Page 28: of Offshore Engineer Magazine (Jan/Feb 2024)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2024 Offshore Engineer Magazine

COVER FEATURE FLOATING PRODUCTION

Image courtesy MODEC

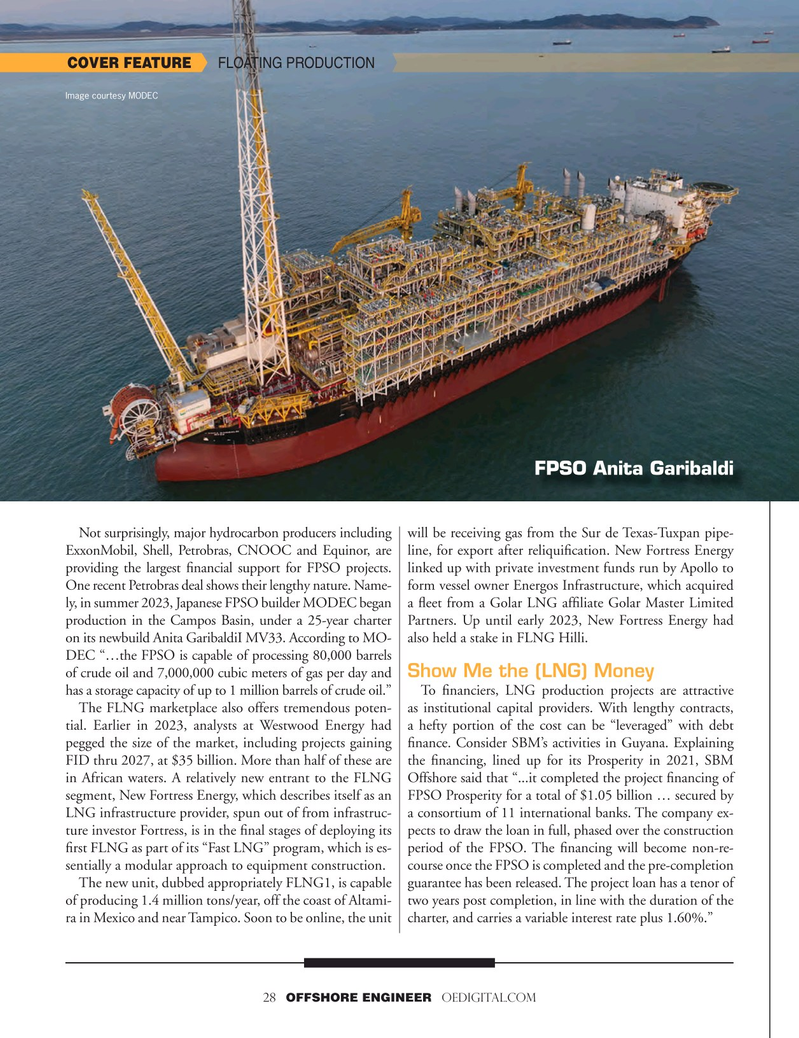

FPSO Anita Garibaldi

Not surprisingly, major hydrocarbon producers including will be receiving gas from the Sur de Texas-Tuxpan pipe-

ExxonMobil, Shell, Petrobras, CNOOC and Equinor, are line, for export after reliquifcation. New Fortress Energy providing the largest fnancial support for FPSO projects. linked up with private investment funds run by Apollo to

One recent Petrobras deal shows their lengthy nature. Name- form vessel owner Energos Infrastructure, which acquired ly, in summer 2023, Japanese FPSO builder MODEC began a feet from a Golar LNG affliate Golar Master Limited production in the Campos Basin, under a 25-year charter Partners. Up until early 2023, New Fortress Energy had on its newbuild Anita GaribaldiI MV33. According to MO- also held a stake in FLNG Hilli.

DEC “…the FPSO is capable of processing 80,000 barrels of crude oil and 7,000,000 cubic meters of gas per day and

Show Me the (LNG) Money has a storage capacity of up to 1 million barrels of crude oil.” To fnanciers, LNG production projects are attractive

The FLNG marketplace also offers tremendous poten- as institutional capital providers. With lengthy contracts, tial. Earlier in 2023, analysts at Westwood Energy had a hefty portion of the cost can be “leveraged” with debt pegged the size of the market, including projects gaining fnance. Consider SBM’s activities in Guyana. Explaining

FID thru 2027, at $35 billion. More than half of these are the fnancing, lined up for its Prosperity in 2021, SBM in African waters. A relatively new entrant to the FLNG Offshore said that “...it completed the project fnancing of segment, New Fortress Energy, which describes itself as an FPSO Prosperity for a total of $1.05 billion … secured by

LNG infrastructure provider, spun out of from infrastruc- a consortium of 11 international banks. The company ex- ture investor Fortress, is in the fnal stages of deploying its pects to draw the loan in full, phased over the construction frst FLNG as part of its “Fast LNG” program, which is es- period of the FPSO. The fnancing will become non-re- sentially a modular approach to equipment construction. course once the FPSO is completed and the pre-completion

The new unit, dubbed appropriately FLNG1, is capable guarantee has been released. The project loan has a tenor of of producing 1.4 million tons/year, off the coast of Altami- two years post completion, in line with the duration of the ra in Mexico and near Tampico. Soon to be online, the unit charter, and carries a variable interest rate plus 1.60%.” 28 OFFSHORE ENGINEER OEDIGITAL.COM

27

27

29

29