Page 25: of Offshore Engineer Magazine (Nov/Dec 2024)

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2024 Offshore Engineer Magazine

MARKETS EXPLORATION making their fscal and contractual regimes more attractive.

[3] LNG – Market Tightness Persists

We have seen Argentina, Brazil, Trinidad & Tobago,

The 2025 LNG market will remain supply-constrained, keeping prices elevated, as Asian and European demand Egypt, Angola, Nigeria, Indonesia and Malaysia, just to growth outpaces the gradual start-up of new, mostly North mention a few examples, introducing fscal incentives and

American, liquefaction trains. Growth will remain muted regulatory changes in 2024. It’s important to note that in as the latest wave of liquefaction trains only begin ramping most cases, these changes are part of a wider policy rather up and we forecast just ~30 MMtpa of new capacity will than isolated actions. We envisage that this trend may be replicated by other countries that are lagging and need to have started by end-2025.

The two largest new projects are the initial trains at take bold actions to reactivate their E&P sectors.

Venture Global’s Plaquemines LNG in the US and Shell’s [5] Less Emphasis on Energy Transition

LNG Canada, the country’s frst export project. Additional

Some E&Ps are adjusting their energy transition targets supply will come online in Australia, Mexico and West Af- rica. Potential FIDs in 2025 include TotalEnergies’ Papua to enable continued investment in oil & gas. The challeng-

LNG project in Papua New Guinea, Eni’s Coral North ing economics of many new energies projects has ultimate- ly manifested in shareholder pressure. And this had led to

FLNG in Mozambique and INPEX’s Abadi LNG proj- ect in Indonesia. President-elect Trump’s agenda includes leadership changes at certain companies with bp’s appoint- ending the current pause on US LNG non-FTA export ment of Murray Auchincloss, who has reprioritized oil & permits, which could propel Venture Global’s CP2 LNG gas, and Shell’s restructuring under Wael Sawan to focus more on hydrocarbons. E&Ps will retain decarbonization development and Sempra Energy’s fourth train at Cam- eron LNG to FID. Woodside is also targeting FID at its targets, but adjustments are expected – for example, some will set emission intensity-based targets, allowing more

Louisiana LNG project in Q1 2025.

fexibility to invest in hydrocarbons.

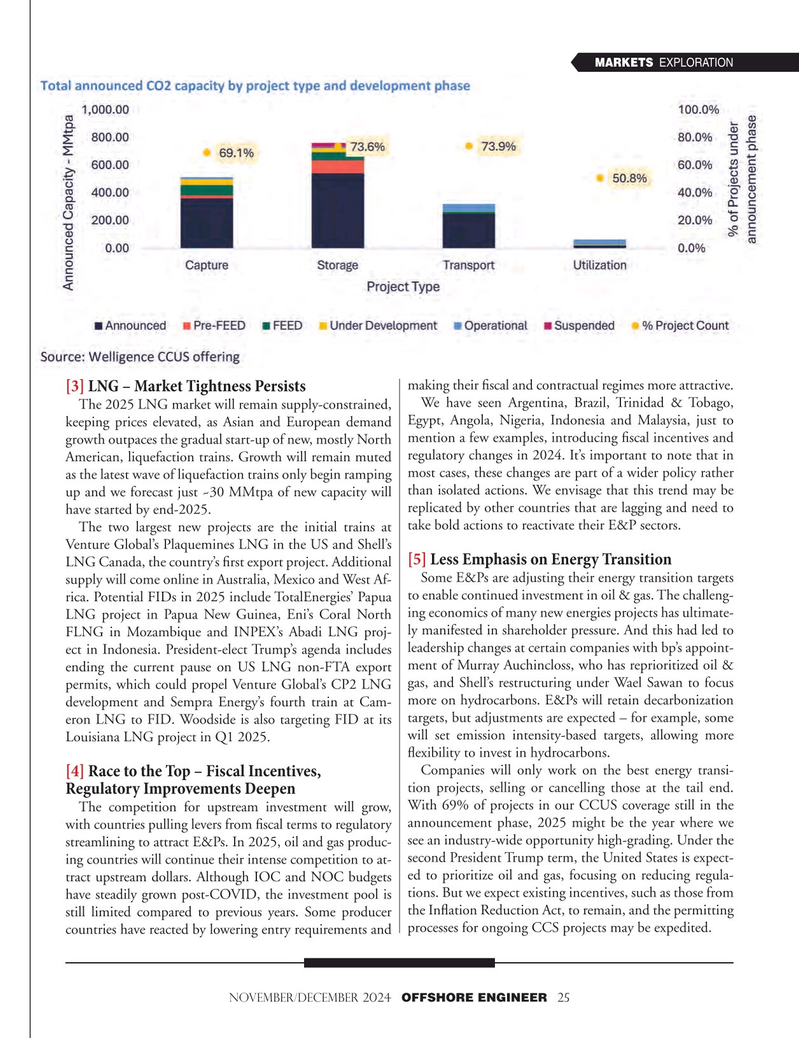

Companies will only work on the best energy transi- [4] Race to the Top – Fiscal Incentives, tion projects, selling or cancelling those at the tail end.

Regulatory Improvements Deepen

The competition for upstream investment will grow, With 69% of projects in our CCUS coverage still in the with countries pulling levers from fscal terms to regulatory announcement phase, 2025 might be the year where we see an industry-wide opportunity high-grading. Under the streamlining to attract E&Ps. In 2025, oil and gas produc- second President Trump term, the United States is expect- ing countries will continue their intense competition to at- tract upstream dollars. Although IOC and NOC budgets ed to prioritize oil and gas, focusing on reducing regula- have steadily grown post-COVID, the investment pool is tions. But we expect existing incentives, such as those from still limited compared to previous years. Some producer the Infation Reduction Act, to remain, and the permitting countries have reacted by lowering entry requirements and processes for ongoing CCS projects may be expedited.

november/december 2024 OFFSHORE ENGINEER 25

24

24

26

26