Page 16: of Offshore Engineer Magazine (Mar/Apr 2024)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2024 Offshore Engineer Magazine

MARKETS SOVs

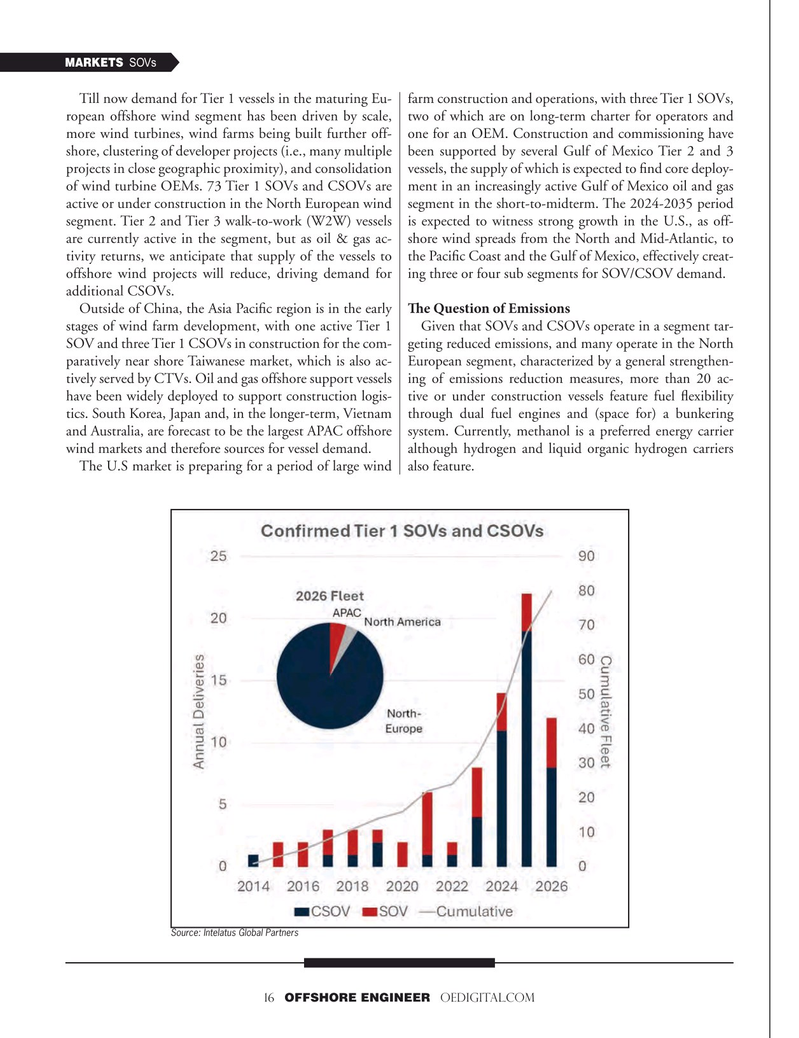

Till now demand for Tier 1 vessels in the maturing Eu- farm construction and operations, with three Tier 1 SOVs, ropean offshore wind segment has been driven by scale, two of which are on long-term charter for operators and more wind turbines, wind farms being built further off- one for an OEM. Construction and commissioning have shore, clustering of developer projects (i.e., many multiple been supported by several Gulf of Mexico Tier 2 and 3 projects in close geographic proximity), and consolidation vessels, the supply of which is expected to fnd core deploy- of wind turbine OEMs. 73 Tier 1 SOVs and CSOVs are ment in an increasingly active Gulf of Mexico oil and gas active or under construction in the North European wind segment in the short-to-midterm. The 2024-2035 period segment. Tier 2 and Tier 3 walk-to-work (W2W) vessels is expected to witness strong growth in the U.S., as off- are currently active in the segment, but as oil & gas ac- shore wind spreads from the North and Mid-Atlantic, to tivity returns, we anticipate that supply of the vessels to the Pacifc Coast and the Gulf of Mexico, effectively creat- offshore wind projects will reduce, driving demand for ing three or four sub segments for SOV/CSOV demand.

additional CSOVs.

Outside of China, the Asia Pacifc region is in the early Te Question of Emissions stages of wind farm development, with one active Tier 1 Given that SOVs and CSOVs operate in a segment tar-

SOV and three Tier 1 CSOVs in construction for the com- geting reduced emissions, and many operate in the North paratively near shore Taiwanese market, which is also ac- European segment, characterized by a general strengthen- tively served by CTVs. Oil and gas offshore support vessels ing of emissions reduction measures, more than 20 ac- have been widely deployed to support construction logis- tive or under construction vessels feature fuel fexibility tics. South Korea, Japan and, in the longer-term, Vietnam through dual fuel engines and (space for) a bunkering and Australia, are forecast to be the largest APAC offshore system. Currently, methanol is a preferred energy carrier wind markets and therefore sources for vessel demand. although hydrogen and liquid organic hydrogen carriers

The U.S market is preparing for a period of large wind also feature.

Source: Intelatus Global Partners 16 OFFSHORE ENGINEER OEDIGITAL.COM

15

15

17

17