Page 40: of Offshore Engineer Magazine (May/Jun 2023)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2023 Offshore Engineer Magazine

OFFSHORE WIND VESSELS supply from nine supplier partnerships in Asia and the

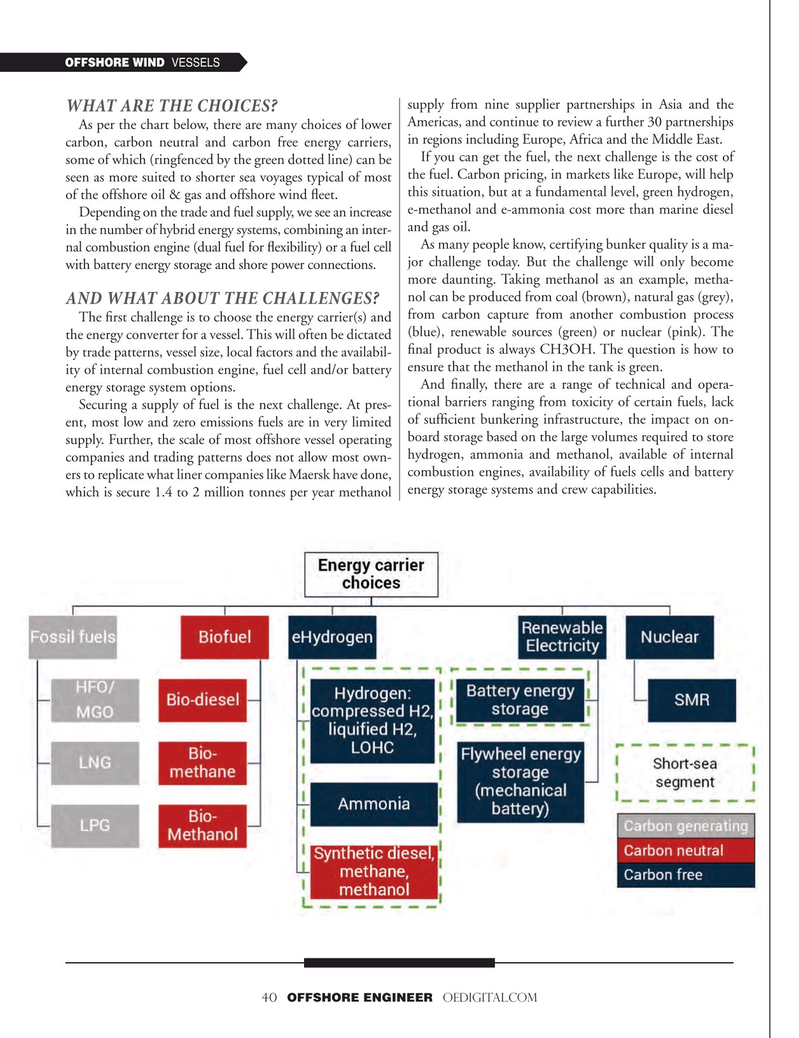

WHAT ARE THE CHOICES?

As per the chart below, there are many choices of lower Americas, and continue to review a further 30 partnerships carbon, carbon neutral and carbon free energy carriers, in regions including Europe, Africa and the Middle East.

If you can get the fuel, the next challenge is the cost of some of which (ringfenced by the green dotted line) can be seen as more suited to shorter sea voyages typical of most the fuel. Carbon pricing, in markets like Europe, will help this situation, but at a fundamental level, green hydrogen, of the offshore oil & gas and offshore wind feet.

Depending on the trade and fuel supply, we see an increase e-methanol and e-ammonia cost more than marine diesel and gas oil.

in the number of hybrid energy systems, combining an inter-

As many people know, certifying bunker quality is a ma- nal combustion engine (dual fuel for fexibility) or a fuel cell jor challenge today. But the challenge will only become with battery energy storage and shore power connections.

more daunting. Taking methanol as an example, metha- nol can be produced from coal (brown), natural gas (grey),

AND WHAT ABOUT THE CHALLENGES?

The frst challenge is to choose the energy carrier(s) and from carbon capture from another combustion process the energy converter for a vessel. This will often be dictated (blue), renewable sources (green) or nuclear (pink). The fnal product is always CH3OH. The question is how to by trade patterns, vessel size, local factors and the availabil- ity of internal combustion engine, fuel cell and/or battery ensure that the methanol in the tank is green.

And fnally, there are a range of technical and opera- energy storage system options.

tional barriers ranging from toxicity of certain fuels, lack

Securing a supply of fuel is the next challenge. At pres- ent, most low and zero emissions fuels are in very limited of suffcient bunkering infrastructure, the impact on on- supply. Further, the scale of most offshore vessel operating board storage based on the large volumes required to store hydrogen, ammonia and methanol, available of internal companies and trading patterns does not allow most own- ers to replicate what liner companies like Maersk have done, combustion engines, availability of fuels cells and battery which is secure 1.4 to 2 million tonnes per year methanol energy storage systems and crew capabilities.

40 OFFSHORE ENGINEER OEDIGITAL.COM

39

39

41

41