Page 9: of Offshore Engineer Magazine (Jan/Feb 2023)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2023 Offshore Engineer Magazine

MARKETS THE RIG MARKET

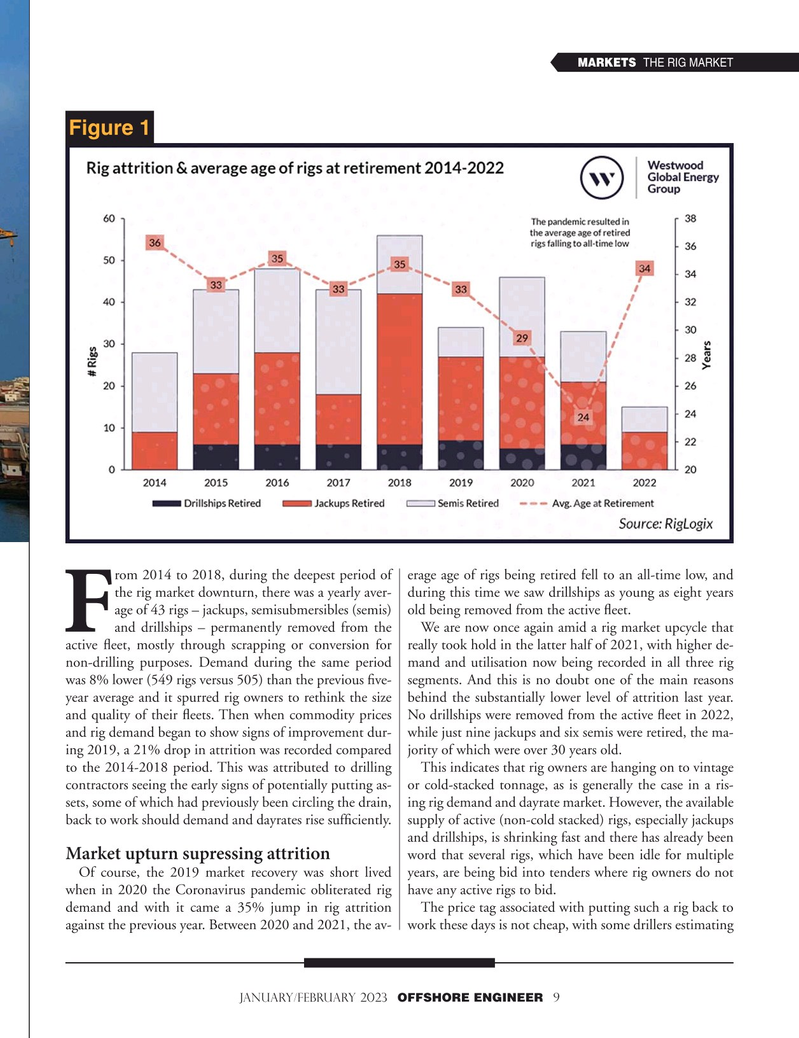

Figure 1 rom 2014 to 2018, during the deepest period of erage age of rigs being retired fell to an all-time low, and the rig market downturn, there was a yearly aver- during this time we saw drillships as young as eight years age of 43 rigs – jackups, semisubmersibles (semis) old being removed from the active ?eet. and drillships – permanently removed from the We are now once again amid a rig market upcycle that

F active ?eet, mostly through scrapping or conversion for really took hold in the latter half of 2021, with higher de- non-drilling purposes. Demand during the same period mand and utilisation now being recorded in all three rig was 8% lower (549 rigs versus 505) than the previous ?ve- segments. And this is no doubt one of the main reasons year average and it spurred rig owners to rethink the size behind the substantially lower level of attrition last year. and quality of their ?eets. Then when commodity prices No drillships were removed from the active ?eet in 2022, and rig demand began to show signs of improvement dur- while just nine jackups and six semis were retired, the ma- ing 2019, a 21% drop in attrition was recorded compared jority of which were over 30 years old. to the 2014-2018 period. This was attributed to drilling This indicates that rig owners are hanging on to vintage contractors seeing the early signs of potentially putting as- or cold-stacked tonnage, as is generally the case in a ris- sets, some of which had previously been circling the drain, ing rig demand and dayrate market. However, the available back to work should demand and dayrates rise suf?ciently. supply of active (non-cold stacked) rigs, especially jackups and drillships, is shrinking fast and there has already been word that several rigs, which have been idle for multiple

Market upturn supressing attrition

Of course, the 2019 market recovery was short lived years, are being bid into tenders where rig owners do not when in 2020 the Coronavirus pandemic obliterated rig have any active rigs to bid. demand and with it came a 35% jump in rig attrition The price tag associated with putting such a rig back to against the previous year. Between 2020 and 2021, the av- work these days is not cheap, with some drillers estimating january/february 2023 OFFSHORE ENGINEER 9

8

8

10

10