Page 19: of Offshore Engineer Magazine (Mar/Apr 2021)

Offshore Wind Outlook

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2021 Offshore Engineer Magazine

MARKETS OFFSHORE WIND or fabrication of turbines, cables, foundation structures and around $2.8bn of annual recuring OPEX once the identifed other equipment. projects are commissioned.

We anticipate around $25bn will be spent on installation Wind farm operators will set routine inspection and mainte- and commissioning activities. The Jones Act supports US nance schedules, chartering in long-term vessel support for the built, owned, and operated vessels. This means that foreign activities. The tonnage will be mostly Jones Act Vessels. Cer- fag installation vessels will not be able to shuttle components tain vessel categories can be modifed/redeployed for the exist- from US ports to the construction site, as is the practice in the ing Jones Act feet. Other requirements call for new buildings.

developed European and East Asian markets. There is limited

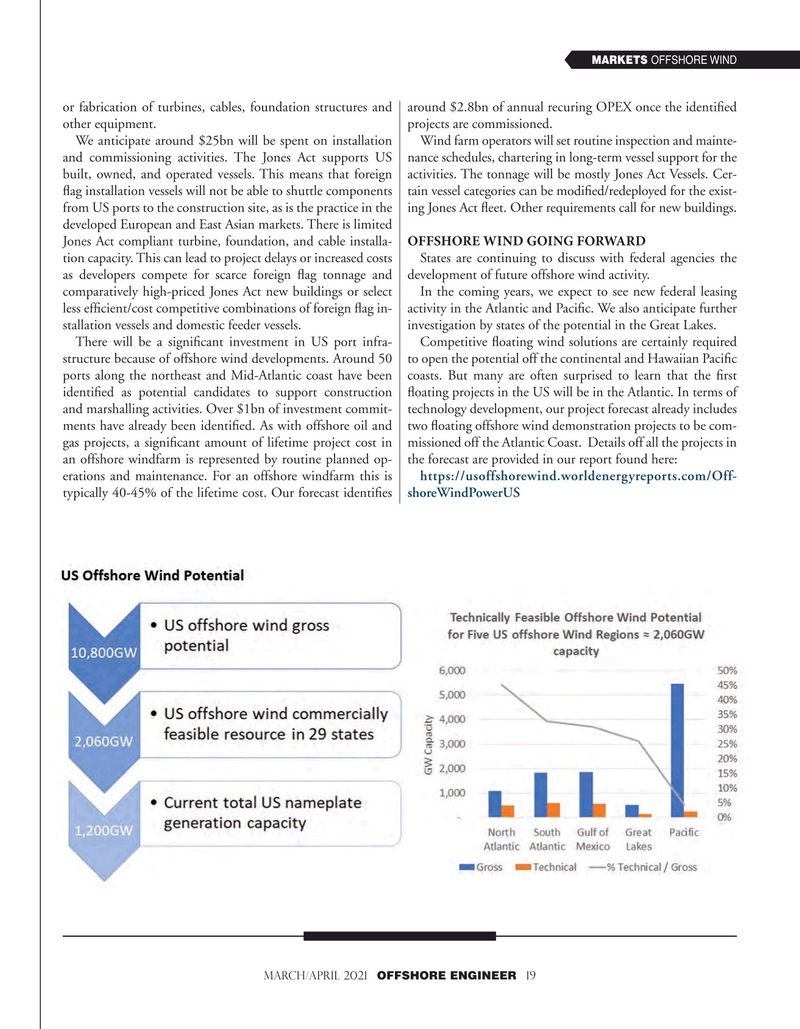

Jones Act compliant turbine, foundation, and cable installa- OFFSHORE WIND GOING FORWARD tion capacity. This can lead to project delays or increased costs States are continuing to discuss with federal agencies the as developers compete for scarce foreign fag tonnage and development of future offshore wind activity. comparatively high-priced Jones Act new buildings or select In the coming years, we expect to see new federal leasing less effcient/cost competitive combinations of foreign fag in- activity in the Atlantic and Pacifc. We also anticipate further stallation vessels and domestic feeder vessels. investigation by states of the potential in the Great Lakes.

There will be a signifcant investment in US port infra- Competitive foating wind solutions are certainly required structure because of offshore wind developments. Around 50 to open the potential off the continental and Hawaiian Pacifc ports along the northeast and Mid-Atlantic coast have been coasts. But many are often surprised to learn that the frst identifed as potential candidates to support construction foating projects in the US will be in the Atlantic. In terms of and marshalling activities. Over $1bn of investment commit- technology development, our project forecast already includes ments have already been identifed. As with offshore oil and two foating offshore wind demonstration projects to be com- gas projects, a signifcant amount of lifetime project cost in missioned off the Atlantic Coast. Details off all the projects in an offshore windfarm is represented by routine planned op- the forecast are provided in our report found here: erations and maintenance. For an offshore windfarm this is https://usoffshorewind.worldenergyreports.com/Off- typically 40-45% of the lifetime cost. Our forecast identifes shoreWindPowerUS

March/April 2021 OFFSHORE ENGINEER 19

18

18

20

20