Page 19: of Offshore Engineer Magazine (Mar/Apr 2024)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2024 Offshore Engineer Magazine

MARKETS SUBSEA VESSELS hile the demand picture is looking solid and arguing

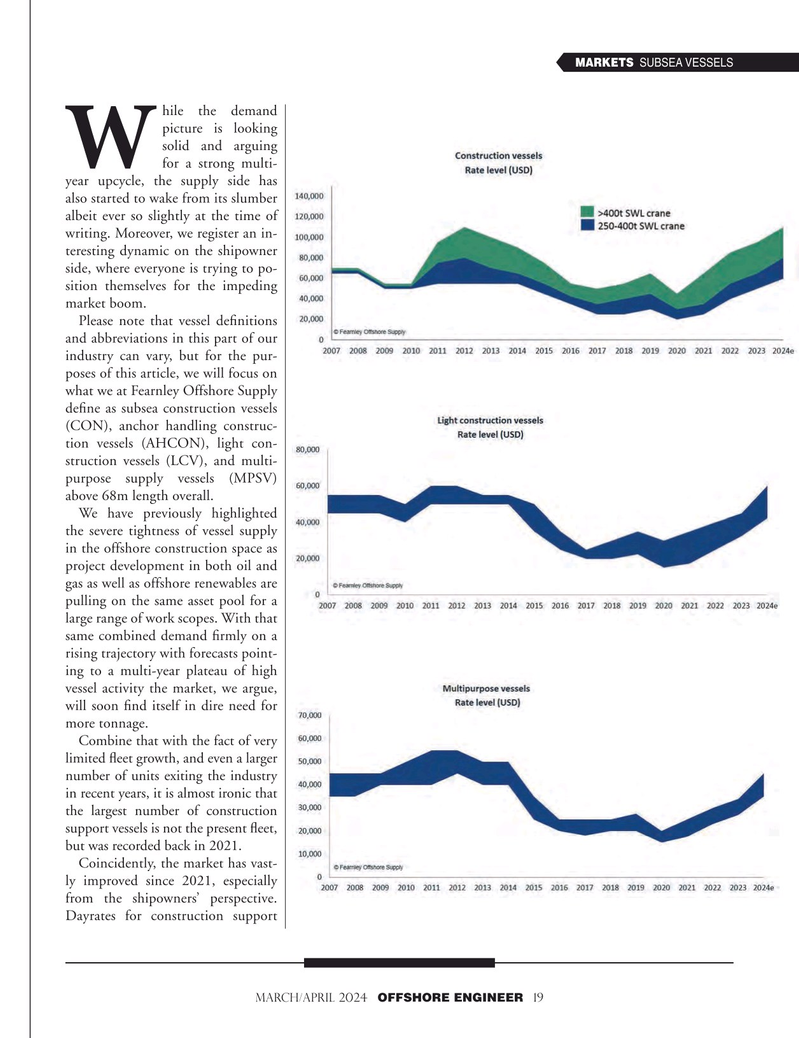

W for a strong multi- year upcycle, the supply side has also started to wake from its slumber albeit ever so slightly at the time of writing. Moreover, we register an in- teresting dynamic on the shipowner side, where everyone is trying to po- sition themselves for the impeding market boom.

Please note that vessel defnitions and abbreviations in this part of our industry can vary, but for the pur- poses of this article, we will focus on what we at Fearnley Offshore Supply defne as subsea construction vessels (CON), anchor handling construc- tion vessels (AHCON), light con- struction vessels (LCV), and multi- purpose supply vessels (MPSV) above 68m length overall.

We have previously highlighted the severe tightness of vessel supply in the offshore construction space as project development in both oil and gas as well as offshore renewables are pulling on the same asset pool for a large range of work scopes. With that same combined demand frmly on a rising trajectory with forecasts point- ing to a multi-year plateau of high vessel activity the market, we argue, will soon fnd itself in dire need for more tonnage.

Combine that with the fact of very limited feet growth, and even a larger number of units exiting the industry in recent years, it is almost ironic that the largest number of construction support vessels is not the present feet, but was recorded back in 2021.

Coincidently, the market has vast- ly improved since 2021, especially from the shipowners’ perspective.

Dayrates for construction support

MARCH/APRIL 2024 OFFSHORE ENGINEER 19

18

18

20

20