Page 15: of Offshore Engineer Magazine (Jul/Aug 2020)

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2020 Offshore Engineer Magazine

MARKET REPORT Jack Up Rigs

SHALLOW OUTPACES DEEPWATER sible for adding the most backlog over the past two years consist

During the last downturn, which took hold in 2014 and of only NOCs, with Saudi Aramco far ahead of the curve. only started to gather recovery momentum during 2018, sev- The top four companies are virtually jackup only operators, eral trends were witnessed in the offshore rig market. One however CNOOC has more of an even mix of shallow and of these was a quicker and fuller recovery in the jackup seg- deepwater rig time. There are various reasons behind this trend ment in comparison to the ?oating rig segment (drillships of hefty rig contracting activity amongst NOCs including a and semisubs). And why was this? Well, excluding Petrobras strong focus on maintaining domestic production, offsetting in Latin America, most of NOC’s operations are in shallow ?eld depletion, being less dependent on imports and meeting waters with the likes of Saudi Aramco, Pemex, ADNOC and state budgets.

ONGC all mass jackup users. On last check, global competitive utilization within the jackup

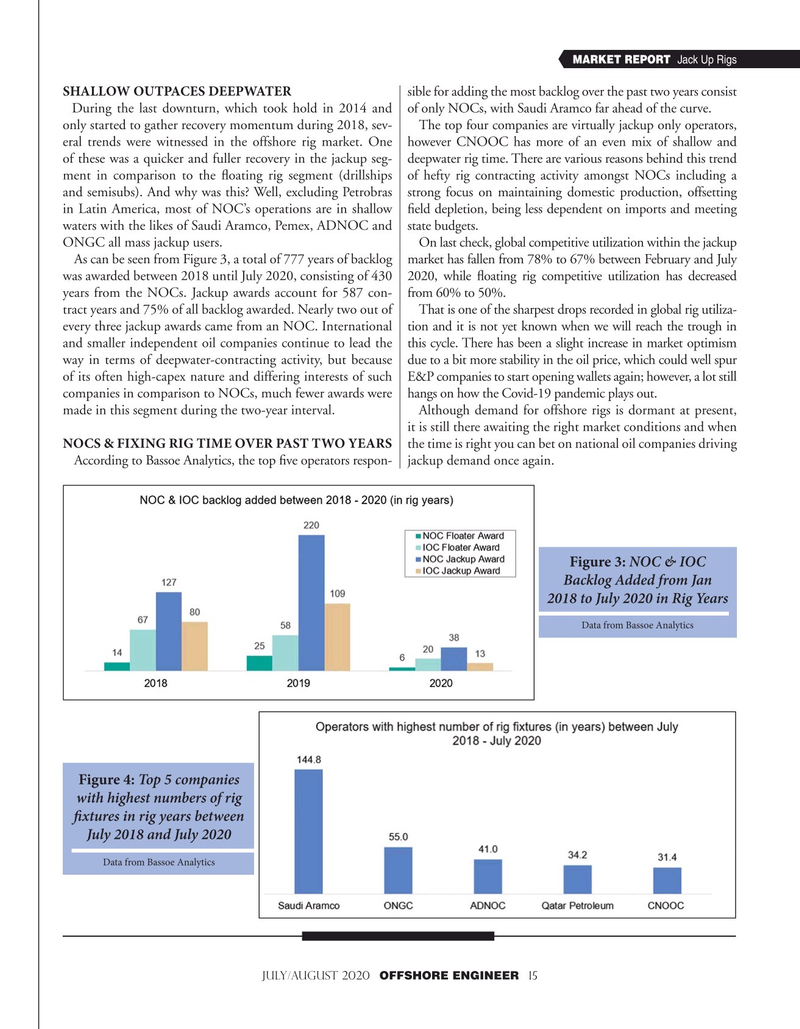

As can be seen from Figure 3, a total of 777 years of backlog market has fallen from 78% to 67% between February and July was awarded between 2018 until July 2020, consisting of 430 2020, while ?oating rig competitive utilization has decreased years from the NOCs. Jackup awards account for 587 con- from 60% to 50%. tract years and 75% of all backlog awarded. Nearly two out of That is one of the sharpest drops recorded in global rig utiliza- every three jackup awards came from an NOC. International tion and it is not yet known when we will reach the trough in and smaller independent oil companies continue to lead the this cycle. There has been a slight increase in market optimism way in terms of deepwater-contracting activity, but because due to a bit more stability in the oil price, which could well spur of its often high-capex nature and differing interests of such E&P companies to start opening wallets again; however, a lot still companies in comparison to NOCs, much fewer awards were hangs on how the Covid-19 pandemic plays out.

made in this segment during the two-year interval. Although demand for offshore rigs is dormant at present, it is still there awaiting the right market conditions and when

NOCS & FIXING RIG TIME OVER PAST TWO YEARS the time is right you can bet on national oil companies driving

According to Bassoe Analytics, the top ?ve operators respon- jackup demand once again.

Figure 3: NOC & IOC

Backlog Added from Jan 2018 to July 2020 in Rig Years

Data from Bassoe Analytics

Figure 4: Top 5 companies with highest numbers of rig fxtures in rig years between

July 2018 and July 2020

Data from Bassoe Analytics

JULY/AUGUST 2020 OFFSHORE ENGINEER 15

14

14

16

16