Page 39: of Offshore Engineer Magazine (May/Jun 2023)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2023 Offshore Engineer Magazine

OFFSHORE WIND VESSELS

Te energy transition is moving ahead amid recovery in ofshore oil & gas and growth in ofshore wind, leaving vessel owners that serve these markets with big questions about energy carrier and energy converter selection for their newbuilds.

By Philip Lewis, Research Director of Intelatus Global Partners full electrifcation of vessels or the use of hydrogen and

WHAT IS DRIVING THE CHANGE?

The foundations of energy transition in the offshore and ammonia as energy carriers.

4) N ow let’s take a local level look within a country. marine segment can be found at global, regional, national

The California Air Resources Board’s (CARB) Commer- and local levels: cial Harbor Craft regulation defnes emissions standards 1) A t a global level, International Maritime Organi- zation (IMO) measures cover vessel energy effciency (for for vessels calling into state waters and stricter amend- vessels over 400 gross tonnes) and carbon intensity (for ments are currently under review. These will likely impact the anchor handlers involved in California offshore wind vessels over 5,000 gross tonnes) but do not necessarily im- pact offshore support vessels (OSV). However, the IMO projects.

In addition to these regulatory conditions, we fnd sev- strategy on emissions is expected to be revised at MEPC 80 in July of this year. Full decarbonization of the maritime eral other main drivers for choosing low or zero emissions sector by 2050 is expected to be discussed but unlikely to fuels, including: 1) V essel charterers are seeking more and more to man- be agreed. Measures such as greenhouse gas fuel standards on a well-to-wake basis and some form of carbon pricing age their Scope 1, 2 and 3 emissions, including emissions as- are expected to be discussed for implementation through sociated with their own or chartered-in vessel operations. 2) S hareholders in listed companies may demand this decade. What we have then is a bit of a moving target.

that vessel operations impact less on the environment.

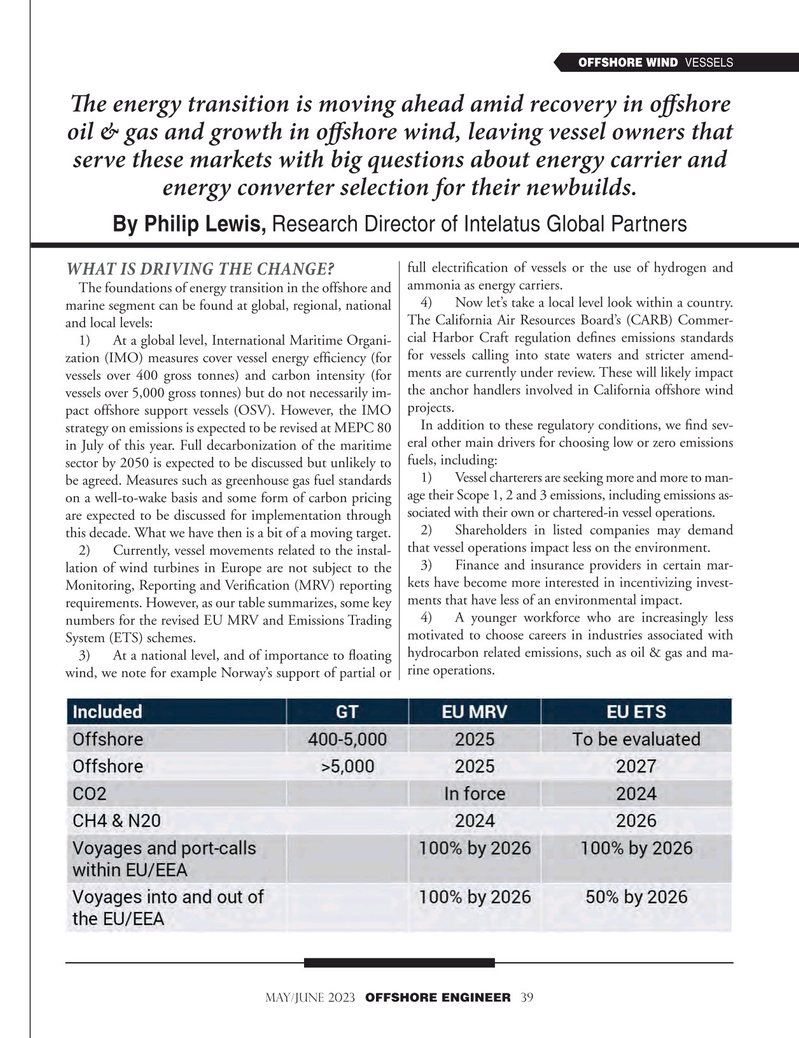

2) C urrently, vessel movements related to the instal- 3) F inance and insurance providers in certain mar- lation of wind turbines in Europe are not subject to the

Monitoring, Reporting and Verifcation (MRV) reporting kets have become more interested in incentivizing invest- requirements. However, as our table summarizes, some key ments that have less of an environmental impact.

4) A y ounger workforce who are increasingly less numbers for the revised EU MRV and Emissions Trading motivated to choose careers in industries associated with

System (ETS) schemes.

t a national level, and of importance to foating hydrocarbon related emissions, such as oil & gas and ma- 3) A wind, we note for example Norway’s support of partial or rine operations.

MAY/JUNE 2023 OFFSHORE ENGINEER 39

38

38

40

40