Page 20: of Offshore Engineer Magazine (Mar/Apr 2024)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2024 Offshore Engineer Magazine

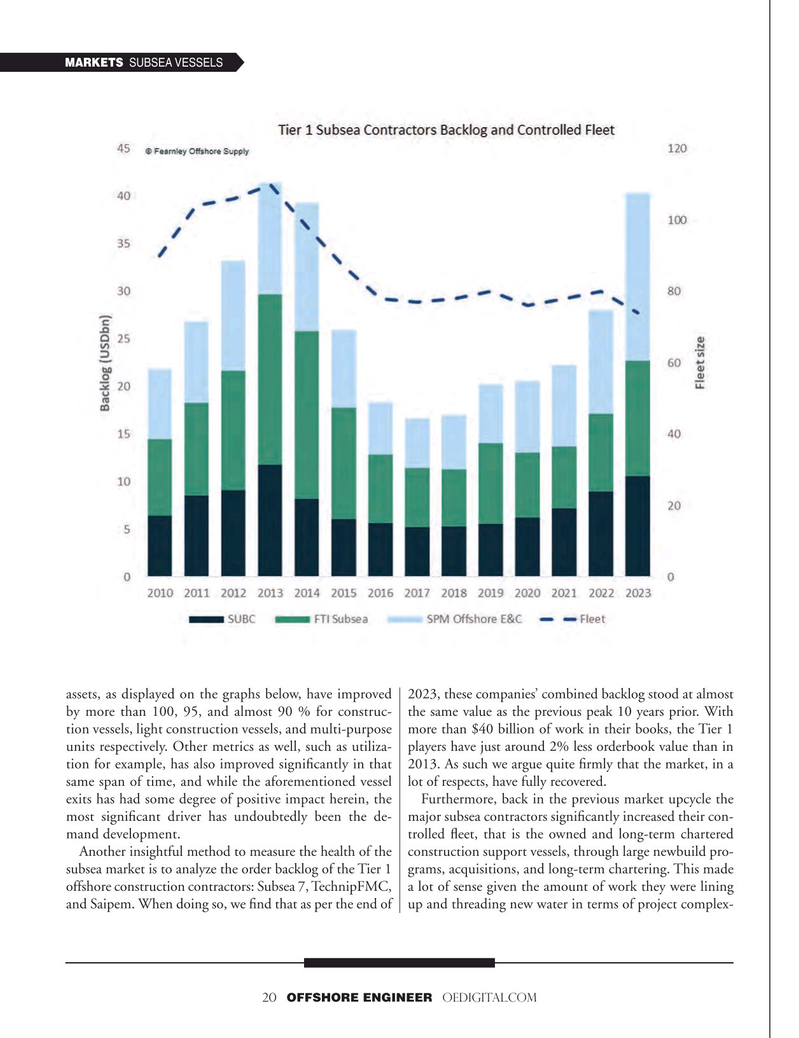

MARKETS SUBSEA VESSELS assets, as displayed on the graphs below, have improved 2023, these companies’ combined backlog stood at almost by more than 100, 95, and almost 90 % for construc- the same value as the previous peak 10 years prior. With tion vessels, light construction vessels, and multi-purpose more than $40 billion of work in their books, the Tier 1 units respectively. Other metrics as well, such as utiliza- players have just around 2% less orderbook value than in tion for example, has also improved signifcantly in that 2013. As such we argue quite frmly that the market, in a same span of time, and while the aforementioned vessel lot of respects, have fully recovered. exits has had some degree of positive impact herein, the Furthermore, back in the previous market upcycle the most signifcant driver has undoubtedly been the de- major subsea contractors signifcantly increased their con- mand development. trolled feet, that is the owned and long-term chartered

Another insightful method to measure the health of the construction support vessels, through large newbuild pro- subsea market is to analyze the order backlog of the Tier 1 grams, acquisitions, and long-term chartering. This made offshore construction contractors: Subsea 7, TechnipFMC, a lot of sense given the amount of work they were lining and Saipem. When doing so, we fnd that as per the end of up and threading new water in terms of project complex- 20 OFFSHORE ENGINEER OEDIGITAL.COM

19

19

21

21