Page 29: of Offshore Engineer Magazine (Jan/Feb 2024)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2024 Offshore Engineer Magazine

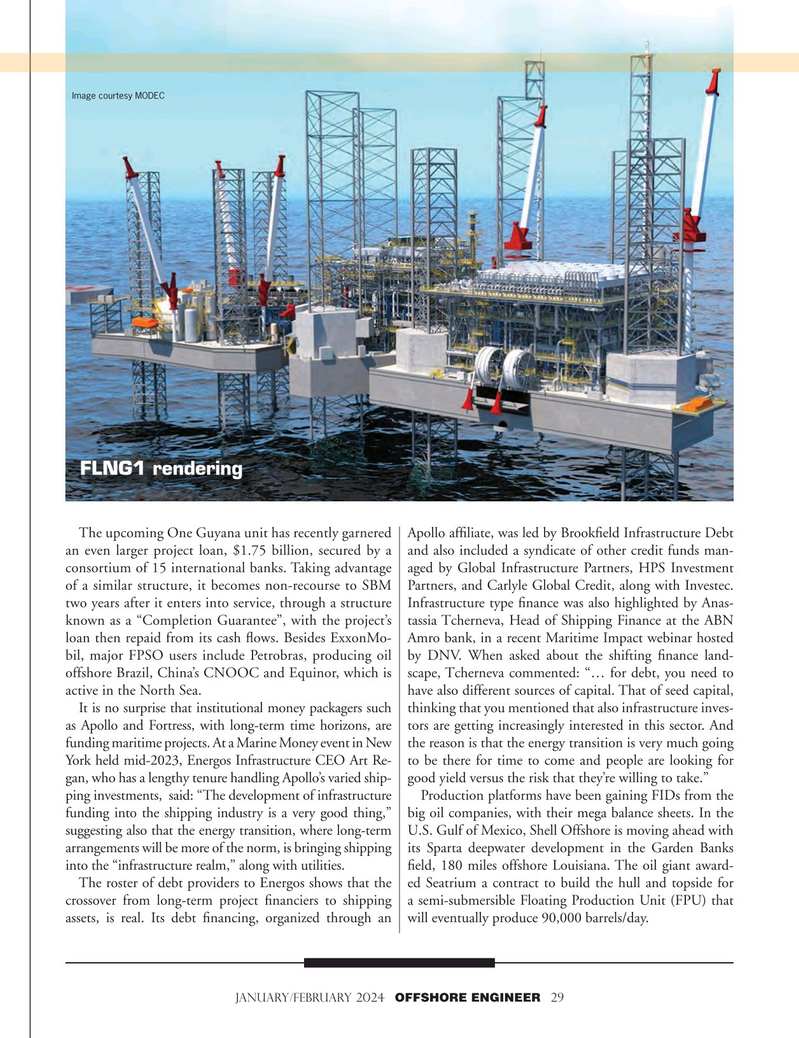

Image courtesy MODEC

FLNG1 rendering

The upcoming One Guyana unit has recently garnered Apollo affliate, was led by Brookfeld Infrastructure Debt an even larger project loan, $1.75 billion, secured by a and also included a syndicate of other credit funds man- consortium of 15 international banks. Taking advantage aged by Global Infrastructure Partners, HPS Investment of a similar structure, it becomes non-recourse to SBM Partners, and Carlyle Global Credit, along with Investec. two years after it enters into service, through a structure Infrastructure type fnance was also highlighted by Anas- known as a “Completion Guarantee”, with the project’s tassia Tcherneva, Head of Shipping Finance at the ABN loan then repaid from its cash fows. Besides ExxonMo- Amro bank, in a recent Maritime Impact webinar hosted bil, major FPSO users include Petrobras, producing oil by DNV. When asked about the shifting fnance land- offshore Brazil, China’s CNOOC and Equinor, which is scape, Tcherneva commented: “… for debt, you need to active in the North Sea. have also different sources of capital. That of seed capital,

It is no surprise that institutional money packagers such thinking that you mentioned that also infrastructure inves- as Apollo and Fortress, with long-term time horizons, are tors are getting increasingly interested in this sector. And funding maritime projects. At a Marine Money event in New the reason is that the energy transition is very much going

York held mid-2023, Energos Infrastructure CEO Art Re- to be there for time to come and people are looking for gan, who has a lengthy tenure handling Apollo’s varied ship- good yield versus the risk that they’re willing to take.” ping investments, said: “The development of infrastructure Production platforms have been gaining FIDs from the funding into the shipping industry is a very good thing,” big oil companies, with their mega balance sheets. In the suggesting also that the energy transition, where long-term U.S. Gulf of Mexico, Shell Offshore is moving ahead with arrangements will be more of the norm, is bringing shipping its Sparta deepwater development in the Garden Banks into the “infrastructure realm,” along with utilities. feld, 180 miles offshore Louisiana. The oil giant award-

The roster of debt providers to Energos shows that the ed Seatrium a contract to build the hull and topside for crossover from long-term project fnanciers to shipping a semi-submersible Floating Production Unit (FPU) that assets, is real. Its debt fnancing, organized through an will eventually produce 90,000 barrels/day. january/february 2024 OFFSHORE ENGINEER 29

28

28

30

30