Page 19: of Offshore Engineer Magazine (Nov/Dec 2023)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2023 Offshore Engineer Magazine

OFFSHORE WIND livery means that the vessel will (most likely) not be deployed Great Lakes. 42 MW of capacity is operational, 938 MW on Ørsted’s Revolution Wind and Sunrise Wind projects. currently in offshore construction and a further 3.3 GW of capacity has passed the fnal investment decision hurdle.

A good barometer for long-term CTV activity is to look

Drivers for CTV and SOV demand

Those reading about U.S. offshore wind over the last at the number of turbines that will be installed as dur- few months will have experienced roller coaster emotions, ing their long lifetime, they will require constant routine lurching between optimism and pessimism. inspection, repair and maintenance, the technicians for

Developers have reported projects have become unf- which are transported and/or housed on CTVs and SOVs.

nanceable due to a combination of infationary factors, Based on current developer plans, the pipeline translates

U.S. specifc tax credits and supply chain challenges. Sev- to close to 4,500 turbines being installed in U.S. waters eral of these developers have sought to renegotiate or can- by 2035, which are expected to be supplied by the three cel contracts to sell electricity to states for agreed rates by dominant western OEMS: Siemens, GE and Vestas.

agreed dates. As a result, some projects will see completion dates shift back for several months to even years.

Looking to other markets for guidance

However, the fundamental drivers for offshore wind re- The mature and large European offshore wind market main sound. At the federal level, the current administration can be used as a guideline to developments in the CTV is focusing resource on the leasing and permitting of off- and SOV market space.

shore wind and plans to approve over 13 GW of project Europe is expected to have installed close to 7,000 tur- capacity before the end of 2024 and provide fnancing sup- bines in total by the end of 2024. By the end of 2024, port through the Infation Reduction Act related tax credits. slightly more than 400 Tier 1 CTVs will be operational in

At the state level, especially for the Northeast and Mid- Europe, supporting both long-term operations and main-

Atlantic segment, we see states with clear ambitions to in- tenance support for existing wind farms as well as con- crease the use of renewable energy, reduce the amount of struction and commissioning of new wind farms. At the imported hydrocarbons, setting offshore wind procurement same time, 43 Tier 1 SOVs are expected to be working for targets and creating a clear route to market for developers. developers and OEMs, a number which will jump to 64 by

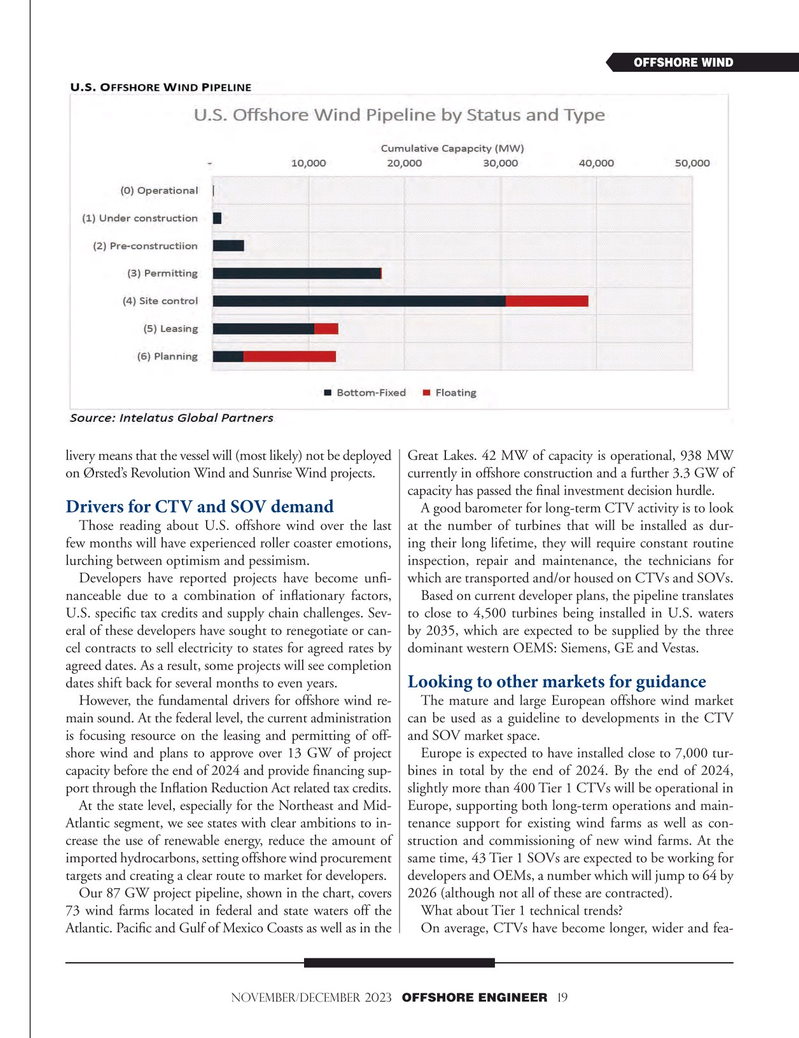

Our 87 GW project pipeline, shown in the chart, covers 2026 (although not all of these are contracted).

73 wind farms located in federal and state waters off the What about Tier 1 technical trends?

Atlantic. Pacifc and Gulf of Mexico Coasts as well as in the On average, CTVs have become longer, wider and fea- november/december 2023 OFFSHORE ENGINEER 19

18

18

20

20