Page 21: of Offshore Engineer Magazine (May/Jun 2023)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2023 Offshore Engineer Magazine

MARKETS FLOATING PRODUCTION VESSELS

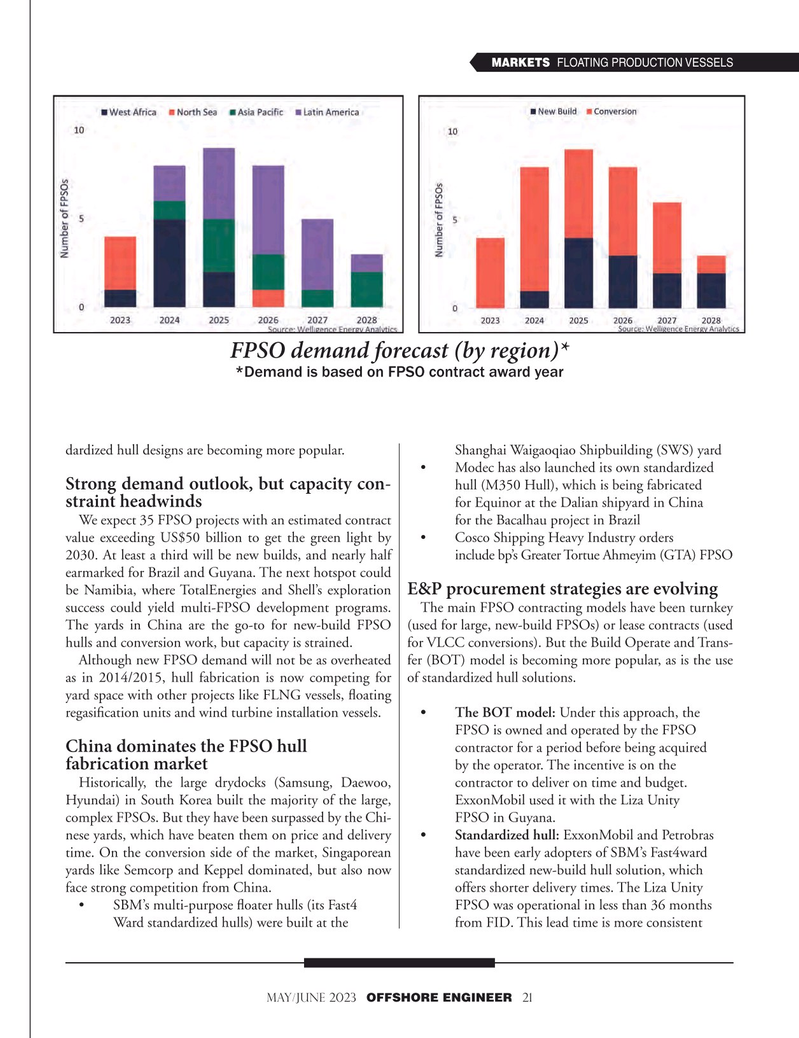

FPSO demand forecast (by region)* *Demand is based on FPSO contract award year dardized hull designs are becoming more popular. S hanghai Waigaoqiao Shipbuilding (SWS) yard • Modec has also launched its own standardized hull (M350 Hull), which is being fabricated

Strong demand outlook, but capacity con- for Equinor at the Dalian shipyard in China straint headwinds

We expect 35 FPSO projects with an estimated contract for the Bacalhau project in Brazil value exceeding US$50 billion to get the green light by • Cosco Shipping Heavy Industry orders 2030. At least a third will be new builds, and nearly half include bp’s Greater Tortue Ahmeyim (GTA) FPSO earmarked for Brazil and Guyana. The next hotspot could

E&P procurement strategies are evolving be Namibia, where TotalEnergies and Shell’s exploration success could yield multi-FPSO development programs. The main FPSO contracting models have been turnkey

The yards in China are the go-to for new-build FPSO (used for large, new-build FPSOs) or lease contracts (used hulls and conversion work, but capacity is strained. for VLCC conversions). But the Build Operate and Trans-

Although new FPSO demand will not be as overheated fer (BOT) model is becoming more popular, as is the use as in 2014/2015, hull fabrication is now competing for of standardized hull solutions.

yard space with other projects like FLNG vessels, foating regasifcation units and wind turbine installation vessels. • The BOT model: Under this approach, the FPSO is owned and operated by the FPSO contractor for a period before being acquired

China dominates the FPSO hull b y the operator. The incentive is on the fabrication market

Historically, the large drydocks (Samsung, Daewoo, contractor to deliver on time and budget.

Hyundai) in South Korea built the majority of the large, E xxonMobil used it with the Liza Unity complex FPSOs. But they have been surpassed by the Chi- FPSO in Guyana.

nese yards, which have beaten them on price and delivery • Standardized hull: ExxonMobil and Petrobras time. On the conversion side of the market, Singaporean hav e been early adopters of SBM’s Fast4ward yards like Semcorp and Keppel dominated, but also now standardized new-build hull solution, which face strong competition from China. offers shorter delivery times. The Liza Unity • SBM’s multi-purpose foater hulls (its Fast4 FPSO was operational in less than 36 months W ard standardized hulls) were built at the fr om FID. This lead time is more consistent

MAY/JUNE 2023 OFFSHORE ENGINEER 21

20

20

22

22