Page 22: of Offshore Engineer Magazine (May/Jun 2023)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2023 Offshore Engineer Magazine

MARKETS FLOATING PRODUCTION VESSELS

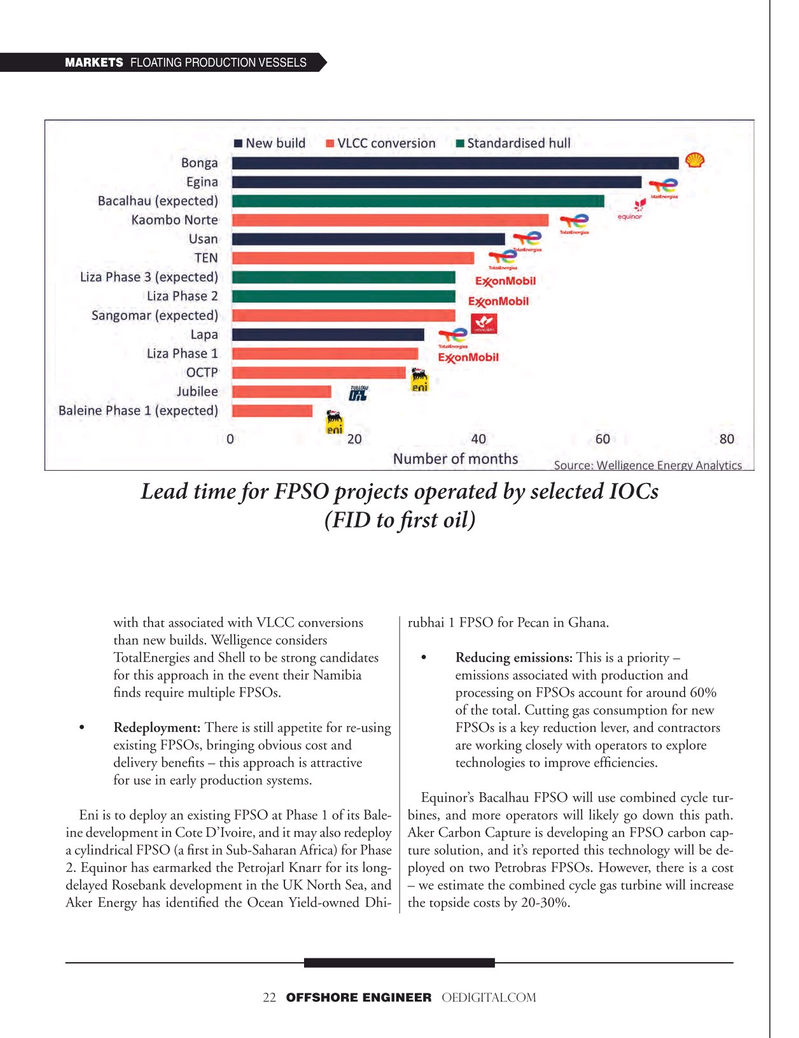

Lead time for FPSO projects operated by selected IOCs (FID to frst oil) with that associated with VLCC conversions rubhai 1 FPSO for Pecan in Ghana.

than new builds. Welligence considers T otalEnergies and Shell to be strong candidates • Reducing emissions: This is a priority – for this approach in the event their Namibia emissions associated with production and fnds require multiple FPSOs. pr ocessing on FPSOs account for around 60% of the total. Cutting gas consumption for new • Redeployment: There is still appetite for re-using FPSOs is a key reduction lever, and contractors existing FPSOs, bringing obvious cost and ar e working closely with operators to explore delivery benefts – this approach is attractive technologies to improve effciencies.

for use in early production systems.

Equinor’s Bacalhau FPSO will use combined cycle tur-

Eni is to deploy an existing FPSO at Phase 1 of its Bale- bines, and more operators will likely go down this path. ine development in Cote D’Ivoire, and it may also redeploy Aker Carbon Capture is developing an FPSO carbon cap- a cylindrical FPSO (a frst in Sub-Saharan Africa) for Phase ture solution, and it’s reported this technology will be de- 2. Equinor has earmarked the Petrojarl Knarr for its long- ployed on two Petrobras FPSOs. However, there is a cost delayed Rosebank development in the UK North Sea, and – we estimate the combined cycle gas turbine will increase

Aker Energy has identifed the Ocean Yield-owned Dhi- the topside costs by 20-30%.

22 OFFSHORE ENGINEER OEDIGITAL.COM

21

21

23

23