Page 18: of Offshore Engineer Magazine (Mar/Apr 2021)

Offshore Wind Outlook

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2021 Offshore Engineer Magazine

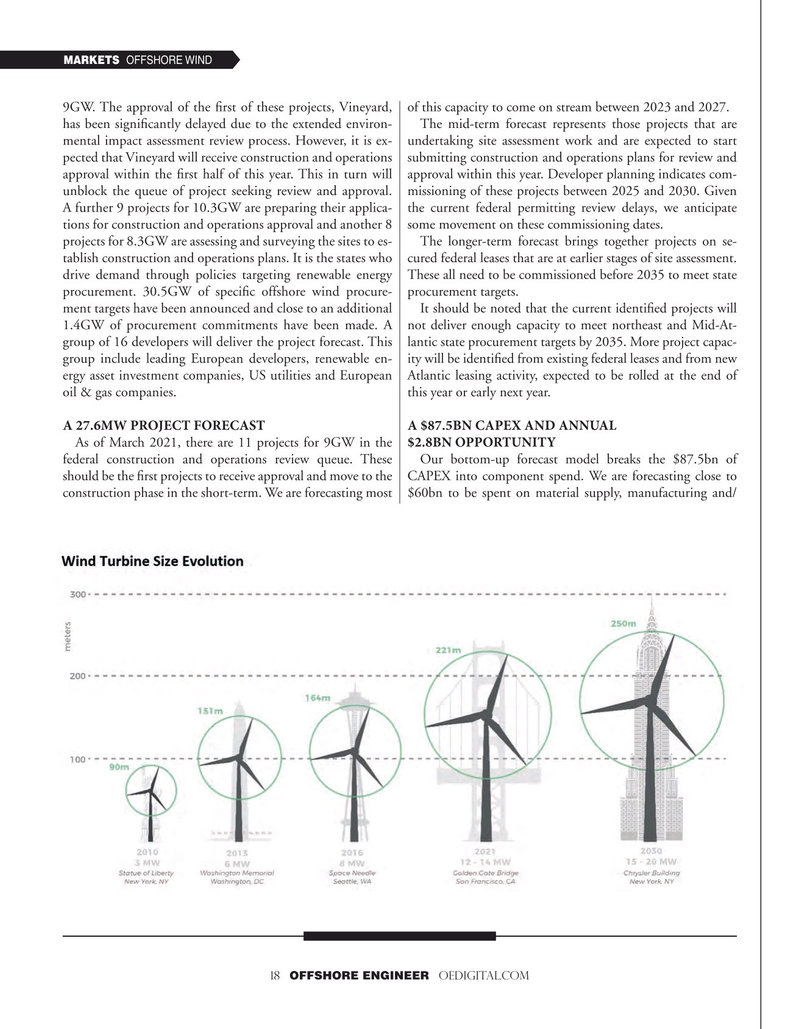

MARKETS OFFSHORE WIND 9GW. The approval of the frst of these projects, Vineyard, of this capacity to come on stream between 2023 and 2027.

has been signifcantly delayed due to the extended environ- The mid-term forecast represents those projects that are mental impact assessment review process. However, it is ex- undertaking site assessment work and are expected to start pected that Vineyard will receive construction and operations submitting construction and operations plans for review and approval within the frst half of this year. This in turn will approval within this year. Developer planning indicates com- unblock the queue of project seeking review and approval. missioning of these projects between 2025 and 2030. Given

A further 9 projects for 10.3GW are preparing their applica- the current federal permitting review delays, we anticipate tions for construction and operations approval and another 8 some movement on these commissioning dates.

projects for 8.3GW are assessing and surveying the sites to es- The longer-term forecast brings together projects on se- tablish construction and operations plans. It is the states who cured federal leases that are at earlier stages of site assessment. drive demand through policies targeting renewable energy These all need to be commissioned before 2035 to meet state procurement. 30.5GW of specifc offshore wind procure- procurement targets.

ment targets have been announced and close to an additional It should be noted that the current identifed projects will 1.4GW of procurement commitments have been made. A not deliver enough capacity to meet northeast and Mid-At- group of 16 developers will deliver the project forecast. This lantic state procurement targets by 2035. More project capac- group include leading European developers, renewable en- ity will be identifed from existing federal leases and from new ergy asset investment companies, US utilities and European Atlantic leasing activity, expected to be rolled at the end of oil & gas companies. this year or early next year.

A 27.6MW PROJECT FORECAST A $87.5BN CAPEX AND ANNUAL

As of March 2021, there are 11 projects for 9GW in the $2.8BN OPPORTUNITY federal construction and operations review queue. These Our bottom-up forecast model breaks the $87.5bn of should be the frst projects to receive approval and move to the CAPEX into component spend. We are forecasting close to construction phase in the short-term. We are forecasting most $60bn to be spent on material supply, manufacturing and/ 18 OFFSHORE ENGINEER OEDIGITAL.COM

17

17

19

19