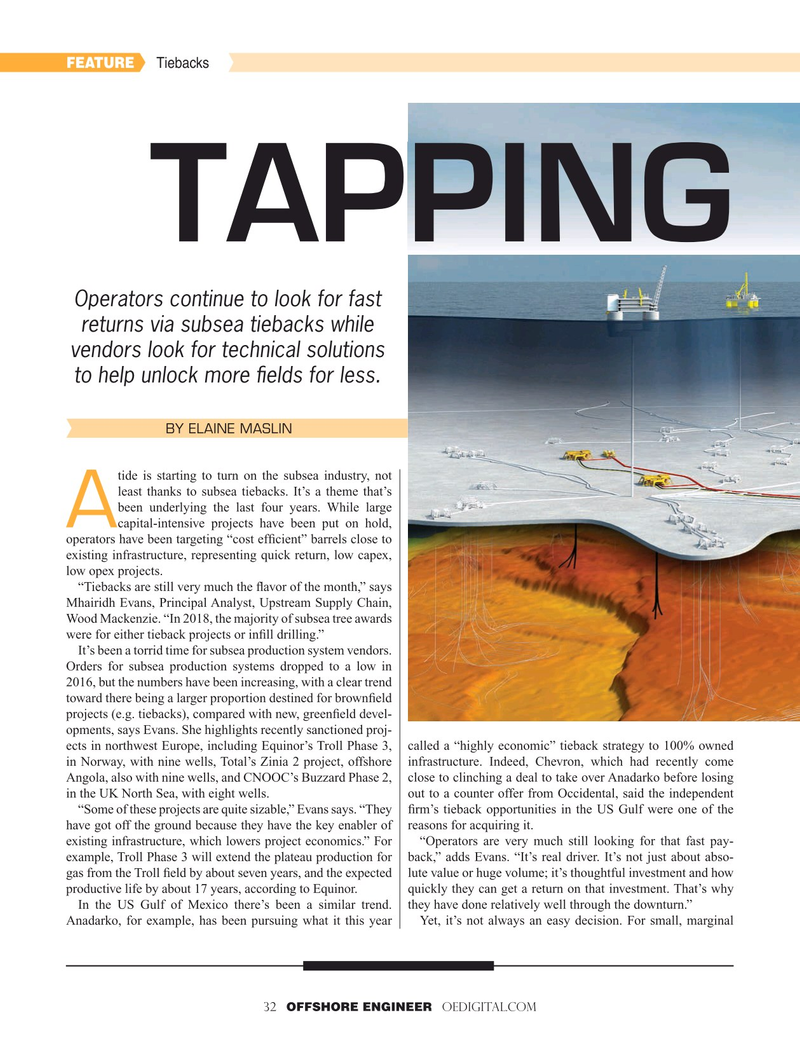

Operators continue to look for fast returns via subsea tiebacks while vendors look for technical solutions to help unlock more ? elds for less.

BY ELAINE MASLIN tide is starting to turn on the subsea industry, not least thanks to subsea tiebacks. It’s a theme that’s been underlying the last four years. While large

A capital-intensive projects have been put on hold, operators have been targeting “cost ef? cient” barrels close to existing infrastructure, representing quick return, low capex, low opex projects. “Tiebacks are still very much the ? avor of the month,” says

Mhairidh Evans, Principal Analyst, Upstream Supply Chain,

Wood Mackenzie. “In 2018, the majority of subsea tree awards were for either tieback projects or in? ll drilling.”

It’s been a torrid time for subsea production system vendors.

Orders for subsea production systems dropped to a low in 2016, but the numbers have been increasing, with a clear trend toward there being a larger proportion destined for brown? eld projects (e.g. tiebacks), compared with new, green? eld devel- opments, says Evans. She highlights recently sanctioned proj- ects in northwest Europe, including Equinor’s Troll Phase 3, called a “highly economic” tieback strategy to 100% owned in Norway, with nine wells, Total’s Zinia 2 project, offshore infrastructure. Indeed, Chevron, which had recently come

Angola, also with nine wells, and CNOOC’s Buzzard Phase 2, close to clinching a deal to take over Anadarko before losing in the UK North Sea, with eight wells. out to a counter offer from Occidental, said the independent “Some of these projects are quite sizable,” Evans says. “They ? rm’s tieback opportunities in the US Gulf were one of the have got off the ground because they have the key enabler of reasons for acquiring it.

existing infrastructure, which lowers project economics.” For “Operators are very much still looking for that fast pay- example, Troll Phase 3 will extend the plateau production for back,” adds Evans. “It’s real driver. It’s not just about abso- gas from the Troll ? eld by about seven years, and the expected lute value or huge volume; it’s thoughtful investment and how productive life by about 17 years, according to Equinor. quickly they can get a return on that investment. That’s why

In the US Gulf of Mexico there’s been a similar trend. they have done relatively well through the downturn.”

Anadarko, for example, has been pursuing what it this year Yet, it’s not always an easy decision. For small, marginal 32 OFFSHORE ENGINEER OEDIGITAL.COM

31

31

33

33