Page 17: of Offshore Engineer Magazine (Mar/Apr 2021)

Offshore Wind Outlook

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2021 Offshore Engineer Magazine

MARKETS OFFSHORE WIND

Europe has played the leading role to date, accounting for One of the drivers for offshore wind cost reduction is the 73% of capacity and a signifcant industrial base for wind development of larger turbines, which help to reduce overall farm component manufacture and logistics capabilities. foundation, cable, and maintenance costs. Projects in the US

China has recorded a surge in capacity since 2015 to reach will mostly deploy the largest commercially available turbines.

23% of global capacity by the end of 2020.

The largest three markets at the end of 2020, the UK, Chi- OFFSHORE WIND IN THE UNITED STATES na, and Germany, accounted for ~78% of global installations. The current US nameplate power generation capacity is

Whereas the European, Chinese, Taiwanese, and Vietnam- ~1,200GW. The US DOE’s NREL has quantifed the off- ese markets will continue to remain strong throughout the shore wind net commercially feasible resource at 2,060GW. decade, we expect to welcome South Korea, Japan, and the This is almost two times today’s total electricity generation

USA to the stage of global scale players within this decade. capacity. Wind resource is available in 29 states along the At-

In the mid- to long-term, we are tracking offshore wind lantic, Pacifc, Gulf of Mexico, and Great Lakes coasts.

projects in 38 countries. This decade will see utility scale projects in the relatively shal-

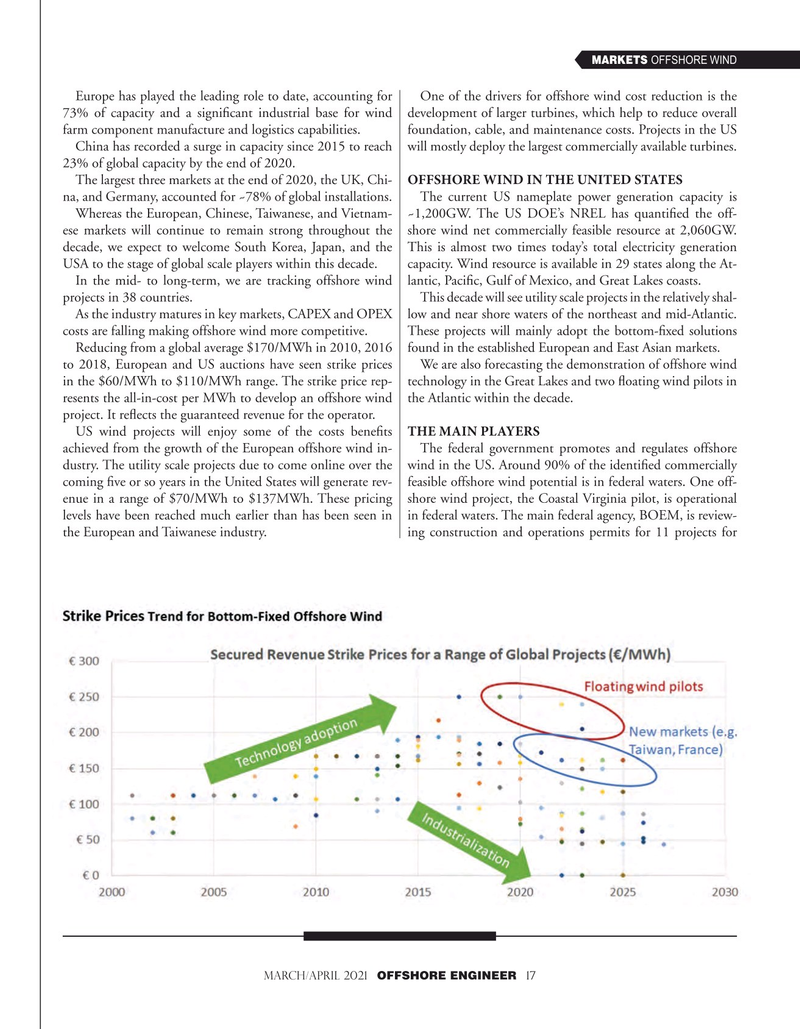

As the industry matures in key markets, CAPEX and OPEX low and near shore waters of the northeast and mid-Atlantic. costs are falling making offshore wind more competitive. These projects will mainly adopt the bottom-fxed solutions

Reducing from a global average $170/MWh in 2010, 2016 found in the established European and East Asian markets.

to 2018, European and US auctions have seen strike prices We are also forecasting the demonstration of offshore wind in the $60/MWh to $110/MWh range. The strike price rep- technology in the Great Lakes and two foating wind pilots in resents the all-in-cost per MWh to develop an offshore wind the Atlantic within the decade.

project. It refects the guaranteed revenue for the operator.

US wind projects will enjoy some of the costs benefts THE MAIN PLAYERS achieved from the growth of the European offshore wind in- The federal government promotes and regulates offshore dustry. The utility scale projects due to come online over the wind in the US. Around 90% of the identifed commercially coming fve or so years in the United States will generate rev- feasible offshore wind potential is in federal waters. One off- enue in a range of $70/MWh to $137MWh. These pricing shore wind project, the Coastal Virginia pilot, is operational levels have been reached much earlier than has been seen in in federal waters. The main federal agency, BOEM, is review- the European and Taiwanese industry. ing construction and operations permits for 11 projects for

MARCH/APRIL 2021 OFFSHORE ENGINEER 17

16

16

18

18