Page 24: of Offshore Engineer Magazine (Mar/Apr 2024)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2024 Offshore Engineer Magazine

MARKETS EXPLORATION as around 60% of upstream emissions come from fuel con- online, while at the same time avoiding the incremental sumption at production and processing facilities. These emissions associated with new dedicated facilities.

emissions are harder to abate and signifcantly more expen- Operators of the host infrastructure can share the cost sive, as fundamental changes to an asset’s infrastructure are and emissions linked to their production platform, extend- required. Options include connections to the grid, build- ing the life of their asset while also decreasing the asso- ing dedicated wind farms, or upgrading existing simple ciated emissions of all tiebacks. This provides the market cycle gas turbines (SSGT) with more effcient, but costly, with incremental, low-emission barrels.

combined cycle turbines (CCGT). No better example of this exists than the Winterfell tie-

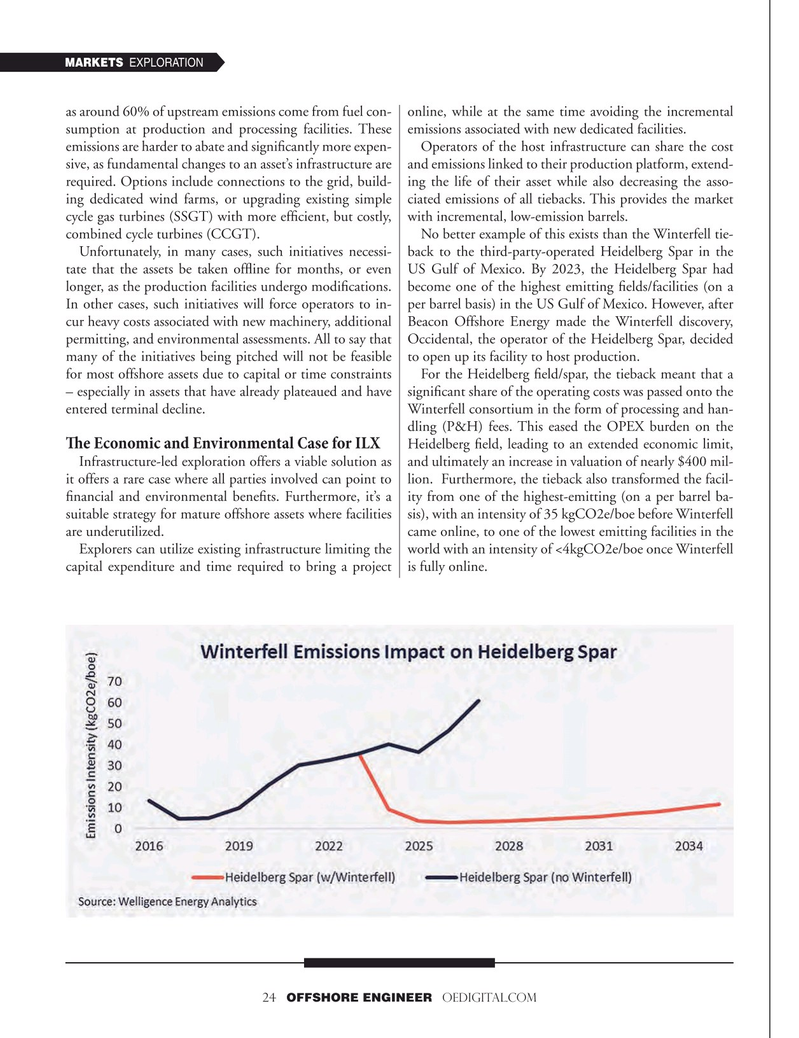

Unfortunately, in many cases, such initiatives necessi- back to the third-party-operated Heidelberg Spar in the tate that the assets be taken offine for months, or even US Gulf of Mexico. By 2023, the Heidelberg Spar had longer, as the production facilities undergo modifcations. become one of the highest emitting felds/facilities (on a

In other cases, such initiatives will force operators to in- per barrel basis) in the US Gulf of Mexico. However, after cur heavy costs associated with new machinery, additional Beacon Offshore Energy made the Winterfell discovery, permitting, and environmental assessments. All to say that Occidental, the operator of the Heidelberg Spar, decided many of the initiatives being pitched will not be feasible to open up its facility to host production.

for most offshore assets due to capital or time constraints For the Heidelberg feld/spar, the tieback meant that a – especially in assets that have already plateaued and have signifcant share of the operating costs was passed onto the entered terminal decline. Winterfell consortium in the form of processing and han- dling (P&H) fees. This eased the OPEX burden on the

Te Economic and Environmental Case for ILX

Heidelberg feld, leading to an extended economic limit,

Infrastructure-led exploration offers a viable solution as and ultimately an increase in valuation of nearly $400 mil- it offers a rare case where all parties involved can point to lion. Furthermore, the tieback also transformed the facil- fnancial and environmental benefts. Furthermore, it’s a ity from one of the highest-emitting (on a per barrel ba- suitable strategy for mature offshore assets where facilities sis), with an intensity of 35 kgCO2e/boe before Winterfell are underutilized. came online, to one of the lowest emitting facilities in the

Explorers can utilize existing infrastructure limiting the world with an intensity of <4kgCO2e/boe once Winterfell capital expenditure and time required to bring a project is fully online. 24 OFFSHORE ENGINEER OEDIGITAL.COM

23

23

25

25