Page 36: of Offshore Engineer Magazine (Mar/Apr 2025)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2025 Offshore Engineer Magazine

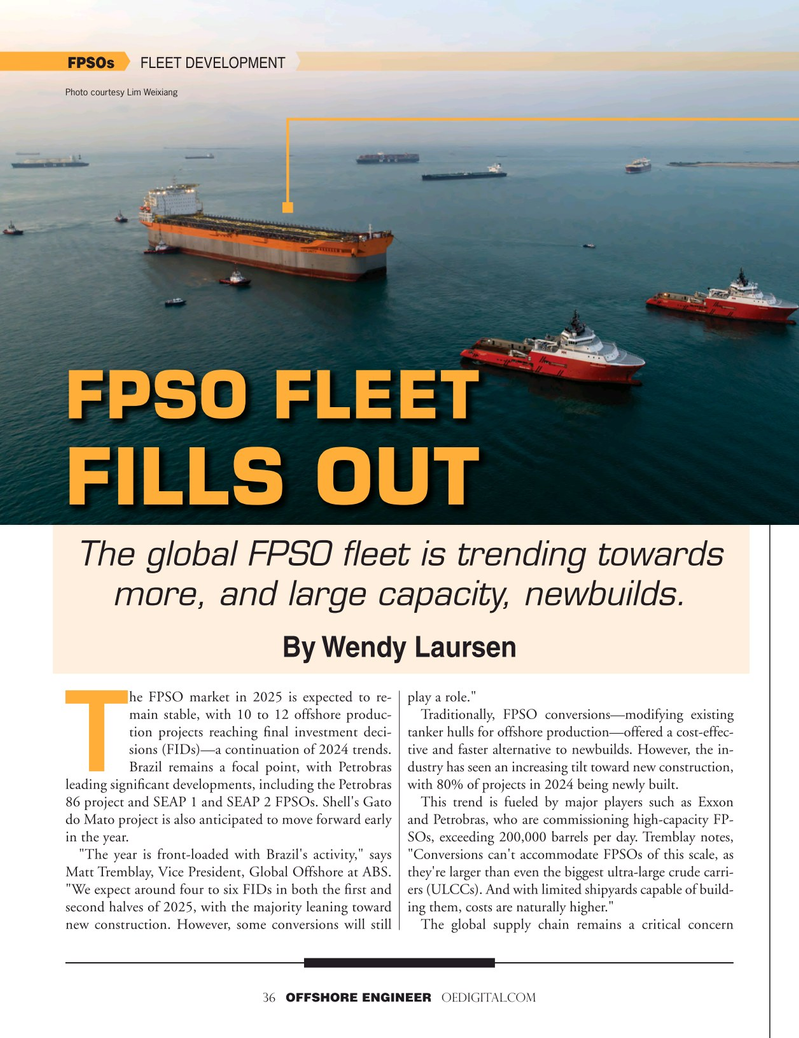

FPSOs FLEET DEVELOPMENT

Photo courtesy Lim Weixiang

FPSO FLEET

FILLS OUT

The global FPSO fleet is trending towards more, and large capacity, newbuilds.

By Wendy Laursen he FPSO market in 2025 is expected to re- play a role." main stable, with 10 to 12 offshore produc- Traditionally, FPSO conversions—modifying existing tion projects reaching fnal investment deci- tanker hulls for offshore production—offered a cost-effec- sions (FIDs)—a continuation of 2024 trends. tive and faster alternative to newbuilds. However, the in-

T Brazil r emains a focal point, with Petrobras dustry has seen an increasing tilt toward new construction, leading signifcant developments, including the Petrobras with 80% of projects in 2024 being newly built.

86 project and SEAP 1 and SEAP 2 FPSOs. Shell's Gato This trend is fueled by major players such as Exxon do Mato project is also anticipated to move forward early and Petrobras, who are commissioning high-capacity FP- in the year. SOs, exceeding 200,000 barrels per day. Tremblay notes, "The y ear is front-loaded with Brazil's activity," says "Conversions can't accommodate FPSOs of this scale, as

Matt T remblay, Vice President, Global Offshore at ABS. they're larger than even the biggest ultra-large crude carri- "We expect around four to six FIDs in both the frst and ers (ULCCs). And with limited shipyards capable of build- second halves of 2025, with the majority leaning toward ing them, costs are naturally higher." new construction. However, some conversions will still The global supply chain remains a critical concern 36 OFFSHORE ENGINEER OEDIGITAL.COM

35

35

37

37