Page 27: of Offshore Engineer Magazine (Jan/Feb 2024)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2024 Offshore Engineer Magazine

for re-chartering underway as the current contract expires in 2019, eight years after the company took fnal investment mid-2026. Meanwhile, Golar LNG, which is actively pursu- decision (FID) on the unit.

ing opportunities offshore Nigeria, has acquired a 2004-built Discussing a vessel coming of its present charter in 2026,

LNG carrier for conversion into a 3.5 mtpa FLNG. Golar LNG explained to its investors that “a fully utilized

Golar LNG’s 2023 third quarter results presentation in- FLNG Hilli has annual revenue potential in excess of $1 dicates that its share of overall capitalization for FLNG Hilli billion based on current LNG forward curves, to be shared has exceeded $1 billion. Following the fnancial results up- between gas resource owners and Golar. Concluding a new date, shares analyst Chris Robertson from Deutsche Bank charter for FLNG Hilli is therefore a commercial prior- wrote: “Once Hilli is re-contracted, it will undergo a period ity for the company.” This FLNG, with a capacity of 2.4 of signifcant downtime of between 6 to 12 months and de- million tons/year, has been working offshore Cameroon pending on the location and duration of the next contract. since 2018. in late 2023, it loaded up its 100th LNG car-

Additionally, it could cost between $150 to $200 MM in rier. Discussing the potential conversion of its LNG carrier incremental CAPEX to prepare Hilli for redeployment.” LNG Fuji into 3.5 million tons/year, Golar LNG told in-

Phil Lewis, Director of Research at Intelatus reports in a vestors the following: “The cost of a converted FLNG Fuji recently released White Paper on Floating Production that is expected to be around $2 billion, equivalent to approxi- “more than 185 new foaters will be installed by the end of mately $570 per ton. Financing proposals for between 2030, of which 70% will be FPSOs close to 20% FLNGs $1.2 to $1.5 billion… are being discussed.” and foating production units without storage (semi-subs, The “pipeline” for FPSO projects could be extensive. In

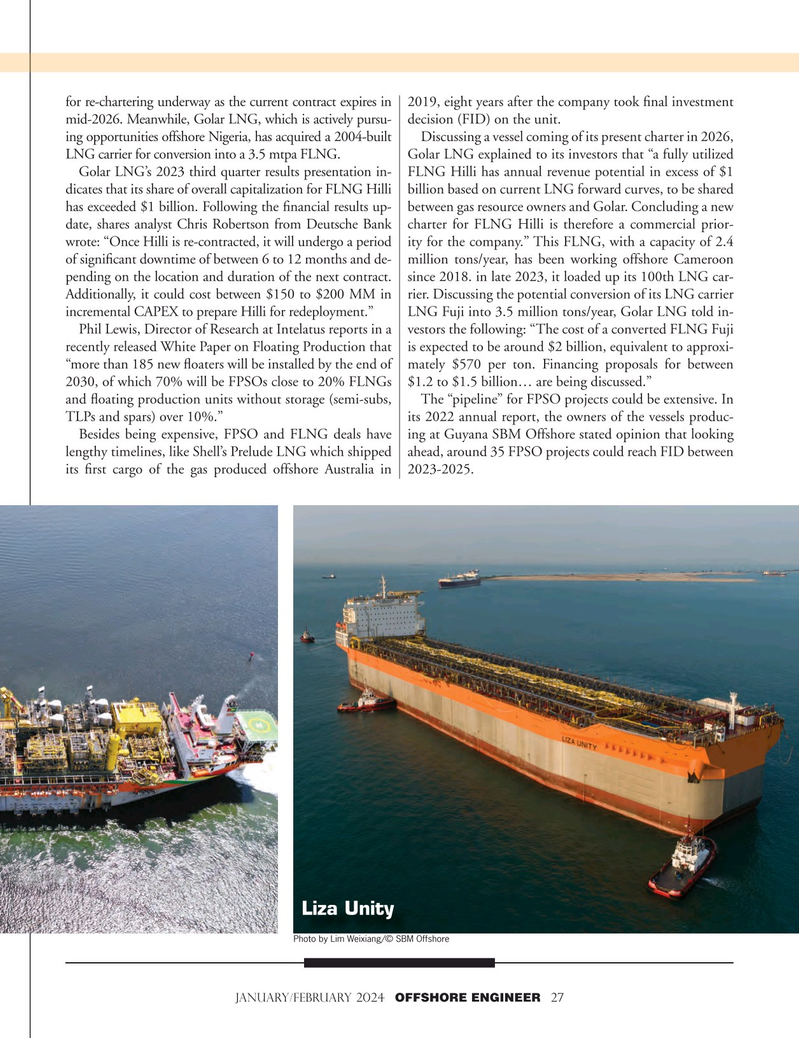

TLPs and spars) over 10%.” its 2022 annual report, the owners of the vessels produc-

Besides being expensive, FPSO and FLNG deals have ing at Guyana SBM Offshore stated opinion that looking lengthy timelines, like Shell’s Prelude LNG which shipped ahead, around 35 FPSO projects could reach FID between its frst cargo of the gas produced offshore Australia in 2023-2025.

Liza Unity

Photo by Lim Weixiang/© SBM Offshore january/february 2024 OFFSHORE ENGINEER 27

26

26

28

28